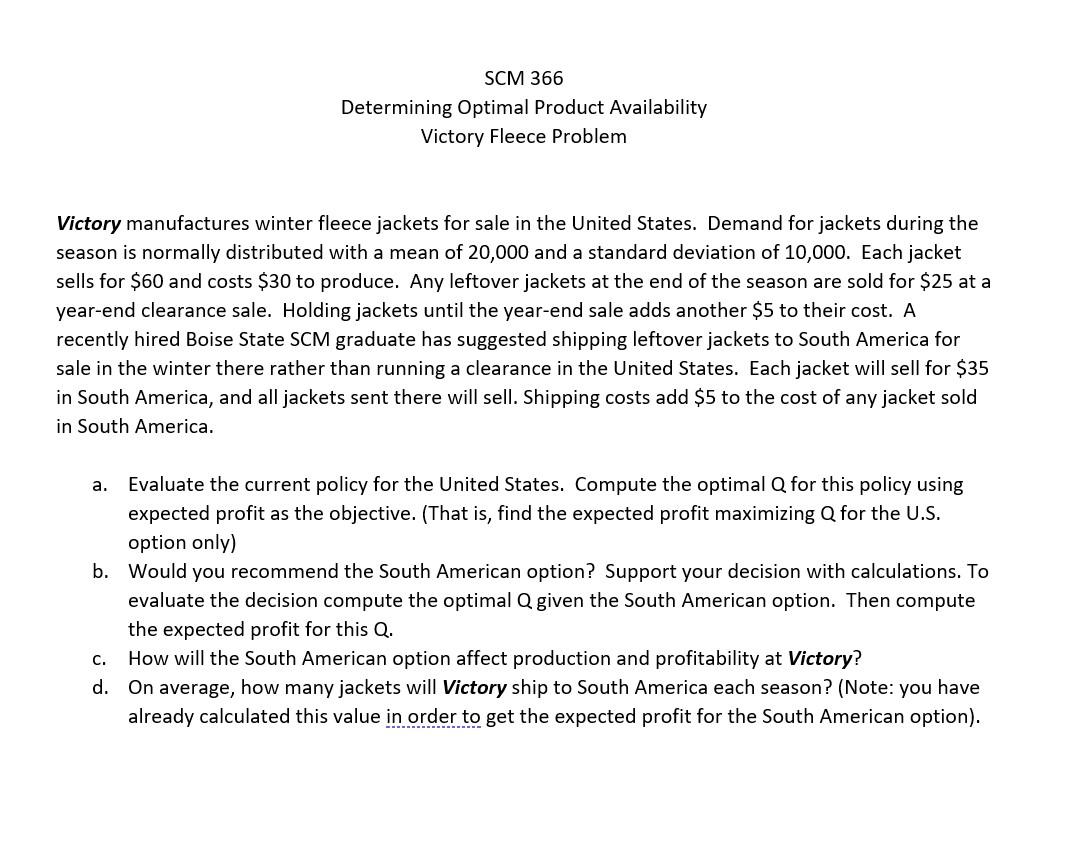

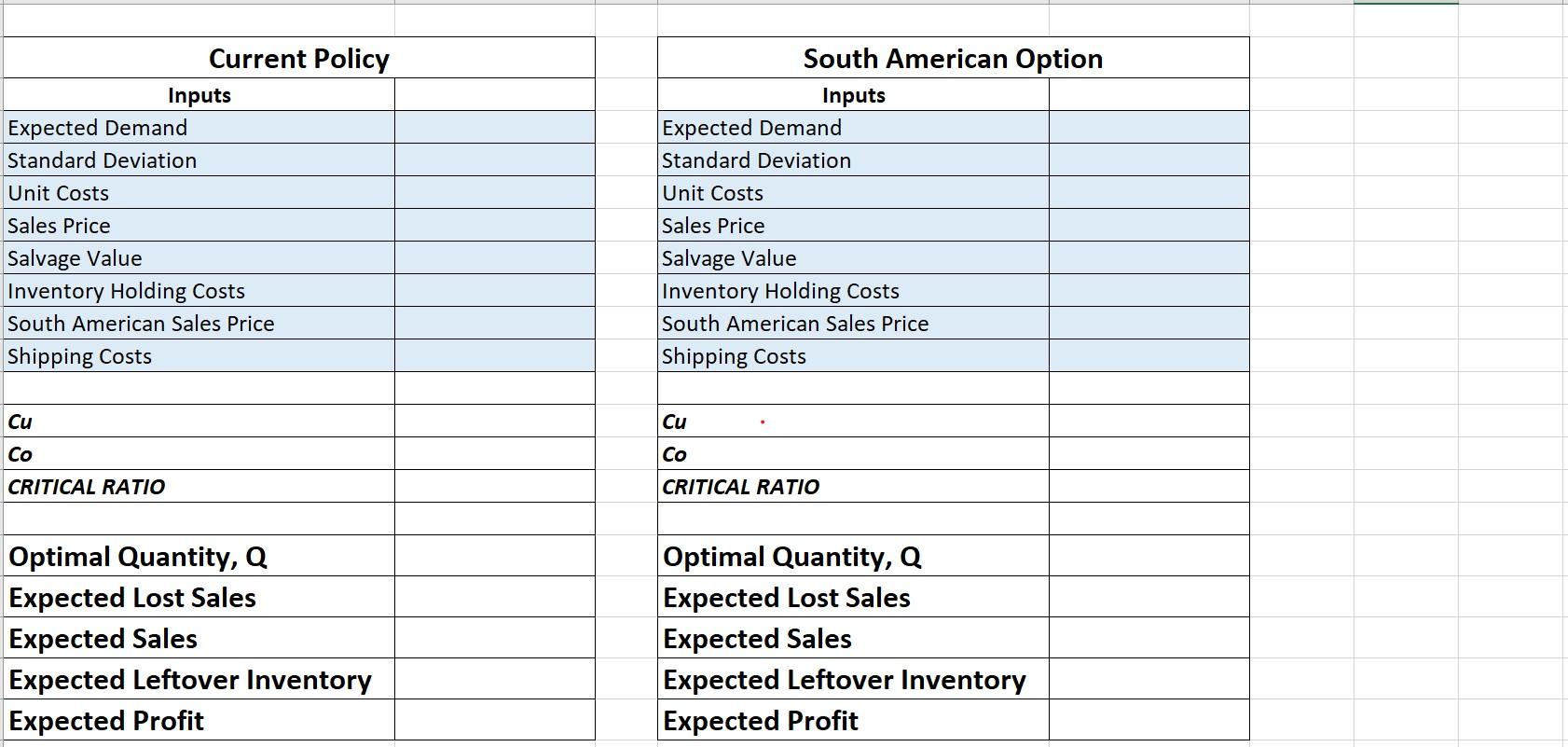

Question: Please use the excel format below to work the problem SCM 366 Determining Optimal Product Availability Victory Fleece Problem Victory manufactures winter fleece jackets for

Please use the excel format below to work the problem

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock