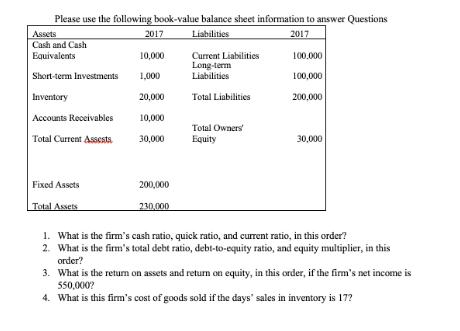

Question: Please use the following book-value balance sheet information to answer Questions Liabilities 2017 Assets Cash and Cash Equivalents 10,000 Short-term Investments 1,000 Inventory 20,000

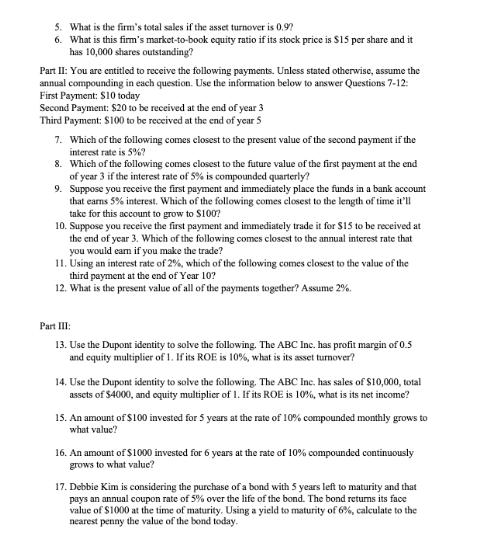

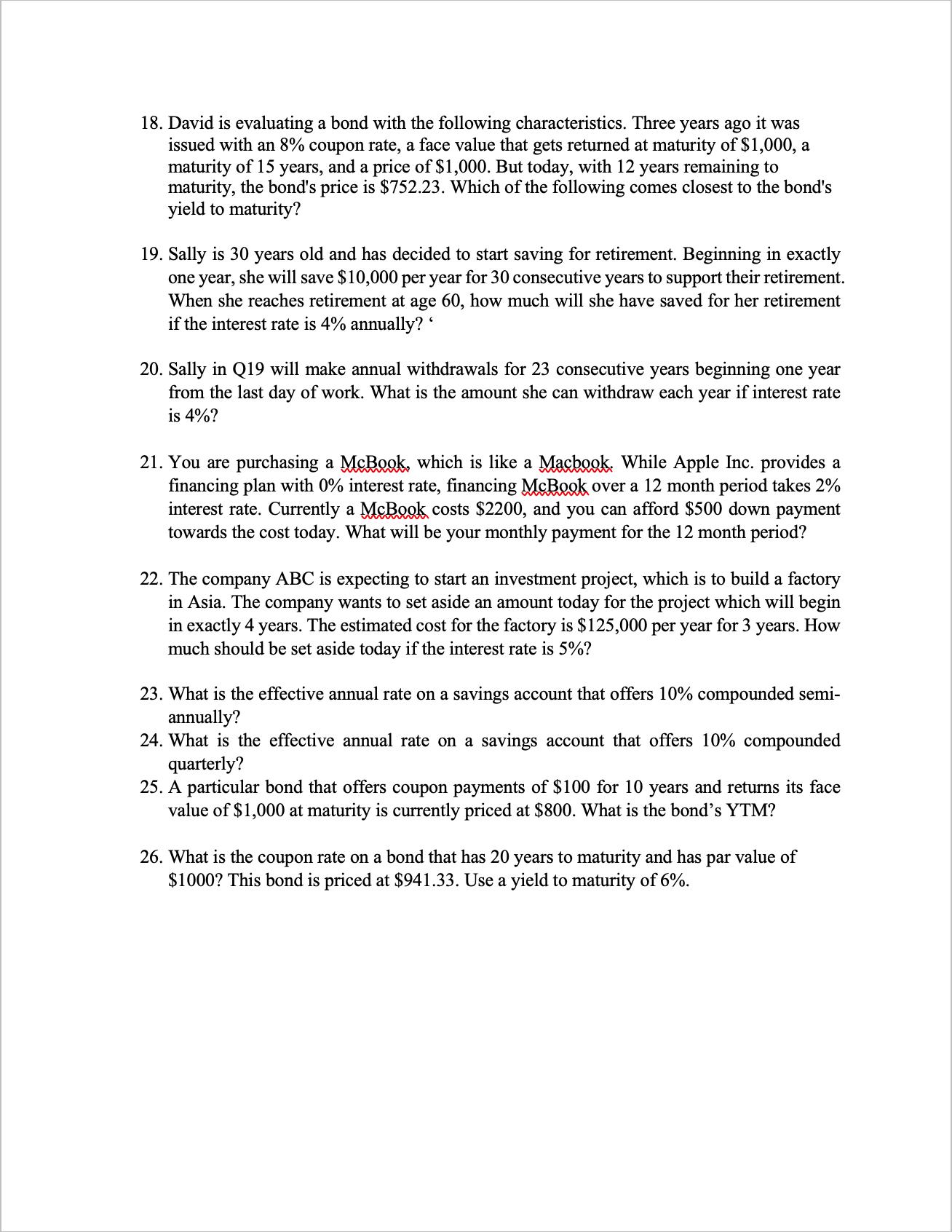

Please use the following book-value balance sheet information to answer Questions Liabilities 2017 Assets Cash and Cash Equivalents 10,000 Short-term Investments 1,000 Inventory 20,000 Accounts Receivables 10,000 Total Current Assets 30,000 2017 Fixed Assets Total Assets 200,000 230,000 Current Liabilities Long-term Liabilities Total Liabilities Total Owners' Equity 100.000 100,000 200,000 30,000 1. What is the firm's cash ratio, quick ratio, and current ratio, in this order? 2. What is the firm's total debt ratio, debt-to-equity ratio, and equity multiplier, in this order? 3. What is the return on assets and return on equity, in this order, if the firm's net income is 550,000? 4. What is this firm's cost of goods sold if the days' sales in inventory is 17? 5. What is the firm's total sales if the asset turnover is 0.97 6. What is this firm's market-to-book equity ratio if its stock price is $15 per share and it has 10,000 shares outstanding? Part II: You are entitled to receive the following payments. Unless stated otherwise, assume the annual compounding in each question. Use the information below to answer Questions 7-12: First Payment: $10 today Second Payment: $20 to be received at the end of year 3 Third Payment: $100 to be received at the end of year 5 7. Which of the following comes closest to the present value of the second payment if the interest rate is 5%? 8. Which of the following comes closest to the future value of the first payment at the end of year 3 if the interest rate of 5% is compounded quarterly? 9. Suppose you receive the first payment and immediately place the funds in a bank account that earns 5% interest. Which of the following comes closest to the length of time it'll take for this account to grow to $100? 10. Suppose you receive the first payment and immediately trade it for $15 to be received at the end of year 3. Which of the following comes closest to the annual interest rate that you would earn if you make the trade? 11. Using an interest rate of 2%, which of the following comes closest to the value of the third payment at the end of Year 10? 12. What is the present value of all of the payments together? Assume 2%. Part III: 13. Use the Dupont identity to solve the following. The ABC Inc. has profit margin of 0.5 and equity multiplier of 1. If its ROE is 10%, what is its asset turnover? 14. Use the Dupont identity to solve the following. The ABC Inc. has sales of $10,000, total assets of $4000, and equity multiplier of 1. If its ROE is 10%, what is its net income? 15. An amount of $100 invested for 5 years at the rate of 10% compounded monthly grows to what value? 16. An amount of $1000 invested for 6 years at the rate of 10% compounded continuously grows to what value? 17. Debbie Kim is considering the purchase of a bond with 5 years left to maturity and that pays an annual coupon rate of 5% over the life of the bond. The bond returns its face value of $1000 at the time of maturity. Using a yield to maturity of 6%, calculate to the nearest penny the value of the bond today. 18. David is evaluating a bond with the following characteristics. Three years ago it was issued with an 8% coupon rate, a face value that gets returned at maturity of $1,000, a maturity of 15 years, and a price of $1,000. But today, with 12 years remaining to maturity, the bond's price is $752.23. Which of the following comes closest to the bond's yield to maturity? 19. Sally is 30 years old and has decided to start saving for retirement. Beginning in exactly one year, she will save $10,000 per year for 30 consecutive years to support their retirement. When she reaches retirement at age 60, how much will she have saved for her retirement if the interest rate is 4% annually?" 20. Sally in Q19 will make annual withdrawals for 23 consecutive years beginning one year from the last day of work. What is the amount she can withdraw each year if interest rate is 4%? 21. You are purchasing a McBook, which is like a Macbook. While Apple Inc. provides a financing plan with 0% interest rate, financing McBook over a 12 month period takes 2% interest rate. Currently a McBook costs $2200, and you can afford $500 down payment towards the cost today. What will be your monthly payment for the 12 month period? 22. The company ABC is expecting to start an investment project, which is to build a factory in Asia. The company wants to set aside an amount today for the project which will begin in exactly 4 years. The estimated cost for the factory is $125,000 per year for 3 years. How much should be set aside today if the interest rate is 5%? 23. What is the effective annual rate on a savings account that offers 10% compounded semi- annually? 24. What is the effective annual rate on a savings account that offers 10% compounded quarterly? 25. A particular bond that offers coupon payments of $100 for 10 years and returns its face value of $1,000 at maturity is currently priced at $800. What is the bond's YTM? 26. What is the coupon rate on a bond that has 20 years to maturity and has par value of $1000? This bond is priced at $941.33. Use a yield to maturity of 6%.

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Answer Lets tackle each question one by one 1 Ratios for the firm Cash ratio Cash and Cash Equivalents Current Liabilities Quick ratio Cash and Cash Equivalents Shortterm Investments Accounts Receivab... View full answer

Get step-by-step solutions from verified subject matter experts