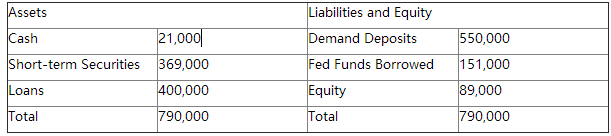

Question: Please use the following balance sheet to answer this question. Assume the bank is required to hold a minimum reserve of 2% of the demand

Please use the following balance sheet to answer this question.  Assume the bank is required to hold a minimum reserve of 2% of the demand deposits, what is (are) the possible way(s) that the bank can meet an expected net deposit drain of $20,000 using stored liquidity management techniques? Select one: a. Run down the $20,000 cash. b. Run down $10,000 cash and sell some short-term securities to raise $10,000 cash. c. Liquidate some loans to raise $20,000 cash. d. Sell some short-term securities to raise $20,000 cash. e. Issue $20,000 new equity.

Assume the bank is required to hold a minimum reserve of 2% of the demand deposits, what is (are) the possible way(s) that the bank can meet an expected net deposit drain of $20,000 using stored liquidity management techniques? Select one: a. Run down the $20,000 cash. b. Run down $10,000 cash and sell some short-term securities to raise $10,000 cash. c. Liquidate some loans to raise $20,000 cash. d. Sell some short-term securities to raise $20,000 cash. e. Issue $20,000 new equity.

Assets Liabilities and Equity Demand Deposits 21,000 550,000 Cash Fed Funds Borrowed 151,000 400,000 790,000 Equity 89,000 (XX) Total Total 790,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts