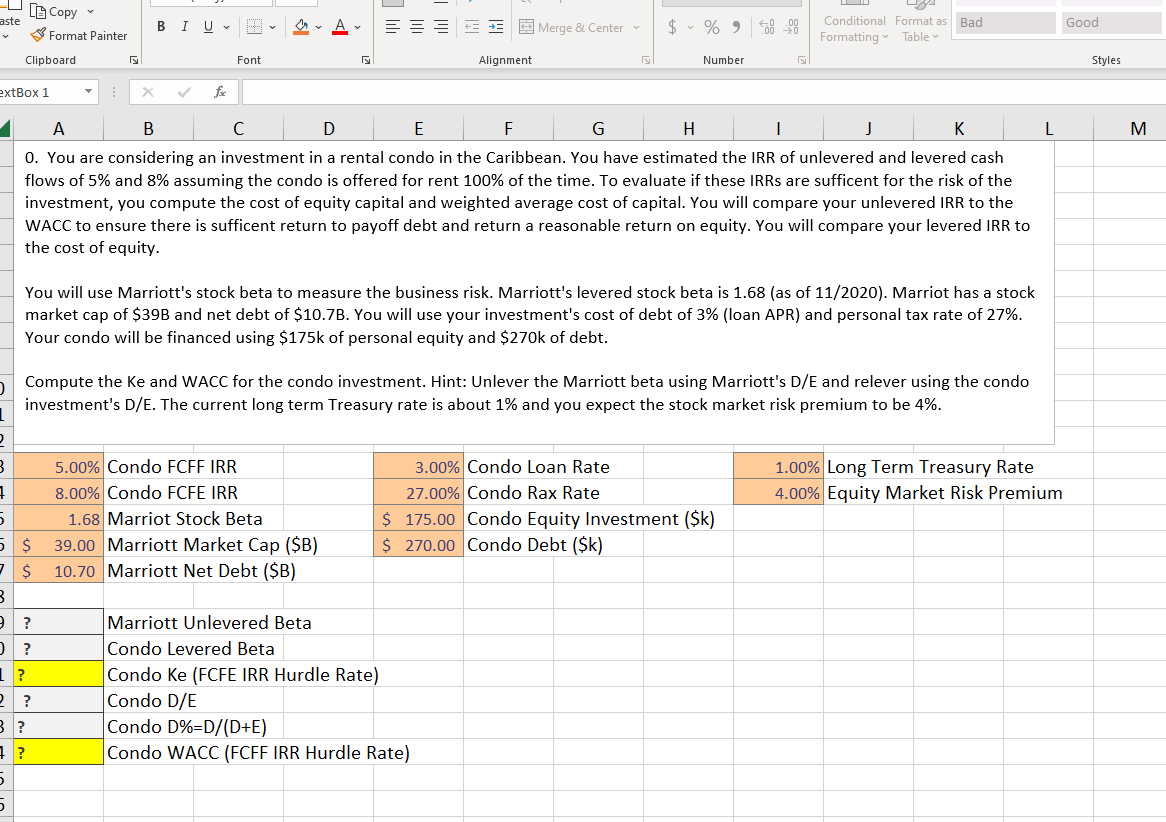

Question: Please use the formula from below only. In excel format and explain how did you come with answer. See the screeshot of the problem. Formulas

Please use the formula from below only. In excel format and explain how did you come with answer. See the screeshot of the problem.

Formulas

Accounting

- Retained Earnings = Prior Year's Value + Current Net Income - Dividends

- EFN = External Funds Needed = Forecasted Assets - Liabilities - Equity (holding debt and stock constant)

- Internal Growth = ROA*Plowback / (1-ROA*Plowback) "Rate of sales, asset, and NWC growth without need for external financing"

- Plowback = 1 - Payout; Payout = Div / Net Income

- Sustainable Growth = ROE*Plowback / (1-ROE*Plowback) "Rate of sales, asset, and NWC growth without need for new stock issuance, but debt can be issued to maintain current D/E ratio"

Cash Flows

- EBIT=Revenue - COGS - SG&A - Depreciation; EBITDA = Revenue - COGS - SG&A

- FCFF=EBIT*(1-tax rate) + Depr - Capex - Changes in NWC; NWC = A/R + Inv - A/P ?+? Cash If cash is needed for operations. If cash is needed for operations - include in NWC but do not reduce debt in stock valuation.

- FCFE=Net Income + Depr - Capex - Changes in NWC + Debt Issuance - Debt Princ. Payments

- Payment function = PMT(rate per period, number of periods, PV)

Present Value

- PVLS = FV(t) / (1+r)^t; FVLS = PV * (1+r)^t; PVGA=PMT*(((1-((1+g)/(1+r))^T))/(r-g))

- PVGP = PMT(1) / (r-g) ; PVGP = (PMT(t) / (r-g)) / (1+r)^(t-1)

Capital Budgeting, NPV, and WACC

- NPV = SUM of CF/(1+r)^t; NPV Function = NPV(rate per period, payments starting at END of first period)

- IRR = Discount rate (r) than makes NPV = 0; IRR also the average annual project rate of return. IRR function cannot be used if cashflows change sign more than once. IRR function cannot be used if CFCs use a growth perpetuity calculation.

- After-Tax Opex FCF = -Opex * (1-tax rate); Depreciation FCF (dep tax shield) = +Depreciation * Tax Rate

- After-tax revenue or opex savings = Revenue or Opex Savings x (1 - tax rate)

- Terminal Year Net Working Capital = 0 for finite life projects

- WACC = Ke * E/(D+E) + Kd *(1 - tax rate) * D (D+E); Note that D/(D+E) = (D/E)/(1+D/E)

- Ke = Rf+Levered Beta*MRP; Levered Beta = Unlevered Beta x (1+D/E); MRP is generally 4-8%, Rf = 10-yr TSY

Equity Valuation

- Enterprise Value (EV) = NPV(FCFFs@WACC); Stock Valuation = (EV - Debt + Cash (if not in NWC)) / Shares

- Equity FCFFs include a terminal value in final year = growth perpetuity, or EBITDA x EBITDA multiple

Hedging

- VaR(X%) = V*Z(X)*; where Z(X)=1.645 for 95% and 2.32 for 99%

- Seller Forward Payoff = (F-St)*Q; Buyer Forward Payoff = (St-F)*Q

- Put Option Profit = -Cost*Q+Max(0,Strike-St)*Q; Call = -Cost*Q+Max(0,St-Strike)*Q

Investing

- Portfolio Expected Return = Sum (Asset Weights x Asset Mean Returns)

- Portfolio Value = Initial Portfolio Value x (1 + return) + contributions - withdrawals

- Portfolio Standard Deviation = (Wi*Wj*Covariance(I,j) --- Not on Final Exam!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock