Question: please use the formula is provided in order to solve these problems and state which equation you used for each problem 11. 12. A new

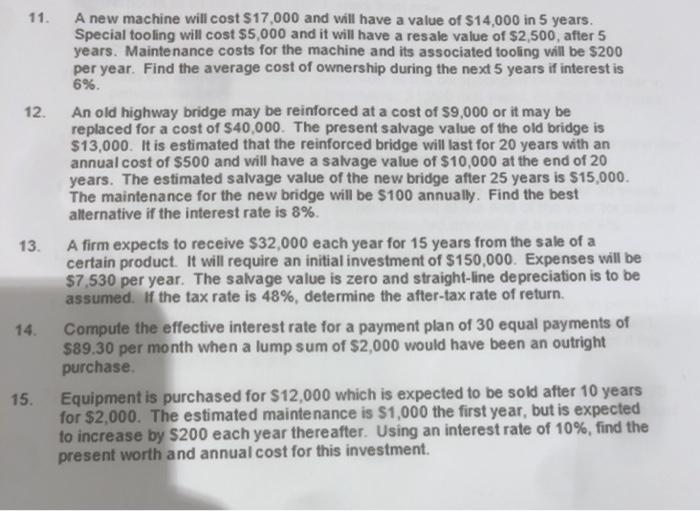

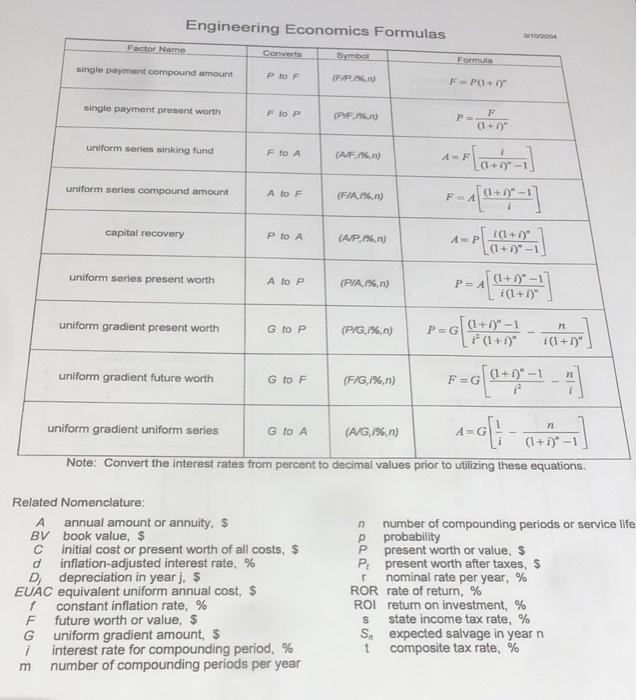

11. 12. A new machine will cost $17,000 and will have a value of $14,000 in 5 years. Special tooling will cost $5,000 and it will have a resale value of $2,500, after 5 years. Maintenance costs for the machine and its associated tooling will be $200 per year. Find the average cost of ownership during the next 5 years if interest is 6% An old highway bridge may be reinforced at a cost of $9,000 or it may be replaced for a cost of $40,000. The present salvage value of the old bridge is $13,000. It is estimated that the reinforced bridge will last for 20 years with an annual cost of $500 and will have a salvage value of $10,000 at the end of 20 years. The estimated salvage value of the new bridge after 25 years is $15,000. The maintenance for the new bridge will be $100 annually. Find the best alternative if the interest rate is 8%. A firm expects to receive $32,000 each year for 15 years from the sale of a certain product. It will require an initial investment of $150,000. Expenses will be $7,530 per year. The salvage value is zero and straight-line depreciation is to be assumed. If the tax rate is 48%, determine the after-tax rate of return. Compute the effective interest rate for a payment plan of 30 equal payments of $89.30 per month when a lump sum of $2,000 would have been an outright purchase. Equipment is purchased for $12,000 which is expected to be sold after 10 years for $2,000. The estimated maintenance is $1,000 the first year, but is expected to increase by $200 each year thereafter. Using an interest rate of 10%, find the present worth and annual cost for this investment. 13 14. 15. Engineering Economics Formulas Factor Name Converts Symbo Formu single payment compound amount PoF CF/P.) FP) single payment present worth Flo P (PYF1.) PE (1+1)" uniform series sinking fund FOA (AF.136.) (1+1)" uniform series compound amount A to F (FIA.n) F-1(043*-'] capital recovery Po A (AP/%n) AP (1+1 (1+y*--1 uniform series present worth A to P (PIA,1%.n) P=A (1+r)" - 1 i(1+1) uniform gradient present worth G to P (P/G,1%.n) p=6) (1+1)-1 [(1+1)" n 1(1+)" uniform gradient future worth G to F (F/G,1%,n) F G (1+1) - n uniform gradient uniform series GOA (AVG,1%.n) A=G (1+1)-1 Note: Convert the interest rates from percent to decimal values prior to utilizing these equations. Related Nomenclature: A annual amount or annuity. $ BV book value, $ initial cost or present worth of all costs, $ inflation-adjusted interest rate, % D depreciation in year], $ EUC equivalent uniform annual cost, $ constant inflation rate, % F future worth or value, $ G uniform gradient amount, $ 1 interest rate for compounding period, % m number of compounding periods per year n number of compounding periods or service life probability P present worth or value, $ P present worth after taxes, $ nominal rate per year, % ROR rate of return, % ROI return on investment, % S state income tax rate, % So expected salvage in year n t composite tax rate, %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts