Question: ( Please, use these formulas that are in the image only ) . A companys capital structure consists solely of debt and common equity. It

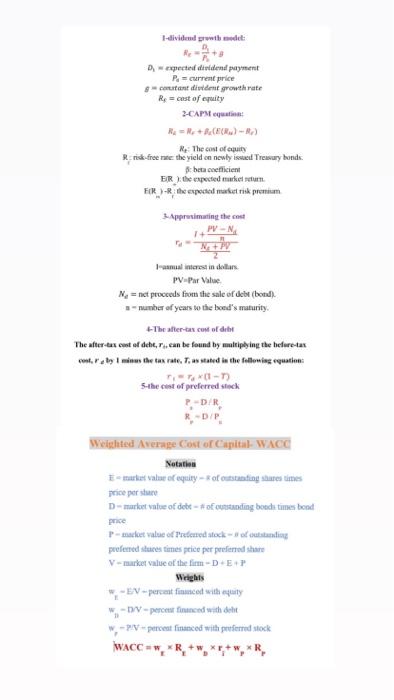

(Please, use these formulas that are in the image only).

A companys capital structure consists solely of debt and common equity. It can issue debt at 15 percent interest rate, and its common stock is expected to pay a $5 dividend per share next year. The stocks price is currently $40, its dividend is expected to grow at a constant rate of 3 percent per year; its tax rate is 30 percent and its weighted average cost of capital (WACC) is 14 percent.

1. Calculate the after-tax cost of debt and the cost of common equity.

2. What percentage of the companys capital structure consists of common equity?

I-divided wheet: + expected tidend payment P = current price gautant divident growth rate Re = cost of equity 2-CAPM RE-RR (HR) - A) ReThe cost of equity Risk-free mite: the yield on newly issue Treasury bonds beta coefficient ER the expected market. FIR-R the expected to premium Approximating the cost PVN 1-arul mieres in dition PV-Par Value N = niet proceeds from the sale of debt (botul). number of years to the boed's maturity. -Theater cool de The after-tax cent of dehe, can be found by multiplying the hefuretas c.reby im the tax rate. Ti as stated in the following equation: 1-T) the cost of preferred stock PDR R-D/P Weighted Average Cost of Capital WACO Notation Emrat value of equity -- of outstanding sure times price persone D-market value of debt - # of saling bendstimes bond price pelet value of Freered stock of outstanding peofened stuves times peice per preferred share V-market value of the firm -DEP Weights -EV-percent inced with equity -DV-percent and with det PV-prest financed with preferred stock WACC-WR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts