Question: Please use the forms found on the IRS website by searching Schedule D and Form 8949 Tax return #2 USE 2021 FORMS You will be

Please use the forms found on the IRS website by searching "Schedule D" and "Form 8949"

Tax return #2 USE 2021 FORMS

You will be preparing Schedule D and form 8949 only. .

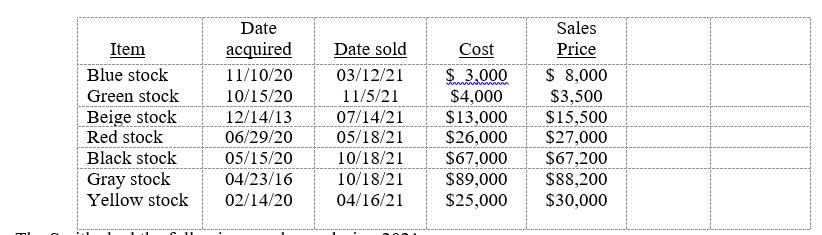

The Smiths had the following asset sales during 2021:

The Smiths had the following purchases during 2021:

REMEMBER ONLY SALES ARE SHOWN ON THE TAX FORMS

Use the following purchase information to determine if any of the above sales trigger the wash sale rule.

Do not list any of these 3 purchases on the forms. Do not adjust the cost basis of any of the stock sales listed above.

Green stock on 11/10/21 for $3,500.

Gray Stock on 12/15/21 for $5,000

If there is a wash sale, be sure to look at the return example for how to show a wash sale on Form 8949.

The Smiths also have a $1,500 net long term capital loss carryover they would like to use this year.

Stop after line 16 on Schedule D: do not fill out the rest of the form.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts