Question: Please use the template below to answer the question above The Greene Corp. produced the following data accompanying its financial data for 2022 ; a.

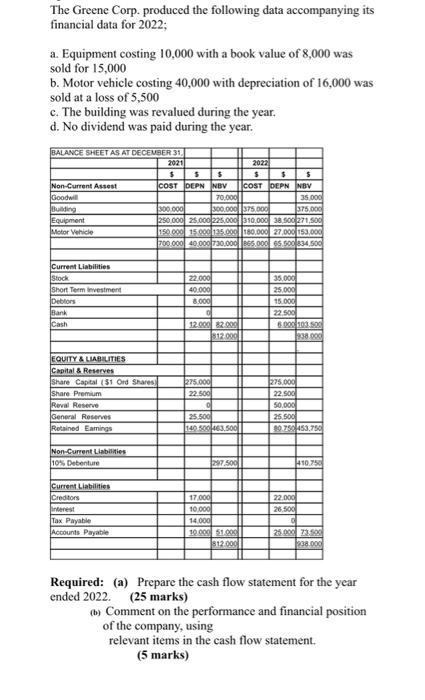

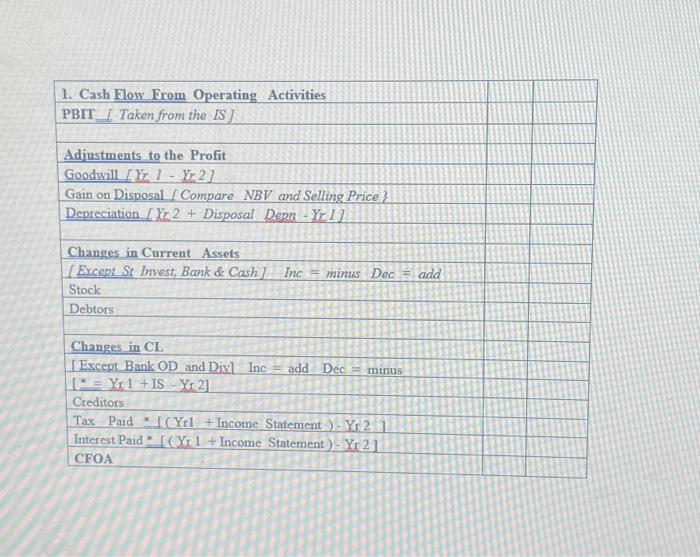

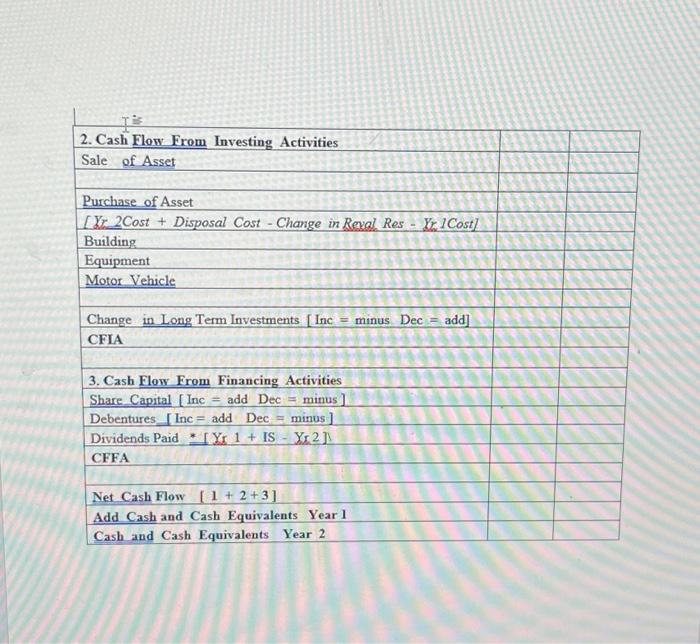

The Greene Corp. produced the following data accompanying its financial data for 2022 ; a. Equipment costing 10,000 with a book value of 8,000 was sold for 15,000 b. Motor vehicle costing 40,000 with depreciation of 16,000 was sold at a loss of 5,500 c. The building was revalued during the year. d. No dividend was paid during the year. Required: (a) Prepare the cash flow statement for the year ended 2022. (25 marks) (b) Comment on the performance and financial position of the company, using relevant items in the cash flow statement. (5 marks) 1. Cash Flow From Operating Activities PBIT [ Taken from the [S] Adiustments to the Profit Goodwill [yx,1yx,2] Gain on Disposal [ Compare NBV and Selling Price? Depreciation [r2+ Disposal Depn r11] Changes in Current Assets [Except St Invest, Bank \& Cash] Inc = minus Dec = add Stock Debtors Changes in CL. [Except Bank OD and Div] Inc = add Dec= minus [=Y51+IS-YY52] Creditors Tax Paid : [(Yr1+ Income Statement )Yr2] Interest Paid = [(Yr1+ Income Statement )Yr2] CFOA \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ 2. Cash Flow From Investing Activities } \\ \hline Sale of Asset & & \\ \hline Purchase of Asset & & \\ \hline [Xr.2Cost + Disposal Cost - Change in Reval Res - YL,1 Cost] & & \\ \hline & & \\ \hline Equipment & & \\ \hline Motor Vehicle & & \\ \hline & & \\ \hline Change in Long Term Investments [ Inc = minus Dec= add] & & \\ \hline & & \\ \hline & & \\ \hline 3. Cash Flow From Financing Activities & & \\ \hline Share Capital [ Inc = add Dec= minus ] & & \\ \hline Debentures [ Inc = add Dec= minus ] & & \\ \hline Dividends Paid [YK1+ISY2] & & \\ \hline CFFA & 8 & \\ \hline & & \\ \hline Net Cash Flow [1+2+3] & & \\ \hline Add Cash and Cash Equivalents Year 1 & & \\ \hline Cash and Cash Equivalents Year 2 & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts