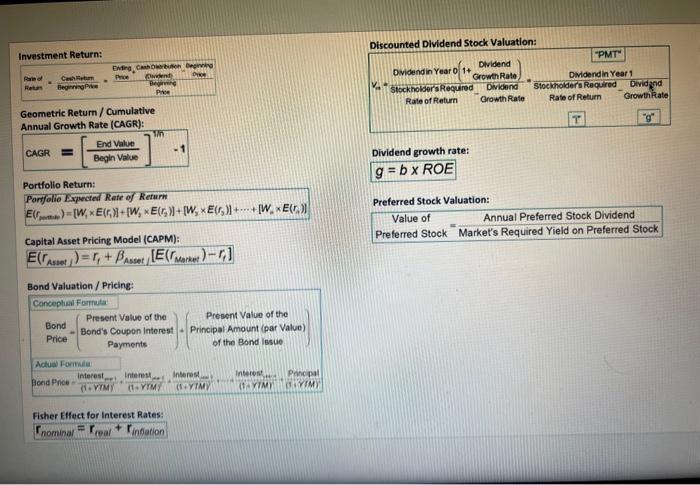

Question: please use the formulas from the formula sheet Investment Return: Geometric Return / Cumulative Annual Growth Rate (CAGR): CAGR=[BeginValueEndValue]1n1 Portfolio Return: Porfflio Expected Rate of

![/ Cumulative Annual Growth Rate (CAGR): CAGR=[BeginValueEndValue]1n1 Portfolio Return: Porfflio Expected Rate](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f206192908f_30466f20618c7bba.jpg)

Investment Return: Geometric Return / Cumulative Annual Growth Rate (CAGR): CAGR=[BeginValueEndValue]1n1 Portfolio Return: Porfflio Expected Rate of Return E(rman)=[W1E(r1)]+[W2E(r2)]+[W2E(r3)]++[WnE(rn)] Capital Asset Pricing Model (CAPM): E(rAsset/L)=rf+Asset/[E(rMarket)rf] Bond Valuation / Pricine: Fisher Effect for Interest Rates: rnominat=rreal+rinfiation Discounted Dividend Stock Valuation: Dividend growth rate: g=bROE Preferred Stock Valuation: Value of Annual Preferred Stock Dividend 28) Company Elbert's bonds mature in 7 years, they pay $45 in annual interest and have a par value of $1,000. Assume the required rate of return on similar bonds is 5.5%. a) What is the current price of one of these bonds? [+ 6pts ] b) Are the bonds trading at par, at a discount or at a premium? [+2 pts]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts