Question: please work by hand as i need to see the steps for solving it. thank you! 22. You are planning to construct a portfolio with

please work by hand as i need to see the steps for solving it. thank you!

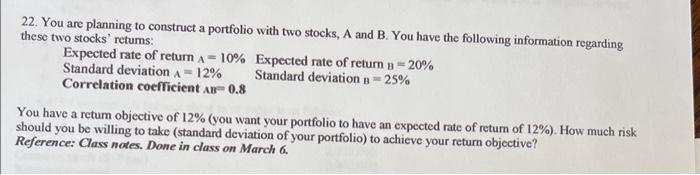

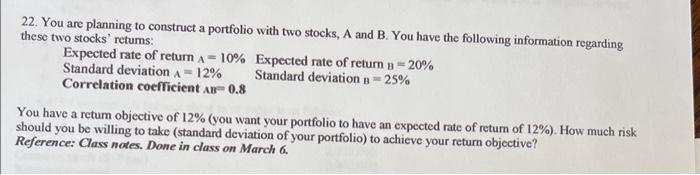

22. You are planning to construct a portfolio with two stocks, A and B. You have the following information regarding these two stocks' retums: Expected rate of return A=10% Expected rate of return B=20% Standard deviation A=12% Standard deviation B=25% Correlation coefficient A8=0.8 You have a retum objective of 12% (you want your portfolio to have an expected rate of return of 12% ). How much risk should you be willing to take (standard deviation of your portfolio) to achieve your return objective? Reference: Class notes. Done in class on March 6

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock