Question: please use the information from part 3 to do parts 4, 5 and 6 There are 2 firms in an industry producing differentiated products. Each

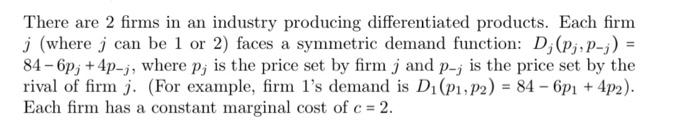

There are 2 firms in an industry producing differentiated products. Each firm j (where j can be 1 or 2) faces a symmetric demand function: D; (Pj,p-;) = 84 - 6p; +4p-j, where p; is the price set by firm j and p-; is the price set by the rival of firm j. (For example, firm l's demand is D: (P1, P2) = 84 - 6p1 + 4p2). Each firm has a constant marginal cost of c = 2. a 3. (6 pts) Now suppose that firm 1 infiltrates firm 2. A secret agent hired by firm 1 is able to take up an important advisory role within firm 2. The secret agent manages to fool the manager of firm 2 into thinking that firm 2's marginal cost is equal to 6 (even though firm 2's true marginal cost remains equal to 2). As such, firm 1 and firm 2 now play a new Bertrand pricing game where firm 1 chooses pl to maximize its actual profits; but firm 2 chooses p2 to maximize its supposed profits, which are calculated by assuming that the marginal cost equals 6. Find the Nash equilibrium of this new game. 4. (3 pts) What is the profit carned by each firm in this new Nash equilib- rium? Hint: when calculating firm 2's profits, remember to use the true marginal 2 cost of 2!. The manager only thinks the marginal cost is 6, but the true marginal cost is still) 2. 5. (3 pts) Would firm 2 benefit from getting rid of the secret agent? Explain carefully (but briefly) the intuition behind your answer. 6. (3 pts) Suppose that the secret agent instead convinced the manager of firm 2 that firm 2's marginal costs were equal to 0 (as opposed to their true value of 2). In the resulting Nash equilibrium, would firm 1 earn higher profits than in the Bertrand equilibrium from part (2)? What about firm 2? Note: you do not need to solve for the new Nash equilibrium, but you should carefully explain the reasoning behind your answer. There are 2 firms in an industry producing differentiated products. Each firm j (where j can be 1 or 2) faces a symmetric demand function: D; (Pj,p-;) = 84 - 6p; +4p-j, where p; is the price set by firm j and p-; is the price set by the rival of firm j. (For example, firm l's demand is D: (P1, P2) = 84 - 6p1 + 4p2). Each firm has a constant marginal cost of c = 2. a 3. (6 pts) Now suppose that firm 1 infiltrates firm 2. A secret agent hired by firm 1 is able to take up an important advisory role within firm 2. The secret agent manages to fool the manager of firm 2 into thinking that firm 2's marginal cost is equal to 6 (even though firm 2's true marginal cost remains equal to 2). As such, firm 1 and firm 2 now play a new Bertrand pricing game where firm 1 chooses pl to maximize its actual profits; but firm 2 chooses p2 to maximize its supposed profits, which are calculated by assuming that the marginal cost equals 6. Find the Nash equilibrium of this new game. 4. (3 pts) What is the profit carned by each firm in this new Nash equilib- rium? Hint: when calculating firm 2's profits, remember to use the true marginal 2 cost of 2!. The manager only thinks the marginal cost is 6, but the true marginal cost is still) 2. 5. (3 pts) Would firm 2 benefit from getting rid of the secret agent? Explain carefully (but briefly) the intuition behind your answer. 6. (3 pts) Suppose that the secret agent instead convinced the manager of firm 2 that firm 2's marginal costs were equal to 0 (as opposed to their true value of 2). In the resulting Nash equilibrium, would firm 1 earn higher profits than in the Bertrand equilibrium from part (2)? What about firm 2? Note: you do not need to solve for the new Nash equilibrium, but you should carefully explain the reasoning behind your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts