Question: Please use the provided excel to work on the problem and show work / formula in working cell for a thumb up. Please use the

Please use the provided excel to work on the problem and show work / formula in working cell for a thumb up.

Please use the provided excel to work on the problem and show work / formula in working cell for a thumb up.

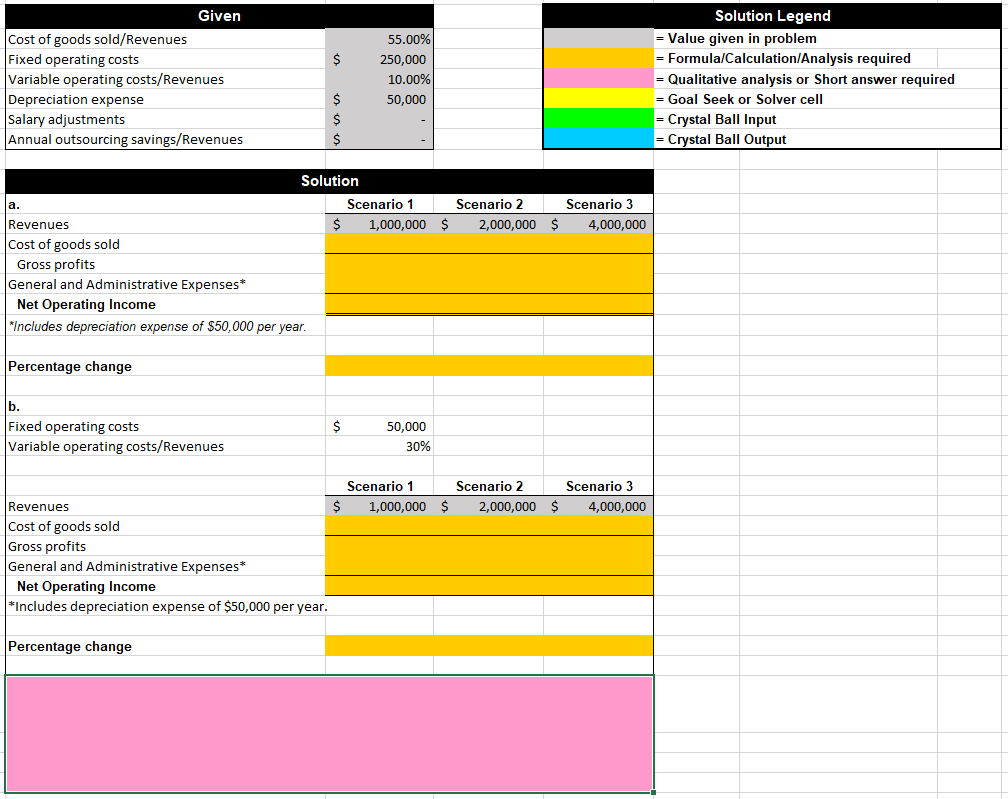

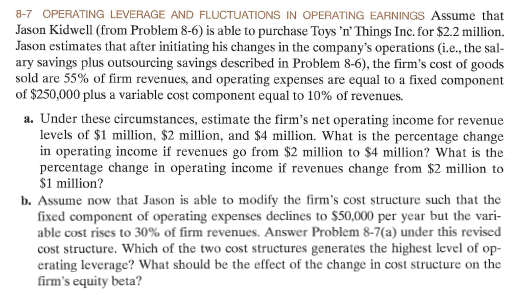

$ Given Cost of goods sold/Revenues Fixed operating costs Variable operating costs/Revenues Depreciation expense Salary adjustments Annual outsourcing savings/Revenues 55.00% 250,000 10.00% 50,000 Solution Legend = Value given in problem = Formula/Calculation/Analysis required = Qualitative analysis or Short answer required = Goal Seek or Solver cell = Crystal Ball Input Crystal Ball Output $ $ $ Scenario 2 Scenario 3 2,000,000 $ 4,000,000 Solution a. Scenario 1 Revenues 1,000,000 $ Cost of goods sold Gross profits General and Administrative Expenses* Net Operating Income *Includes depreciation expense of $50,000 per year. Percentage change b. Fixed operating costs Variable operating costs/Revenues $ 50,000 30% Scenario 1 1,000,000 $ Scenario 2 2,000,000 $ Scenario 3 4,000,000 Revenues $ Cost of goods sold Gross profits General and Administrative Expenses* Net Operating Income *Includes depreciation expense of $50,000 per year. Percentage change 8-7 OPERATING LEVERAGE AND FLUCTUATIONS IN OPERATING EARNINGS Assume that Jason Kidwell (from Problem 8-6) is able to purchase Toys 'n' Things Inc. for $2.2 million. Jason estimates that after initiating his changes in the company's operations (i.e., the sal- ary savings plus outsourcing savings described in Problem 8-6), the firm's cost of goods sold are 55% of firm revenues, and operating expenses are equal to a fixed component of $250,000 plus a variable cost component equal to 10% of revenues. a. Under these circumstances, estimate the firm's net operating income for revenue levels of $1 million, $2 million, and $4 million. What is the percentage change in operating income if revenues go from $2 million to $4 million? What is the percentage change in operating income if revenues change from $2 million to $1 million? b. Assume now that Jason is able to modify the firm's cost structure such that the fixed component of operating expenses declines to $50,000 per year but the vari- able cost rises to 30% of firm revenues. Answer Problem 8-7(a) under this revised cost structure. Which of the two cost structures generates the highest level of op- erating leverage? What should be the effect of the change in cost structure on the firm's equity beta? $ Given Cost of goods sold/Revenues Fixed operating costs Variable operating costs/Revenues Depreciation expense Salary adjustments Annual outsourcing savings/Revenues 55.00% 250,000 10.00% 50,000 Solution Legend = Value given in problem = Formula/Calculation/Analysis required = Qualitative analysis or Short answer required = Goal Seek or Solver cell = Crystal Ball Input Crystal Ball Output $ $ $ Scenario 2 Scenario 3 2,000,000 $ 4,000,000 Solution a. Scenario 1 Revenues 1,000,000 $ Cost of goods sold Gross profits General and Administrative Expenses* Net Operating Income *Includes depreciation expense of $50,000 per year. Percentage change b. Fixed operating costs Variable operating costs/Revenues $ 50,000 30% Scenario 1 1,000,000 $ Scenario 2 2,000,000 $ Scenario 3 4,000,000 Revenues $ Cost of goods sold Gross profits General and Administrative Expenses* Net Operating Income *Includes depreciation expense of $50,000 per year. Percentage change 8-7 OPERATING LEVERAGE AND FLUCTUATIONS IN OPERATING EARNINGS Assume that Jason Kidwell (from Problem 8-6) is able to purchase Toys 'n' Things Inc. for $2.2 million. Jason estimates that after initiating his changes in the company's operations (i.e., the sal- ary savings plus outsourcing savings described in Problem 8-6), the firm's cost of goods sold are 55% of firm revenues, and operating expenses are equal to a fixed component of $250,000 plus a variable cost component equal to 10% of revenues. a. Under these circumstances, estimate the firm's net operating income for revenue levels of $1 million, $2 million, and $4 million. What is the percentage change in operating income if revenues go from $2 million to $4 million? What is the percentage change in operating income if revenues change from $2 million to $1 million? b. Assume now that Jason is able to modify the firm's cost structure such that the fixed component of operating expenses declines to $50,000 per year but the vari- able cost rises to 30% of firm revenues. Answer Problem 8-7(a) under this revised cost structure. Which of the two cost structures generates the highest level of op- erating leverage? What should be the effect of the change in cost structure on the firm's equity beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts