Question: PLEASE USE THE TABLES PROVIDED WILL UPVOTE ANSWER QUESTION 3 The following information has been extracted from the financial records of Nocturnes Ltd: Cash Accounts

PLEASE USE THE TABLES PROVIDED WILL UPVOTE ANSWER

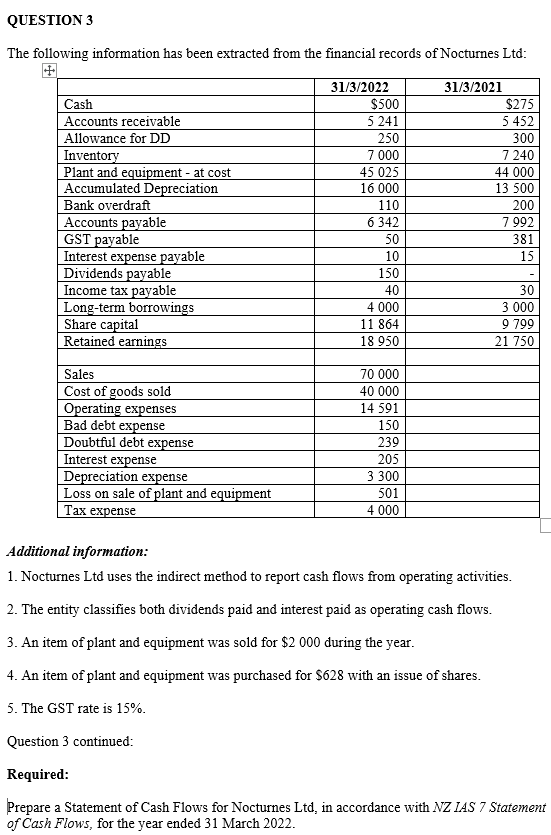

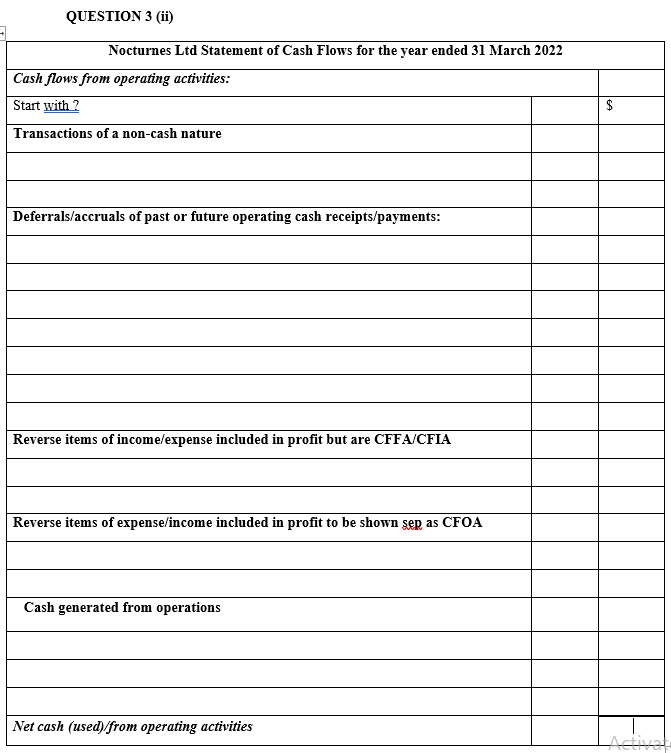

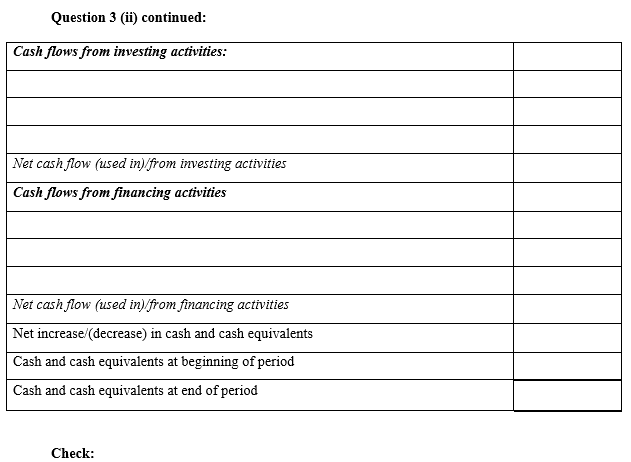

QUESTION 3 The following information has been extracted from the financial records of Nocturnes Ltd: Cash Accounts receivable Allowance for DD Inventory Plant and equipment - at cost Accumulated Depreciation Bank overdraft Accounts payable GST payable Interest expense payable Dividends payable Income tax payable Long-term borrowings Share capital Retained earnings 31/3/2022 $500 5241 250 7 000 45 025 16 000 110 6 342 50 10 150 31/3/2021 $275 5 452 300 7 240 44 000 13 500 200 7 992 381 15 40 4 000 11 864 18 950 30 3 000 9 799 21 750 Sales Cost of goods sold Operating expenses Bad debt expense Doubtful debt expense Interest expense Depreciation expense Loss on sale of plant and equipment Tax expense 70 000 40 000 14 591 150 239 205 3 300 501 4 000 Additional information: 1. Nocturnes Ltd uses the indirect method to report cash flows from operating activities. 2. The entity classifies both dividends paid and interest paid as operating cash flows. 3. An item of plant and equipment was sold for $2 000 during the year. 4. An item of plant and equipment was purchased for $628 with an issue of shares. 5. The GST rate is 15%. Question 3 continued: Required: Prepare a Statement of Cash Flows for Nocturnes Ltd, in accordance with NZ IAS 7 Statement of Cash Flows, for the year ended 31 March 2022. QUESTION 3 (ii) Nocturnes Ltd Statement of Cash Flows for the year ended 31 March 2022 Cash flows from operating activities: Start with 2 Transactions of a non-cash nature $ Deferrals/accruals of past or future operating cash receipts/payments: Reverse items of income/expense included in profit but are CFFA/CFIA Reverse items of expense/income included in profit to be shown ser as CFOA Cash generated from operations Net cash (used)/from operating activities Active Question 3 (ii) continued: Cash flows from investing activities: Net cash flow (used in) from investing activities Cash flows from financing activities Net cash flow (used in) from financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts