Question: please use the modified instructions PS Continuing Problem The completed by Miller June 14 were described the end of Chapter 1 The following were pleted

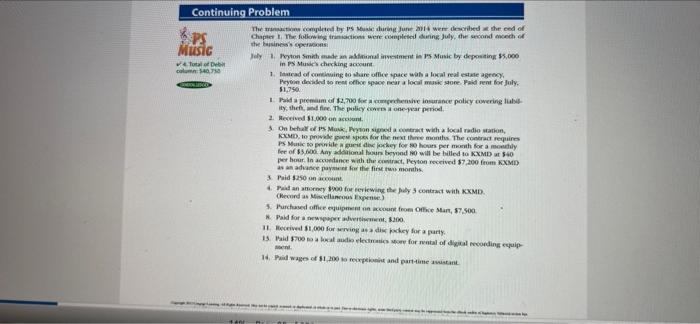

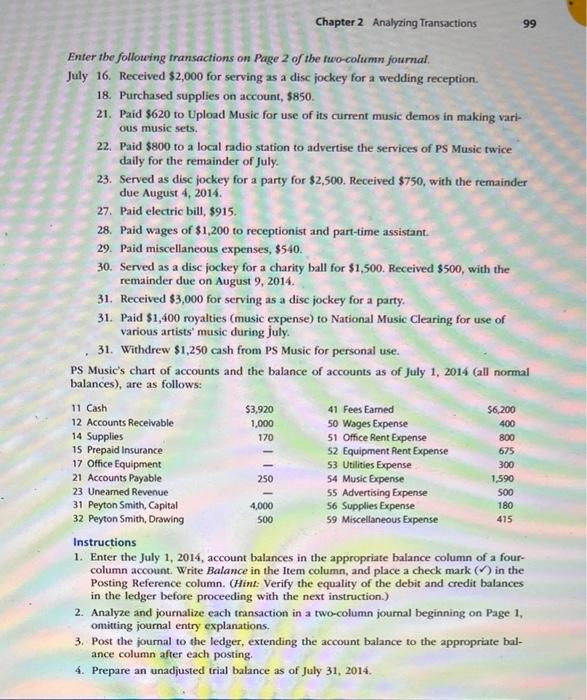

PS Continuing Problem The completed by Miller June 14 were described the end of Chapter 1 The following were pleted during July, the second month of the business's Music 1. Peyton Smith made an investment in Music by depositing $5,000 Toode in Muse checking out 40.750 1. Instead of continuing to share office space wiha local real estate agrocy, Peyton aded to rent office space near a local mussore Paid rent for July $1,750 Pada premium of 12.00 when she insurance policy covering lase ity, the The policy Wear period 2. Received $1.000 3. On behalf Mo, Pryson act with a local radio station KIMD, top for the next three months. The contract requires PS Music to wiedy for hours per month for a moly fee of. Any olyan o will be willed to KXMD 540 per hour in accendence with the car, Peyton received 7.200 from KXMI) as an advance pay the first two months 3 Paid 50 Plan for reviewing the contact with KXMD. Hecord Melance pense) 5. Purchased office count from Office Mant, 7.500 Paid for a new 200 11 Received $1.000 fordi dey for party 13 Pad 700 doled or forwaal of del recording equip 1 Page of 1.200 erexpo and pantiment tan Chapter 2 Analyzing Transactions 99 Enter the following transactions on Page 2 of the two-column fournal July 16. Received $2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, $850 21. Paid $620 to Upload Music for use of its current music demos in making vari- ous music sets. 22. Paid $800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July 23. Served as disc jockey for a party for $2,500. Received $750, with the remainder due August 4, 2014 27. Paid electric bill, $915. 28. Paid wages of $1,200 to receptionist and part-time assistant 29. Paid miscellaneous expenses, $540. 30. Served as a disc jockey for a charity ball for $1,500. Received $500, with the remainder due on August 9, 2014. 31. Received $3,000 for serving as a disc jockey for a party. 31. Paid $1,400 royalties (music expense) to National Music Clearing for use of various artists' music during july. 31. Withdrew $1,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2014 (all normal balances), are as follows: $3,920 41 Fees Eamed $6.200 12 Accounts Receivable 1,000 50 Wages Expense 14 Supplies 170 51 Office Rent Expense 15 Prepaid Insurance 52 Equipment Rent Expense 17 Office Equipment 53 Utilities Expense 21 Accounts Payable 54 Music Expense 23 Unearned Revenue 55 Advertising Expense 31 Peyton Smith, Capital 4,000 56 Supplies Expense 32 Peyton Smith, Drawing 500 59 Miscellaneous Expense Instructions 1. Enter the July 1, 2014, account balances in the appropriate balance column of a four- column account. Write Balance in the Item column, and place a check mark in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1 omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate bal- ance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2014. 11 Cash 400 800 675 300 250 1,590 500 180 415 1. Enter the July 1, 2014 account balances in the general ledger (file on Module 5 'page'). All accounts have normal balances. Verify the equality of the debit and credit balances in the ledger before proceeding with part 2 2. Analyze and journalize each transaction in the general journal (file on Module 5 'page'). 3. Post the journal to the ledger. Compute the ending balance of each T-account. 4. Prepare an unadjusted trial balance as of July 31, 2014 Scan and upload completed assignment by midnight, Monday, March 21. (Three items to upload: general journal, general ledger, unadjusted trial balance.) The general ledger entries must be hand written, then scanned/take a picture, and uploaded. You can either hand write the journal entries and unadjusted trial balance, then scan/take a picture and upload OR complete the journal entries in word and upload. PS Continuing Problem The completed by Miller June 14 were described the end of Chapter 1 The following were pleted during July, the second month of the business's Music 1. Peyton Smith made an investment in Music by depositing $5,000 Toode in Muse checking out 40.750 1. Instead of continuing to share office space wiha local real estate agrocy, Peyton aded to rent office space near a local mussore Paid rent for July $1,750 Pada premium of 12.00 when she insurance policy covering lase ity, the The policy Wear period 2. Received $1.000 3. On behalf Mo, Pryson act with a local radio station KIMD, top for the next three months. The contract requires PS Music to wiedy for hours per month for a moly fee of. Any olyan o will be willed to KXMD 540 per hour in accendence with the car, Peyton received 7.200 from KXMI) as an advance pay the first two months 3 Paid 50 Plan for reviewing the contact with KXMD. Hecord Melance pense) 5. Purchased office count from Office Mant, 7.500 Paid for a new 200 11 Received $1.000 fordi dey for party 13 Pad 700 doled or forwaal of del recording equip 1 Page of 1.200 erexpo and pantiment tan Chapter 2 Analyzing Transactions 99 Enter the following transactions on Page 2 of the two-column fournal July 16. Received $2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, $850 21. Paid $620 to Upload Music for use of its current music demos in making vari- ous music sets. 22. Paid $800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July 23. Served as disc jockey for a party for $2,500. Received $750, with the remainder due August 4, 2014 27. Paid electric bill, $915. 28. Paid wages of $1,200 to receptionist and part-time assistant 29. Paid miscellaneous expenses, $540. 30. Served as a disc jockey for a charity ball for $1,500. Received $500, with the remainder due on August 9, 2014. 31. Received $3,000 for serving as a disc jockey for a party. 31. Paid $1,400 royalties (music expense) to National Music Clearing for use of various artists' music during july. 31. Withdrew $1,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2014 (all normal balances), are as follows: $3,920 41 Fees Eamed $6.200 12 Accounts Receivable 1,000 50 Wages Expense 14 Supplies 170 51 Office Rent Expense 15 Prepaid Insurance 52 Equipment Rent Expense 17 Office Equipment 53 Utilities Expense 21 Accounts Payable 54 Music Expense 23 Unearned Revenue 55 Advertising Expense 31 Peyton Smith, Capital 4,000 56 Supplies Expense 32 Peyton Smith, Drawing 500 59 Miscellaneous Expense Instructions 1. Enter the July 1, 2014, account balances in the appropriate balance column of a four- column account. Write Balance in the Item column, and place a check mark in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1 omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate bal- ance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2014. 11 Cash 400 800 675 300 250 1,590 500 180 415 1. Enter the July 1, 2014 account balances in the general ledger (file on Module 5 'page'). All accounts have normal balances. Verify the equality of the debit and credit balances in the ledger before proceeding with part 2 2. Analyze and journalize each transaction in the general journal (file on Module 5 'page'). 3. Post the journal to the ledger. Compute the ending balance of each T-account. 4. Prepare an unadjusted trial balance as of July 31, 2014 Scan and upload completed assignment by midnight, Monday, March 21. (Three items to upload: general journal, general ledger, unadjusted trial balance.) The general ledger entries must be hand written, then scanned/take a picture, and uploaded. You can either hand write the journal entries and unadjusted trial balance, then scan/take a picture and upload OR complete the journal entries in word and upload

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts