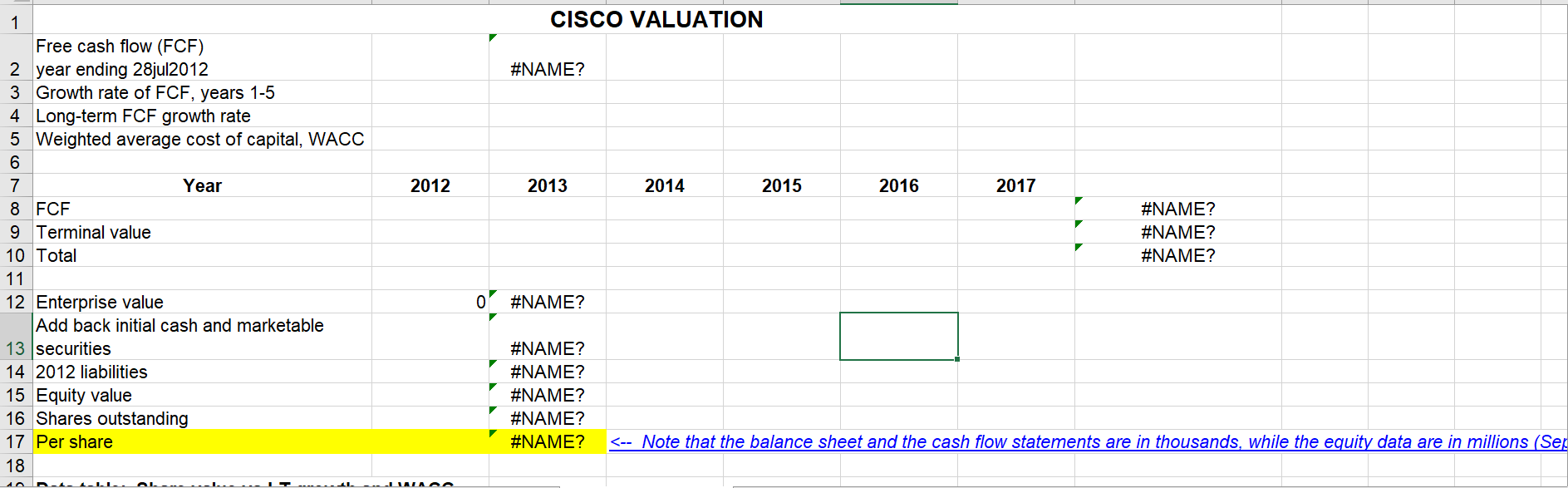

Question: Please use the excel file. 19 Data table: Share value vs LT growth and WACC 20 Long-term growth ] 0% #NAME? -4% 2% 4% 6%

![LT growth and WACC 20 Long-term growth ] 0% #NAME? -4% 2%](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe8beac1fdc_99466fe8bea51b78.jpg)

Please use the excel file.

19 Data table: Share value vs LT growth and WACC 20 Long-term growth ] 0% #NAME? -4% 2% 4% 6% 21 22 WACC 23 24 25 26 10% 12% 14% 16% 18% 20% 22% 27 28 29 30 31 32 33 34 35 36 Use the template for the ABC Corp. valuation in section 2.7 to value Cisco stock. Assume that the weighted average cost of capital for Cisco is 12.6%, the growth rate for years 1-5 is 4%, and that the long-term growth rate is 0%. (Details and template on the disk that accompanies this book.) 19 Data table: Share value vs LT growth and WACC 20 Long-term growth ] 0% #NAME? -4% 2% 4% 6% 21 22 WACC 23 24 25 26 10% 12% 14% 16% 18% 20% 22% 27 28 29 30 31 32 33 34 35 36 Use the template for the ABC Corp. valuation in section 2.7 to value Cisco stock. Assume that the weighted average cost of capital for Cisco is 12.6%, the growth rate for years 1-5 is 4%, and that the long-term growth rate is 0%. (Details and template on the disk that accompanies this book.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts