Question: Please use word doc pics to complete both the excel layout and word doc questions, thank you. Stay in format. Redgrave and Hargren founded the

Please use word doc pics to complete both the excel layout and word doc questions, thank you. Stay in format.

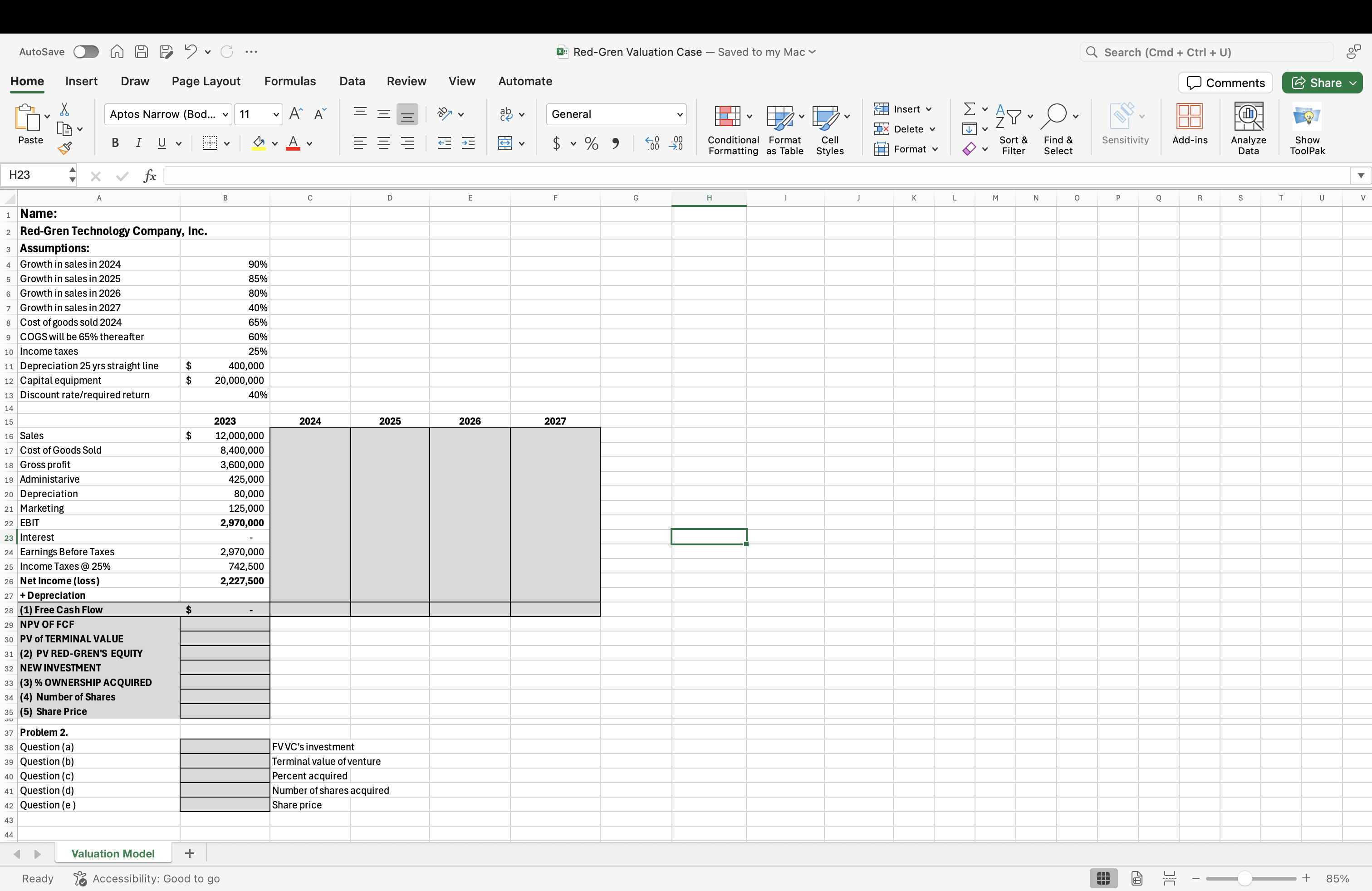

Redgrave and Hargren founded the RedGren Technology Company started the company with $ and issued million shares in The company manufactures night vision lenses for commercial drone cameras. These lenses can be applied in a variety of situations night search and rescue operations and potentially in security operations for Customs and Border Patrol. The company began operating in just as the economy was emerging from the pandemic. That year was particularly bad, as its operations

were being tested for survival and suffered a net loss of $ In the company suffered a net loss of $ albeit lower than in However, market prospects seem very bright, and the future looked promising and the demand for the product was picking up Tere was also good news for RedGren. The US Department of defense has shown interest in the product. RedGren realized that they will need new equipment and additional staff to produce the quantities that the military was interested in So based on the interest of the Military, RedGren decided to invest in the latest glass cutting and manufacturing equipment and staff needed to produce the lenses. As a result, RedGren is seeking $ million in equity financing to purchase the equipment and hire the necessary staff to run the equipment. In other words, they were ramping up production.

JAV Venture Financing JAV is interested in providing equity financing for the project and suggests James and Mychel "run the numbers" for an upcoming meeting at which time, if the numbers are convincing, JAV will cut the check. JAV told them that they invest in projects on a present value of free cash flow basis using a required rate of return due to the life stage the business was in However, neither James nor Mychel was familiar with this kind of cash flow valuation. After all, they are engineers, not financial analysts, and ask you to develop the valuation. To do a thorough analysis, you projected operating statements based on results using the following assumptions.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock