Question: Please without any copies from the Internet explain how the Al Andalus company applied the IFRS 10 ( consolidated financial statement ) in their financial

Please without any copies from the Internet

explain how the Al Andalus company applied the IFRS 10 ( consolidated financial statement ) in their financial statements

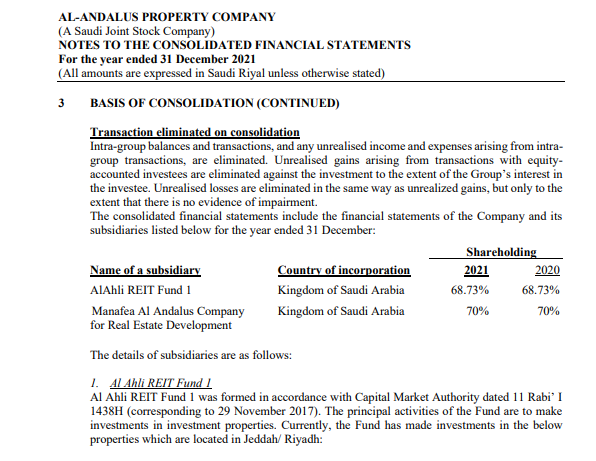

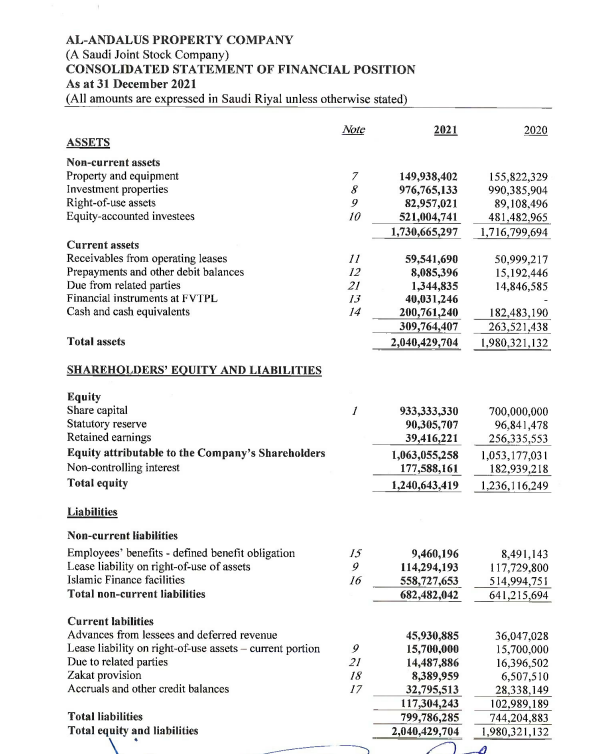

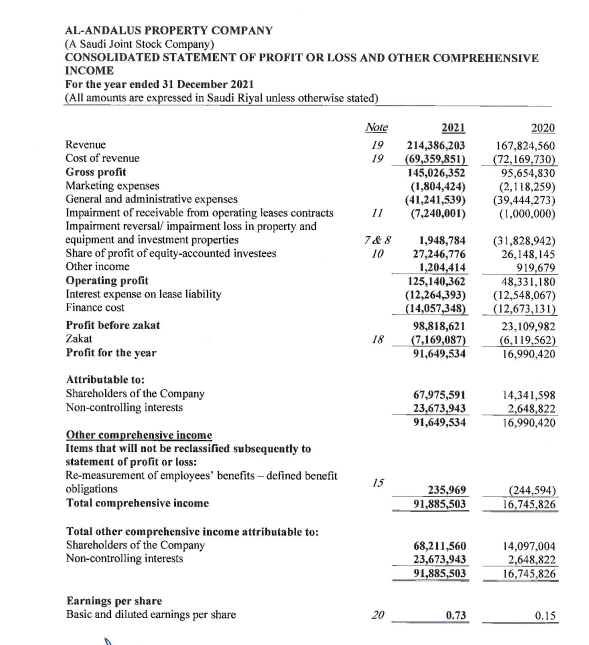

(All amounts are expressed in Saudi Riyal unless otherwise stated) 2 BASIS OF PREPARATION (CONTINUED) On 31 December 2019, CMA has examined the suitability of continuing to use the cost model or permitting the use of the fair value model or revaluation options and made the following decisions: Obligating listed companies to continue to use the cost model to measure Properties (IAS 16) and Investment Properties (IAS 40) in the financial statements prepared for financial periods within fiscal years, which start before the calendar year 2022; and Allowing listed companies, the policy choice to use the fair value model for investment property subsequent to initial measurement or the policy choice to use the revaluation model for property (IAS 16) subsequent to initial recognition in the financial statements prepared for financial periods within fiscal years starting during the calendar year 2022 or thereafter. The group disclose about its investment properties in the Note (8). 2.3 Impact of coronavirus (Covid-19) outbreak The COVID-19 pandemic, which has spread to various geographical regions around the world, has disrupted business and economic activities. Both domestic and international financial and monetary authorities have announced various support measures around the world to counter the potential negative repercussions of this pandemic. However, the Government of the Kingdom of Saudi Arabia (the "Government") has been able to successfully control the outbreak of the virus so far, primarily due to the unprecedented and effective measures taken by the Government. With the ongoing outbreak of the Covid-19 virus, it is difficult to predict the extent and duration of its full economic impact so far. As on December 31, 2021, and in addition to this, the management of the group is monitoring the developments of the pandemic situation and the extent of the impact on the group's operations, cash flows and financial position, and concluded that no adjustments should be made to the amounts recorded in these financial statements. In addition, the management believes, based on its assessment, that the group has enough available liquidity to continue to meet its financial obligations in the future when they become due. The management has not found any indications of a decrease in the value of the group's investment properties. In addition, the group also Assessed the tenants' ability to pay rents related to the period affected by the COVID-19 outbreak during the past year. It was not clear that there was a need to grant additional discounts to tenants during the current year, and accordingly there were no indications that there were any problems or doubts about the going concern of the group's activities. 2.4 Presentational currency The presentational currency of the Group is Saudi Riyals (SR) 3 BASIS OF CONSOLIDATION The Group accounts for business combinations using the acquisition method when control is transferred to the Group. The consideration transferred in the acquisition is generally measured at fair value, as are the identifiable net assets acquired. Any goodwill that arises is tested annually for impairment. Any gain on a bargain purchase is recognized in profit or loss immediately. Transaction costs are expensed as incurred, except if related to the issue of debt or equity securities. The consideration transferred does not include amounts related to the settlement of pre-existing relationships. Such amounts are generally recognized in profit or loss and other comprehensive income. Any contingent consideration is measured at fair value at the date of acquisition. If an obligation to pay contingent consideration that meets the definition of a financial instrument is classified as equity, then it is not remeasured, and settlement is accounted for within equity. Otherwise, other contingent consideration is remeasured at fair value at each reporting date and subsequent changes in the fair value of the contingent consideration are recognized in profit or loss.For the year ended 31 December 2021 (All amounts are expressed in Saudi Riyal unless otherwise stated) 3 BASES OF CONSOLIDATION (CONTINUED) If share-based payment awards (replacement awards) are required to be exchanged for awards held by the acquiree's employees (acquirer's awards), then all or a portion of the amount of the acquirer's replacement awards is included in measuring the consideration transferred in the business combination. This determination is based on the market-based measure of the replacement awards compared with the market-based measure of the acquirer's awards and the extent to which the replacement awards relate to pre-combination service. The consolidated financial statements comprise the financial statements of the Company and its subsidiaries as of 31 December 2021. Control is achieved when the Group is exposed or has rights to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee. Specifically, the Group controls an investee if, and only if. the Group has: Power over the investee (i.e. existing rights that give it the current ability to direct the relevant activities of the investee). Exposure, or rights, to variable returns from its involvement with the investee The ability to use its power over the investee to affect its returns Generally, there is a presumption that a majority of voting rights results in control. To support this presumption and when the Group has less than a majority of the voting or similar rights of an investee, the Group considers all relevant facts and circumstances in assessing whether it has power over an investee, including: . The contractual arrangement(s) with the other vote holders of the investee . Rights arising from other contractual arrangements . The Group's voting rights and potential voting rights The Group re-assesses whether or not it controls an investee if facts and circumstances indicate that there are changes to one or more of the three elements of control. Consolidation of a subsidiary begins when the Group obtains control over the subsidiary and ceases when the Group loses control of the subsidiary. Assets, liabilities, income and expenses of a subsidiary acquired or disposed of during the year are included in the consolidated financial statements from the date the Group gains control until the date the Group ceases to control the subsidiary. The financial statements of subsidiaries are prepared for the same reporting period as the Group. When necessary, adjustments are made to the financial statements of subsidiaries to bring their accounting policies in line with the Group's accounting policies. Non- Controlling interest (NCI) For each business combination, the Group elects whether to measure the non-controlling interests in the acquiree at fair value or at the proportionate share of the acquiree's identifiable net assets. Acquisition-related costs are expensed as incurred and included in administrative expenses. Changes in the Group's interest in a subsidiary that do not result in a loss of control are accounted for as equity transactions. Loss of control When the Group losses control over a subsidiary, it derecognizes the assets and liabilities of the subsidiary, and any related NCI and other components of equity. Any resulting gain or loss is recognized in profit or loss. Any interest retained in the former subsidiary is measured at fair value when control is lost.AL-ANDALUS PROPERTY COMPANY (A Saudi Joint Stock Company) NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS For the year ended 31 December 2021 ( All amounts are expressed in Saudi Riyal unless otherwise stated) 3 BASIS OF CONSOLIDATION (CONTINUED) Transaction eliminated on consolidation Intra-group balances and transactions, and any unrealised income and expenses arising from intra- group transactions, are eliminated. Unrealised gains arising from transactions with equity- accounted investees are eliminated against the investment to the extent of the Group's interest in the investee. Unrealised losses are eliminated in the same way as unrealized gains, but only to the extent that there is no evidence of impairment. The consolidated financial statements include the financial statements of the Company and its subsidiaries listed below for the year ended 31 December: Shareholding Name of a subsidiary Country of incorporation 2021 2020 AlAhli REIT Fund 1 Kingdom of Saudi Arabia 68.73% 68.73% Manafea Al Andalus Company Kingdom of Saudi Arabia 70% 70% for Real Estate Development The details of subsidiaries are as follows: 1. Al Ahli REIT Fund I Al Ahli REIT Fund I was formed in accordance with Capital Market Authority dated 11 Rabi' I 1438H (corresponding to 29 November 2017). The principal activities of the Fund are to make investments in investment properties. Currently, the Fund has made investments in the below properties which are located in Jeddah/ Riyadh:AL-ANDALUS PROPERTY COMPANY (A Saudi Joint Stock Company) CONSOLIDATED STATEMENT OF FINANCIAL POSITION As at 31 December 2021 (All amounts are expressed in Saudi Riyal unless otherwise stated) Note 2021 2020 ASSETS Non-current assets Property and equipment 149,938,402 155,822,329 Investment properties 976,765,133 990,385,904 Right-of-use assets 82,957,021 89,108.496 Equity-accounted investees 521,004,741 481,482,965 1,730,665,297 1,716,799,694 Current assets Receivables from operating leases 11 59,541,690 50,999,217 Prepayments and other debit balances 12 8,085,396 15,192,446 Due from related parties 21 1,344,835 14,846,585 Financial instruments at FVTPL 13 40,031,246 Cash and cash equivalents 14 200,761,240 182,483,190 309,764,407 263,521,438 Total assets 2,040,429,704 1,980,321,132 SHAREHOLDERS' EQUITY AND LIABILITIES Equity Share capital 933,333,330 700,000,000 Statutory reserve 90,305,707 96,841,478 Retained earnings 39,416,221 256.335,553 Equity attributable to the Company's Shareholders 1,063,055,258 1,053,177,03 Non-controlling interest 177,588,161 182,939,218 Total equity 1,240,643.419 1,236,116,249 Liabilities Non-current liabilities Employees' benefits - defined benefit obligation 9,460,196 8,491,143 Lease liability on right-of-use of assets 9 114,294,193 117,729,800 Islamic Finance facilities 16 558,727,653 514,994,751 Total non-current liabilities 682,482,042 641,215.694 Current labilities Advances from lessees and deferred revenue 45,930,885 36,047,028 Lease liability on right-of-use assets - current portion 9 15,700,000 15,700,000 Due to related parties 21 14,487,886 16,396,502 Zakat provision 18 8,389,959 6,507.510 Accruals and other credit balances 17 32,795,513 28,338,149 117,304,243 102.989.189 Total liabilities 799,786,285 744,204,883 Total equity and liabilities 2,040,429,704 1,980,321,132AL-ANDALUS PROPERTY COMPANY (A Saudi Joint Stock Company) CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME For the year ended 31 December 2021 (All amounts are expressed in Saudi Riyal unless otherwise stated) Note 2021 2020 Revenue 19 214,386,203 167,824,560 Cost of revenue 19 (69,359,851) (72, 169,730) Gross profit 145,026,352 95,654,830 Marketing expenses (1,804,424) (2,118,259) General and administrative expenses (41,241,539) (39,444,273) Impairment of receivable from operating leases contracts (7,240,001) (1,000,000) Impairment reversal/ impairment loss in property and equipment and investment properties 7& 8 1,948,784 (31,828,942) Share of profit of equity-accounted investees 10 27,246,776 26,148,145 Other income 1,204,414 919.679 Operating profit 125,140,362 18,331,180 Interest expense on lease liability (12,264,393) (12,548,067) Finance cost (14,057,348) (12,673,131) Profit before zakat 98,818,621 23,109,982 Zakat 18 (7,169,087) (6,119,562) Profit for the year 91,649,534 16,990,420 Attributable to: Shareholders of the Company 67,975,591 14,341,598 Non-controlling interests 23,673,943 2,648,822 91,649,534 16,990,420 Other comprehensive income Items that will not be reclassified subsequently to statement of profit or loss: Re-measurement of employees' benefits - defined benefit 15 obligations 235,969 (244,594) Total comprehensive income 91,885,503 16,745,826 Total other comprehensive income attributable to: Shareholders of the Company 68,211,560 14,097,004 Non-controlling interests 23,673,943 2,648,822 91,885.503 16,745,826 Earnings per share Basic and diluted earnings per share 20 0.73 0.15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts