Question: Please use the data to answer the question HW4P3 b. What is the probability that Hometown would lose money on the contract? [10] c. Suppose

![is the probability that Hometown would lose money on the contract? [10]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6700ccb22d326_6496700ccb19a44e.jpg)

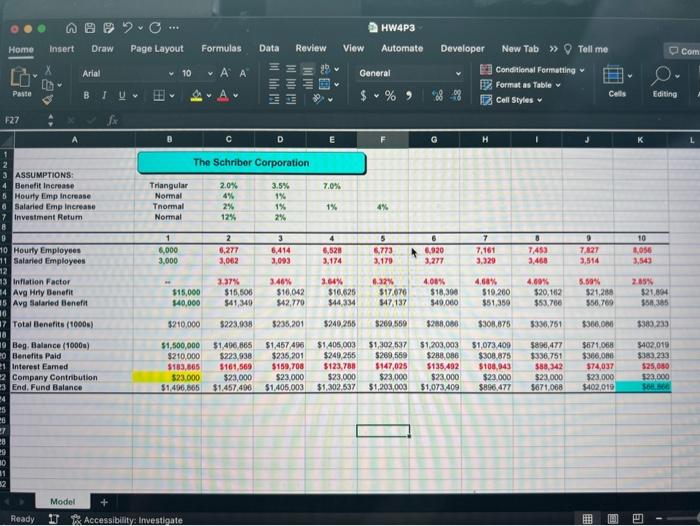

HW4P3 b. What is the probability that Hometown would lose money on the contract? [10] c. Suppose that Hometown wants to identify the minimum guaranteed annual rate of retum that provides a 2% chance of the company losing money on the contract. What should the minimum guaranteed annual rate of return be? [15] 3. Each year, the Schriber Corporation must determine how much to contribute to the company's pension plan. The company uses a ten-year planning horizon to determine the contribution which, if made annually in each of the next ten years, would allow for only a 10% chance of the fund running short of money. ( Read that again.) The company then makes that contribution in the current year and repeats this process in each subsequent year to determine the specific amount to contribute each year. (Last year, the company contributed $23 million to the plan.) The pension plan covers two types of employees: hourly and salaried. In the current year, there will be 6,000 former hourly employees and 3,00ciformer salaried employees receiving benefits from the plan. The change in the number of retired hourly employees from one year to the next is expected to vary according to a normal distribution with a mean of 4% and standard deviation of 1%. The change in the number of retired salaried employees from one year to the next is expected to vary between 1% and 4% according to a truncated normal distribution with a mean of 2% and standard deviation of 1%. Currently, hourly retirees receive an average benefit of $15,000 per year, whereas salaried retirees receive an average annual benefit of $40,000. Both of these averoges are expected to increase annually with the rate of inflation, which is assumed to vary between 2% and 7% according to a triangular distribution with a most likely value of 3.5%. The current balance in the company/s pension fund is $1.5 billion. Investments in this fund earn an annual retum that is assumed to be normally distributed with a mean of 12% and standard deviation of 2%. How much should the company contribute to the pension fund in the current year? [30] HW4P3 b. What is the probability that Hometown would lose money on the contract? [10] c. Suppose that Hometown wants to identify the minimum guaranteed annual rate of retum that provides a 2% chance of the company losing money on the contract. What should the minimum guaranteed annual rate of return be? [15] 3. Each year, the Schriber Corporation must determine how much to contribute to the company's pension plan. The company uses a ten-year planning horizon to determine the contribution which, if made annually in each of the next ten years, would allow for only a 10% chance of the fund running short of money. ( Read that again.) The company then makes that contribution in the current year and repeats this process in each subsequent year to determine the specific amount to contribute each year. (Last year, the company contributed $23 million to the plan.) The pension plan covers two types of employees: hourly and salaried. In the current year, there will be 6,000 former hourly employees and 3,00ciformer salaried employees receiving benefits from the plan. The change in the number of retired hourly employees from one year to the next is expected to vary according to a normal distribution with a mean of 4% and standard deviation of 1%. The change in the number of retired salaried employees from one year to the next is expected to vary between 1% and 4% according to a truncated normal distribution with a mean of 2% and standard deviation of 1%. Currently, hourly retirees receive an average benefit of $15,000 per year, whereas salaried retirees receive an average annual benefit of $40,000. Both of these averoges are expected to increase annually with the rate of inflation, which is assumed to vary between 2% and 7% according to a triangular distribution with a most likely value of 3.5%. The current balance in the company/s pension fund is $1.5 billion. Investments in this fund earn an annual retum that is assumed to be normally distributed with a mean of 12% and standard deviation of 2%. How much should the company contribute to the pension fund in the current year? [30]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts