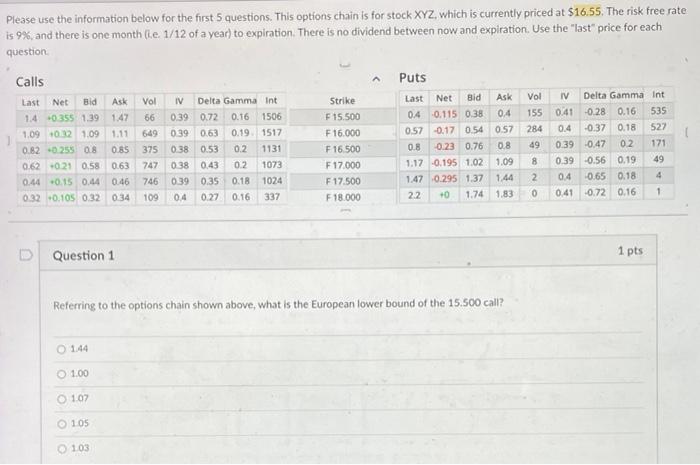

Question: Please use the information below for the first 5 questions. This options chain is for stock XYZ which is currently priced at $16.55. The risk

Please use the information below for the first 5 questions. This options chain is for stock XYZ which is currently priced at $16.55. The risk free rate is 9%, and there is one month (ie 1/12 of a year) to explration. There is no dividend between now and explration. Use the last price for each question Calls Last Net Bid Ask 1.4 0355 1.39 1.47 1.0902 1.09 1.11 0.82 -0.25 0.8 0.85 0.62 0.21 0.58 0.63 0.44 +0.15 0.44 0.46 0.32 +0.10 0.32 0.34 Vol 155 284 49 Vol 66 649 375 747 746 109 IV Delta Gamma int 0.39 0.72 0.16 1506 0.39 0.63 0.19 1517 0.38 0.53 0.2 1131 0.38 0.43 02 1073 0.39 0.35 0.18 1024 04 0.27 0.16 337 Puts Last Net Bid Ask 0.4 -0.115 0.38 0.4 0.57 0.17 0.54 0.57 0.8 0.23 0.76 0.8 1.17 0.195 1.02 1.09 1.47 0.295 1.37 1.44 2.2 +0 1.74 1.83 Strike F 15.500 F16.000 F16 500 F 17.000 F 17.500 F 18.000 IV Delta Gamma Int 0.41 -0.28 0.16 535 0.4 -0.37 0.18 527 0.39 0.47 02 171 0.39 0.56 0.19 49 0.4 0.65 0.18 4 0.72 0.16 1 NO 0.41 D Question 1 1 pts Referring to the options chain shown above, what is the European lower bound of the 15.500 call? 144 1.00 107 105 103

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts