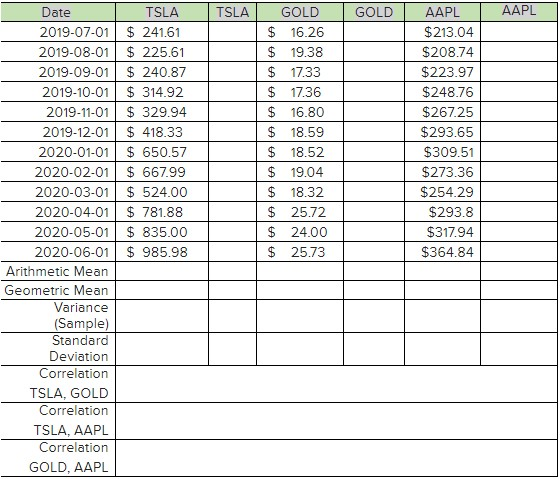

Question: Please use the following data to answer the questions. The ticker symbols are for Tesla Inc (TSLA), Barrick Gold Corporation (GOLD) and Apple Inc (AAPL).

Please use the following data to answer the questions. The ticker symbols are for Tesla Inc (TSLA), Barrick Gold Corporation (GOLD) and Apple Inc (AAPL). The prices shown are the closing stock prices for the date shown. Your first task is to compute the monthly holding period returns for each stock for each month, using the Holding Period Return formula, which is HPR = (P1 - P0)/P0, where P1 is the end of period price and P0 is the start of period price. Be very careful to not mix up your dates. After you have computed the HPRs, then answer the following question.

Assume you have a portfolio of $20,000, invested 60% in TSLA and 40% in GOLD. What was the sample standard deviation of the portfolio?

A. 14.8%

B. 17.6%

C. 12.9%

D. 15.1%

TSLA GOLD AAPL Date TSLA 2019-07-01 $ 241.61 2019-08-01 $ 225.61 2019-09-01 $ 240.87 2019-10-01 $ 314.92 2019-11-01 $ 329.94 2019-12-01 $ 418.33 2020-01-01 $ 650.57 2020-02-01 $ 667.99 2020-03-01 $ 524.00 2020-04-01 $ 781.88 2020-05-01 $ 835.00 2020-06-01 $ 985.98 Arithmetic Mean Geometric Mean Variance (Sample) Standard Deviation Correlation TSLA, GOLD Correlation TSLA, AAPL Correlation GOLD, AAPL GOLD $ 16.26 $ 19.38 $ 17.33 $ 17.36 $ 16.80 $ 18.59 $ 18.52 $ 19.04 $ 18.32 $ 25.72 $ 24.00 $ 25.73 AAPL $213.04 $208.74 $223.97 $248.76 $267.25 $293.65 $309.51 $273.36 $254.29 $293.8 $317.94 $364.84

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts