Question: Please with full explained steps Question 10 1 pts The Treasury bill rate is 4%, and the expected return on the market portfolio is 12%.

Please with full explained steps

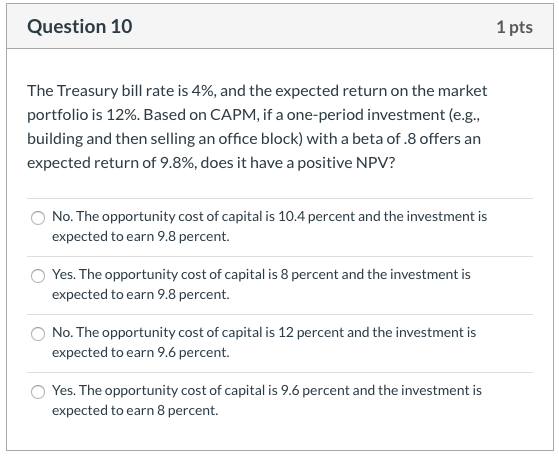

Question 10 1 pts The Treasury bill rate is 4%, and the expected return on the market portfolio is 12%. Based on CAPM, if a one-period investment (e.g. building and then selling an office block) with a beta of.8 offers an expected return of 9.8%, does it have a positive NPV? No. The opportunity cost of capital is 10.4 percent and the investment is expected to earn 9.8 percent. Yes. The opportunity cost of capital is 8 percent and the investment is expected to earn 9.8 percent. No. The opportunity cost of capital is 12 percent and the investment is expected to earn 9.6 percent. Yes. The opportunity cost of capital is 9.6 percent and the investment is expected to earn 8 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts