Question: please workout and show formuls and solutions in excel spreadsheet! 10s.2 Consider the following financial data for an investment project: Required capital investment at n

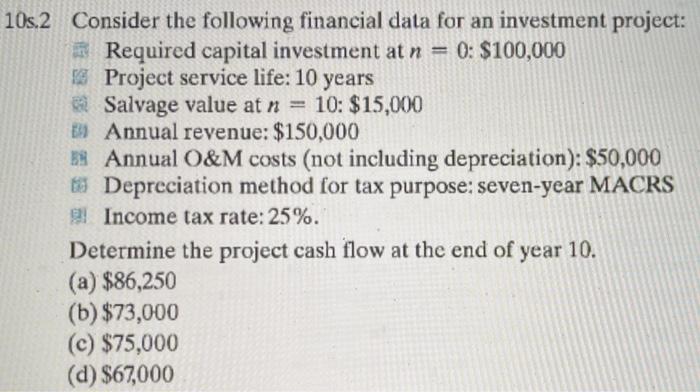

10s.2 Consider the following financial data for an investment project: Required capital investment at n = 0: $100,000 & Project service life: 10 years Salvage value at n = 10: $15,000 B) Annual revenue: $150,000 B4 Annual O&M costs (not including depreciation): $50,000 Depreciation method for tax purpose: seven-year MACRS Income tax rate: 25%. Determine the project cash flow at the end of year 10. (a) $86,250 (b) $73,000 (C) $75,000 (d) $67,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts