Question: Please use TWO different approach to calculate. The computed answer of these two suppose the same. The First Approach: CFFA= Operating Cash Flow+Net Capital Spending+

Please use TWO different approach to calculate. The computed answer of these two suppose the same.

The First Approach:

CFFA= Operating Cash Flow+Net Capital Spending+ Change in Net Working Capital

The Second Approach:

CFFA= Cash Flow to the creditor - Cash Flow to stockholder

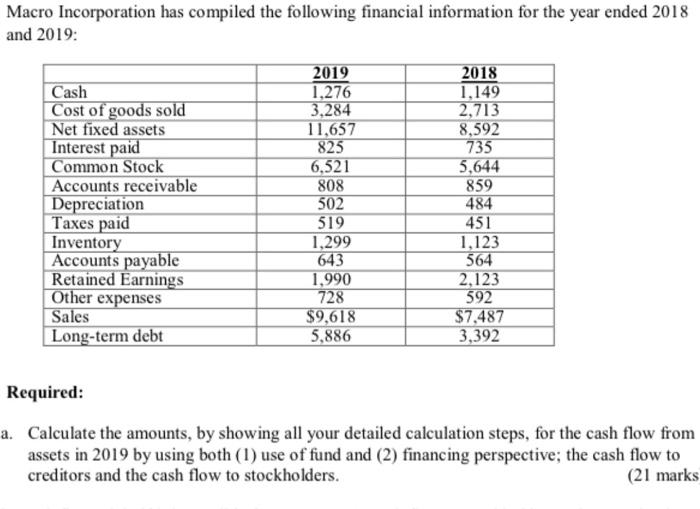

Macro Incorporation has compiled the following financial information for the year ended 2018 and 2019: Cash Cost of goods sold Net fixed assets Interest paid Common Stock Accounts receivable Depreciation Taxes paid Inventory Accounts payable Retained Earnings Other expenses Sales Long-term debt 2019 1,276 3,284 11,657 825 6,521 808 502 519 1,299 643 1,990 728 $9,618 5,886 2018 1,149 2,713 8,592 735 5,644 859 484 451 1,123 564 2,123 592 $7,487 3,392 Required: a. Calculate the amounts, by showing all your detailed calculation steps, for the cash flow from assets in 2019 by using both (1) use of fund and (2) financing perspective; the cash flow to creditors and the cash flow to stockholders. (21 marks

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Sales Cost of goods sold 2019 2018 9618 7487 3284 2713 Gross M... View full answer

Get step-by-step solutions from verified subject matter experts