Question: please work all parts with a detailed answer. will give a big thumb for sure. A company is presented with 2 projects which are expected

please work all parts with a detailed answer. will give a big thumb for sure.

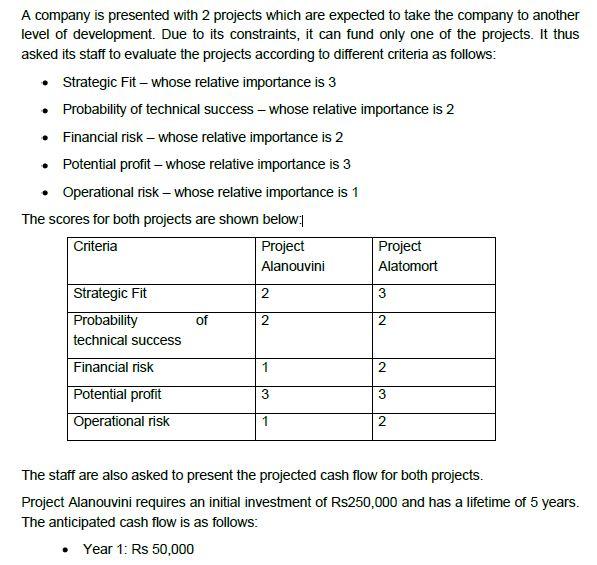

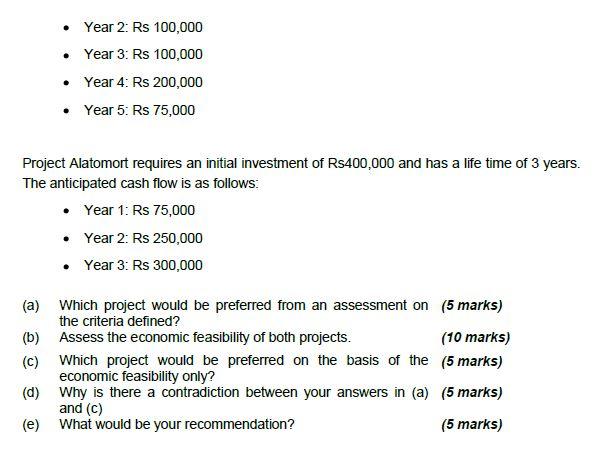

A company is presented with 2 projects which are expected to take the company to another level of development. Due to its constraints, it can fund only one of the projects. It thus asked its staff to evaluate the projects according to different criteria as follows: - Strategic Fit - whose relative importance is 3 - Probability of technical success - whose relative importance is 2 - Financial risk - whose relative importance is 2 - Potential profit - whose relative importance is 3 - Operational risk - whose relative importance is 1 The scores for both projects are shown below: The staff are also asked to present the projected cash flow for both projects. Project Alanouvini requires an initial investment of Rs 250,000 and has a lifetime of 5 years. The anticipated cash flow is as follows: - Year 1: Rs 50,000 - Year 2: Rs 100,000 - Year 3: Rs 100,000 - Year 4: Rs 200,000 - Year 5: Rs 75,000 Project Alatomort requires an initial investment of Rs 400,000 and has a life time of 3 years. The anticipated cash flow is as follows: - Year 1: Rs 75,000 - Year 2: Rs 250,000 - Year 3: Rs 300,000 (a) Which project would be preferred from an assessment on (5 marks) the criteria defined? (b) Assess the economic feasibility of both projects. (10 marks) (c) Which project would be preferred on the basis of the (5 marks) economic feasibility only? (d) Why is there a contradiction between your answers in (a) (5 marks) and (c) (e) What would be your recommendation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts