Question: Please using SAS Assume that the current interest rate is 4% per annum compounding continuously. Consider the Vaiek model with the parameters: a = 100,

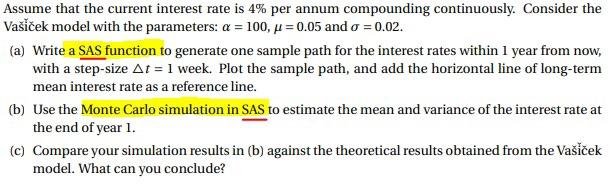

Assume that the current interest rate is 4% per annum compounding continuously. Consider the Vaiek model with the parameters: a = 100, h = 0.05 and o = 0.02. (a) Write a SAS function to generate one sample path for the interest rates within 1 year from now, with a step-size At = 1 week. Plot the sample path, and add the horizontal line of long-term mean interest rate as a reference line. (b) Use the Monte Carlo simulation in SAS to estimate the mean and variance of the interest rate at the end of year 1. (c) Compare your simulation results in (b) against the theoretical results obtained from the Vaiek model. What can you conclude? Assume that the current interest rate is 4% per annum compounding continuously. Consider the Vaiek model with the parameters: a = 100, h = 0.05 and o = 0.02. (a) Write a SAS function to generate one sample path for the interest rates within 1 year from now, with a step-size At = 1 week. Plot the sample path, and add the horizontal line of long-term mean interest rate as a reference line. (b) Use the Monte Carlo simulation in SAS to estimate the mean and variance of the interest rate at the end of year 1. (c) Compare your simulation results in (b) against the theoretical results obtained from the Vaiek model. What can you conclude

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts