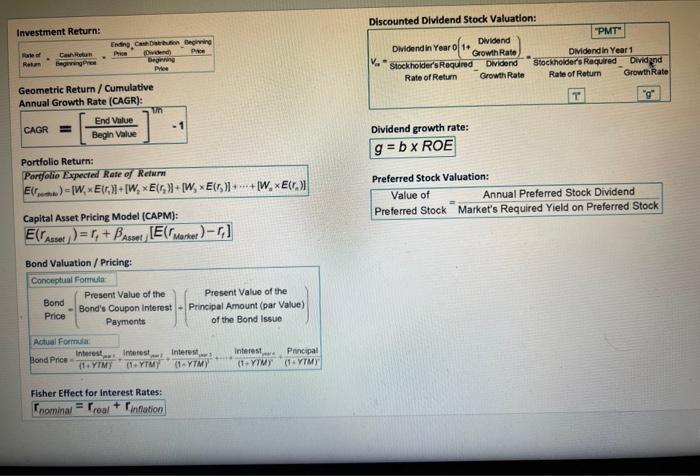

Question: please use the formulas from the formula sheet Investment Return: Discounted Dividend Stock Valuation: Geometric Return / Cumulative Annual Growth Rate (CAGR): Portfolio Return: Portjolie

Investment Return: Discounted Dividend Stock Valuation: Geometric Return / Cumulative Annual Growth Rate (CAGR): Portfolio Return: Portjolie Expected Rate of Retwrm E(rnen)=[W1E(r1)]+[W2E(r2)]+[W3E(r3)]++[WnE(rn)] Capital Asset Pricing Model (CAPM): E(rAssetj)=rt+Assetj[E(rMarket)rt] Bond Valuation / Pricing: \( \begin{tabular}{l} \) Bond \\ Price \( -\left(\begin{tabular}{c} ight. \) Pond's Coupon interest \\ Payments \end{tabular}\( )+\left(\begin{tabular}{c} ight. \) Principal Amount (par Value) \\ of the Bond Issue \end{tabular}) \\ Actual Fornulat \end{tabular}) Dividend growth rate: g=bROE Preferred Stock Valuation: Value of Annual Preferred Stock Dividend Preferred Stock = Market's Required Yield on Preferred Stock Fisher Effect for Interest Rates: rrominal=rcea!+rinfination 30) Based on the CAPM model, what should be the expected return for a stock with a beta of 2.1 when the risk-free rate is 2.5% and the market risk premium is 8.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts