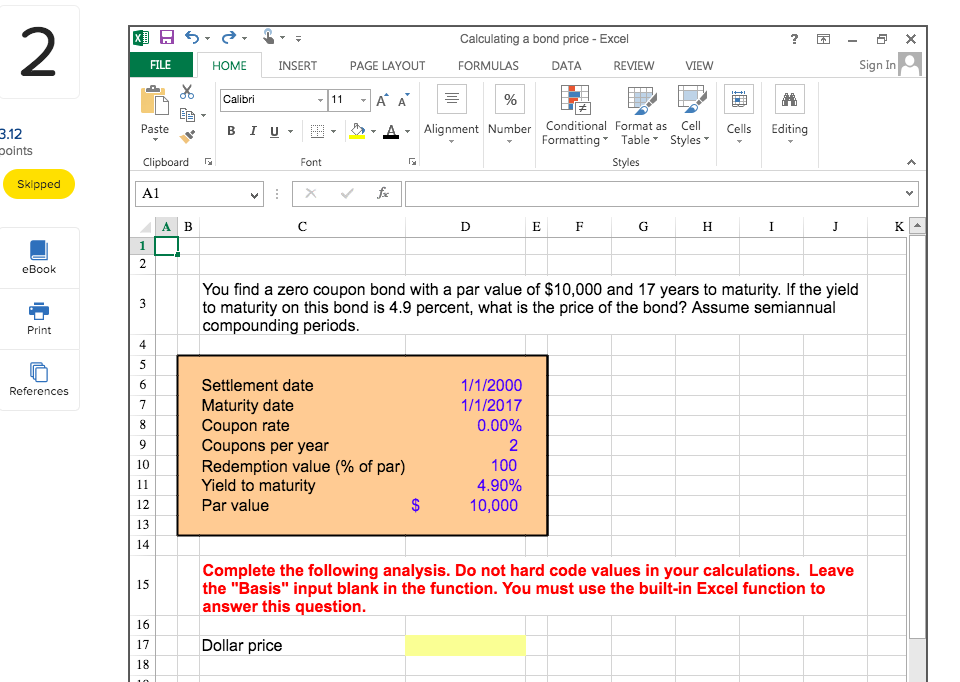

Question: PLEASE WRITE ALL ANSWERS AS EXCEL FORMULA AS A EXCEL FORMULA x 5 ? x H FILE Calculating a bond price - Excel FORMULAS DATA

PLEASE WRITE ALL ANSWERS AS EXCEL FORMULA

AS A EXCEL FORMULA

AS A EXCEL FORMULA

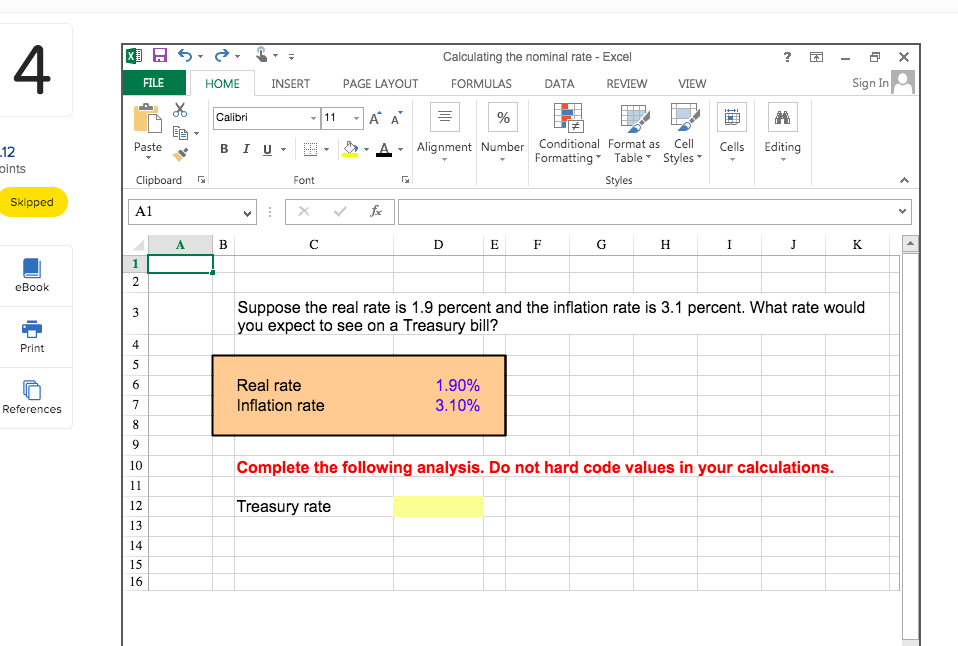

x 5 ? x H FILE Calculating a bond price - Excel FORMULAS DATA REVIEW - Sign In HOME INSERT PAGE LAYOUT VIEW Paste B IU , - A Alignment Number 3.12 points Editing Conditional Format as Cell Formatting Table Styles Styles Cells - Clipboard Font Skipped A1 D E F G H I J eBook You find a zero coupon bond with a par value of $10,000 and 17 years to maturity. If the yield to maturity on this bond is 4.9 percent, what is the price of the bond? Assume semiannual compounding periods. Print References 1/1/2000 1/1/2017 0.00% Settlement date Maturity date Coupon rate Coupons per year Redemption value (% of par) Yield to maturity Par value $ ... 2 100 4.90% 10,000 Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the function. You must use the built-in Excel function to answer this question. Dollar price 5 ? X . HOME Calculating the nominal rate - Excel FORMULAS DATA REVIEW - Sign In FILE INSERT PAGE LAYOUT VIEW LA- Paste B IU A , Alignment Number Cells Editing _12 pints Conditional Format as Cell Formatting Table Styles Styles Clipboard Font Skipped A1 E F G H eBook Suppose the real rate is 1.9 percent and the inflation rate is 3.1 percent. What rate would you expect to see on a Treasury bill? Print Real rate Inflation rate 1.90% 3.10% References Complete the following analysis. Do not hard code values in your calculations. Treasury rate All answers must be entered as a formula Click OK to begin. OK

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts