The property is located at the intersection of two heavily traveled major arteries. It is a...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

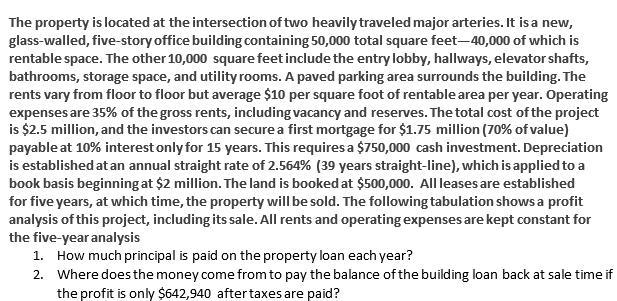

The property is located at the intersection of two heavily traveled major arteries. It is a new, glass-walled, five-story office building containing 50,000 total square feet-40,000 of which is rentable space. The other 10,000 square feet include the entry lobby, hallways, elevator shafts, bathrooms, storage space, and utility rooms. A paved parking area surrounds the building. The rents vary from floor to floor but average $10 per square foot of rentable area per year. Operating expenses are 35% of the gross rents, including vacancy and reserves. The total cost of the project is $2.5 million, and the investors can secure a first mortgage for $1.75 million (70% of value) payable at 10% interest only for 15 years. This requires a $750,000 cash investment. Depreciation is established at an annual straight rate of 2.564% (39 years straight-line), which is applied to a book basis beginning at $2 million. The land is booked at $500,000. All leases are established for five years, at which time, the property will be sold. The following tabulation shows a profit analysis of this project, including its sale. All rents and operating expenses are kept constant for the five-year analysis 1. How much principal is paid on the property loan each year? 2. Where does the money come from to pay the balance of the building loan back at sale time if the profit is only $642,940 after taxes are paid? The property is located at the intersection of two heavily traveled major arteries. It is a new, glass-walled, five-story office building containing 50,000 total square feet-40,000 of which is rentable space. The other 10,000 square feet include the entry lobby, hallways, elevator shafts, bathrooms, storage space, and utility rooms. A paved parking area surrounds the building. The rents vary from floor to floor but average $10 per square foot of rentable area per year. Operating expenses are 35% of the gross rents, including vacancy and reserves. The total cost of the project is $2.5 million, and the investors can secure a first mortgage for $1.75 million (70% of value) payable at 10% interest only for 15 years. This requires a $750,000 cash investment. Depreciation is established at an annual straight rate of 2.564% (39 years straight-line), which is applied to a book basis beginning at $2 million. The land is booked at $500,000. All leases are established for five years, at which time, the property will be sold. The following tabulation shows a profit analysis of this project, including its sale. All rents and operating expenses are kept constant for the five-year analysis 1. How much principal is paid on the property loan each year? 2. Where does the money come from to pay the balance of the building loan back at sale time if the profit is only $642,940 after taxes are paid?

Expert Answer:

Related Book For

Real Estate Finance and Investments

ISBN: 978-0073377339

14th edition

Authors: William Brueggeman, Jeffrey Fisher

Posted Date:

Students also viewed these finance questions

-

A warehouse operator has 24,000square feet of floor space in which to store two products. Each unit of product I requires 20 square feet of floor space and costs $12 per day to store. Each unit of...

-

Two heavily industrial areas are located 10 miles apart, as shown in the figure. if the concentration of particulate matter (in parts per million) decreases as the reciprocal of the square of the...

-

An elevator containing p passengers is at the ground floor of a building with n floors. On its way to the top of the building, the elevator will stop if a passenger needs to get off. Passengers get...

-

Top executive officers of Preston Company, a merchandising firm, are preparing the next years budget. The controller has provided everyone with the current years projected income statement. Current...

-

Many IT professionals feel that wireless networks pose the highest risks in a companys network system. a. Why do you think this is true? b. Which general controls can help reduce these risks?

-

Alladin Company purchased Machine #201 on May 1, 2015. The following information relating to Machine #201 was gathered at the end of May. Price \($85\),000 Credit terms 2/10, n/30 Freight-in costs $...

-

Define the following: a. Asset b. Liability c. Net asset

-

The expected annual returns are 15% for investment 1 and 12% for investment 2. The standard deviation of the first investments return is 10%; the second investments return has a standard deviation of...

-

ELLA'S ELECTRONICS ACCOUNTING PROJECT PART 2Adjusting InformationAt the end of February, the following information is determined:a. One month of the business insurance coverage has expired.b. At the...

-

Iranzo Ammunition is an all-equity firm that currently has 6,000,000 shares outstanding worth $50 per share. The company's considering converting to a capital structure that is 50.0% debt. The firm...

-

A graph is finite if * O (b) It vertex set is infinite. (c) Both of it is vertex set and it is edge set are infinite O (d) It edge set is infinite. O (a) It is vertex set or edge set is infinite

-

The following is the trial balance of Manju Chawla on March 31, 2005. You are required to prepare trading and profit and loss account and a balance sheet as on date : Closing stock Rs. 2,000. Account...

-

Following are the Balance Sheets of A Ltd. and B Ltd. as on 31.3.2016: B Ltd. is to be absorbed by A Ltd. on the following terms : (1) B Ltd. declares a dividend of 10% before absorption for the...

-

On January 1, Professor Smith made a resolution to lose some weight and save some money. He decided that he would strictly budget $100 for lunches each month. For lunch, he has only two choices: the...

-

The following is the trial balance of Mr. Deepak as on March 31, 2005. You are required to prepare trading account, profit and loss account and a balance sheet as on date : Closing stock Rs. 35,000....

-

Refer to the information provided for Wong Company in EC-2. Instructions (a) Draw cash receipts and cash payments journals (see Illustrations C-5 and C-7) and a general journal. Use page 1 for each...

-

Sidney only gets utility from commodities xl and x2 and preferences over these two commodities can be represented by the utility function, U(x, x) = (x+x2)/2. Sidney maximizes her utility subject to...

-

Hardin Services Co. experienced the following events in 2016: 1. Provided services on account. 2. Collected cash for accounts receivable. 3. Attempted to collect an account and, when unsuccessful,...

-

What is meant by a unit of comparison? Why is it important?

-

You have been asked to develop a pro forma statement of cash flow for the coming year for Autumn Seasons, a 200-unit suburban garden apartment community. This community has a mix of 40 studio, 80...

-

Lee Development Co. has found a site that it believes will support 75 homesites. The company also believes that the land can be purchased for $225,000 while direct development costs will run an...

-

Why does the free-rider problem occur in the debt market?

-

You are in the market for a used car. At a used car lot, you know that the Blue Book value of the car you are looking at is between $15,000 and $19,000. If you believe the dealer knows as much about...

-

You wish to hire Ron to manage your Dallas operations. The profits from the operations depend partially on how hard Ron works, as follows. If Ron is lazy, he will surf the Internet all day, and he...

Study smarter with the SolutionInn App