Question: Please use the information below to answer the following question. Your company has a debt to equity breakdown of 60% debt and 40% equity. The

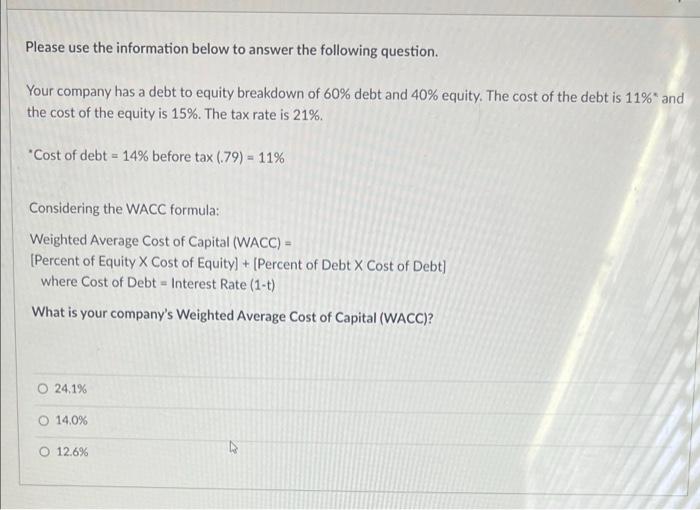

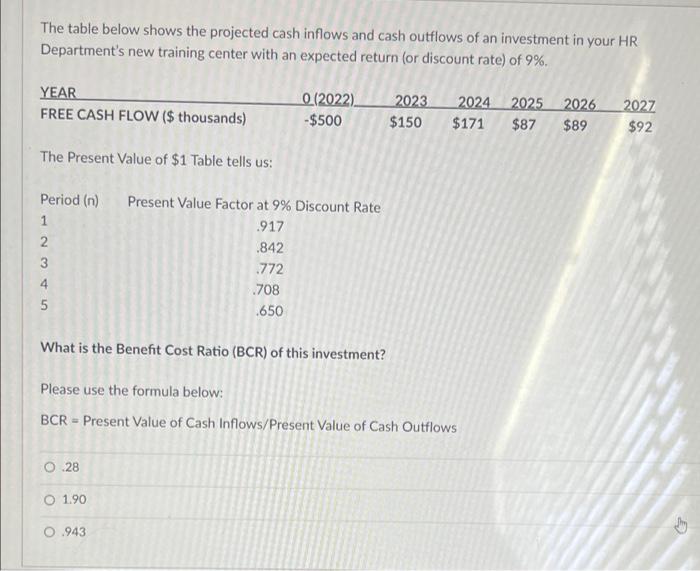

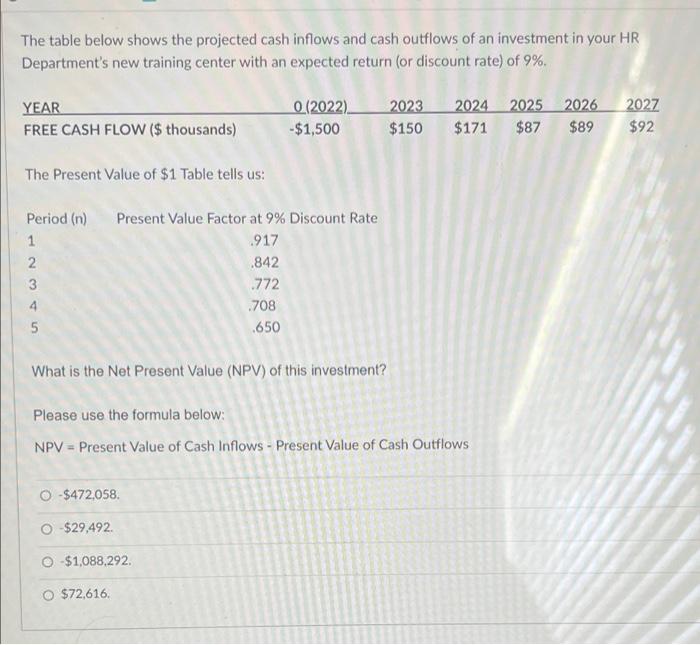

Please use the information below to answer the following question. Your company has a debt to equity breakdown of 60% debt and 40% equity. The cost of the debt is 11% and the cost of the equity is 15%. The tax rate is 21%. "Cost of debt = 14% before tax (79) - 11% Considering the WACC formula: Weighted Average Cost of Capital (WACC) = [Percent of Equity X Cost of Equity] + (Percent of Debt X Cost of Debt) where Cost of Debt - Interest Rate (1-t) What is your company's Weighted Average Cost of Capital (WACC)? O 24.1% O 14,0% O 12.6% The table below shows the projected cash inflows and cash outflows of an investment in your HR Department's new training center with an expected return (or discount rate) of 9%. YEAR FREE CASH FLOW ($ thousands) 0 (2022). -$500 2023 $150 2027 2024 2025 2026 $171 $87 $89 $92 The Present Value of $1 Table tells us: Period (n) Present Value Factor at 9% Discount Rate .917 .842 .772 .708 .650 3 4 5 What is the Benefit Cost Ratio (BCR) of this investment? Please use the formula below: BCR - Present Value of Cash Inflows/Present Value of Cash Outflows O 28 O 1.90 0.943 The table below shows the projected cash inflows and cash outflows of an investment in your HR Department's new training center with an expected return (or discount rate) of 9% YEAR FREE CASH FLOW ($ thousands) 0.(2022) -$1,500 2023 $150 2024 2025 2026 $171 $87 $89 2027 $92 The Present Value of $1 Table tells us: Period (n) 1 2 3 Present Value Factor at 9% Discount Rate .917 .842 .772 .708 .650 4 5 What is the Net Present Value (NPV) of this investment? Please use the formula below: NPV = Present Value of Cash Inflows - Present Value of Cash Outflows O $472,058. O $29,492. O $1,088,292 o $72,616

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts