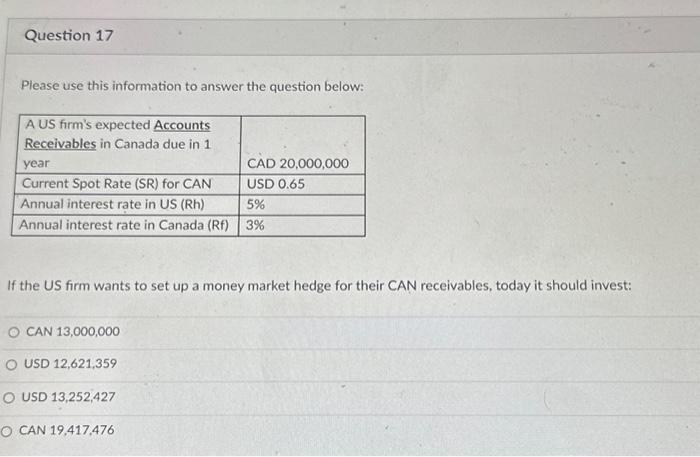

Question: Please use this information to answer the question below: If the US firm wants to set up a money market hedge for their CAN receivables,

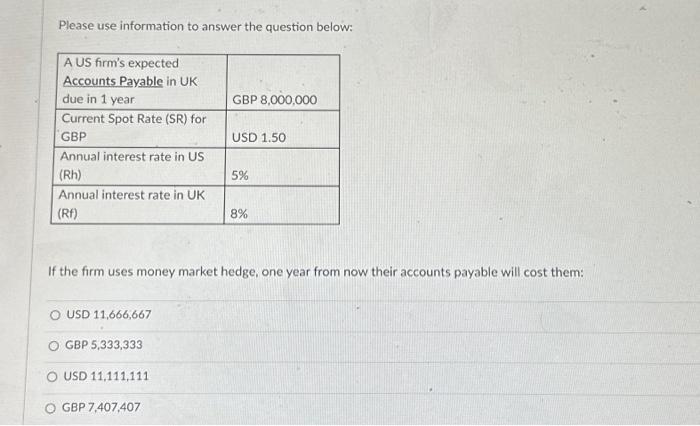

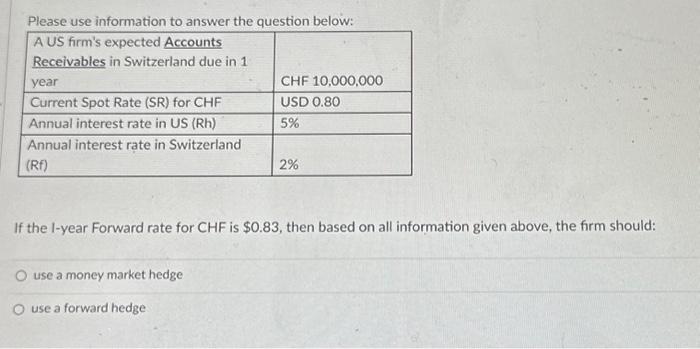

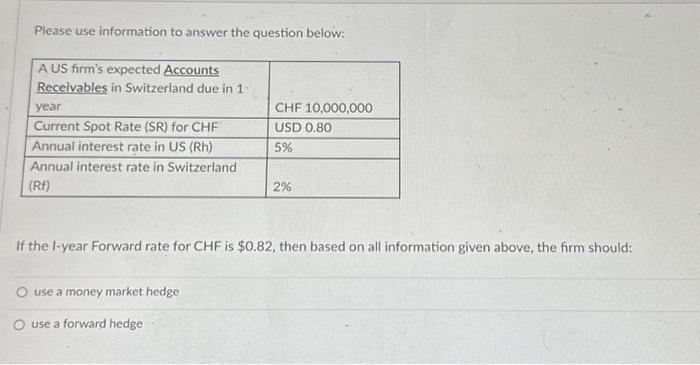

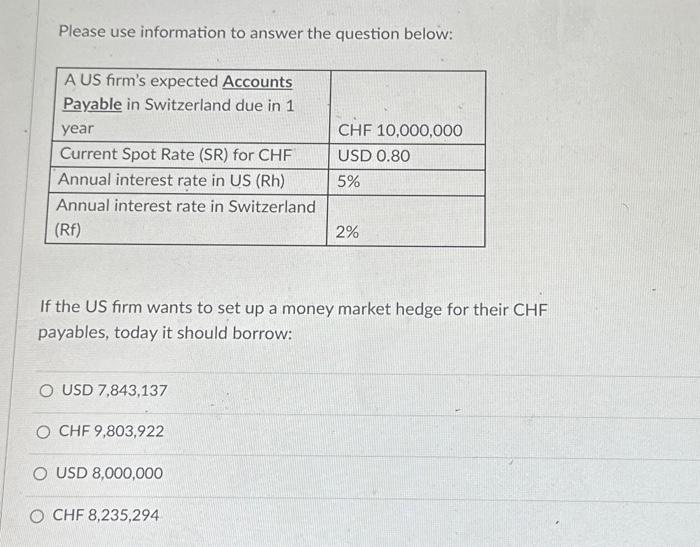

Please use this information to answer the question below: If the US firm wants to set up a money market hedge for their CAN receivables, today it should invest: CAN 13,000,000 USD 12,621,359 USD 13,252,427 CAN 19,417,476 Please use information to answer the question below: If the firm uses money market hedge, one year from now their accounts payable will cost them: USD 11,666,667 GBP 5,333,333 USD 11,111,111 GBP 7,407,407 Please use information to answer the question below: If the l-year Forward rate for CHF is $0.83, then based on all information given above, the firm should: use a money market hedge use a forward hedge Please use information to answer the question below: If the I-year Forward rate for CHF is $0.82, then based on all information given above, the firm should: use a money market hedge use a forward hedge Please use information to answer the question below: If the US firm wants to set up a money market hedge for their CHF payables, today it should borrow: USD 7,843,137 CHF 9,803,922 USD 8,000,000 CHF 8,235,294

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts