Question: Please write answer and explan 29) An investor can design a risky portfolio based on two stocks, A and B. The standard deviation of return

Please write answer and explan

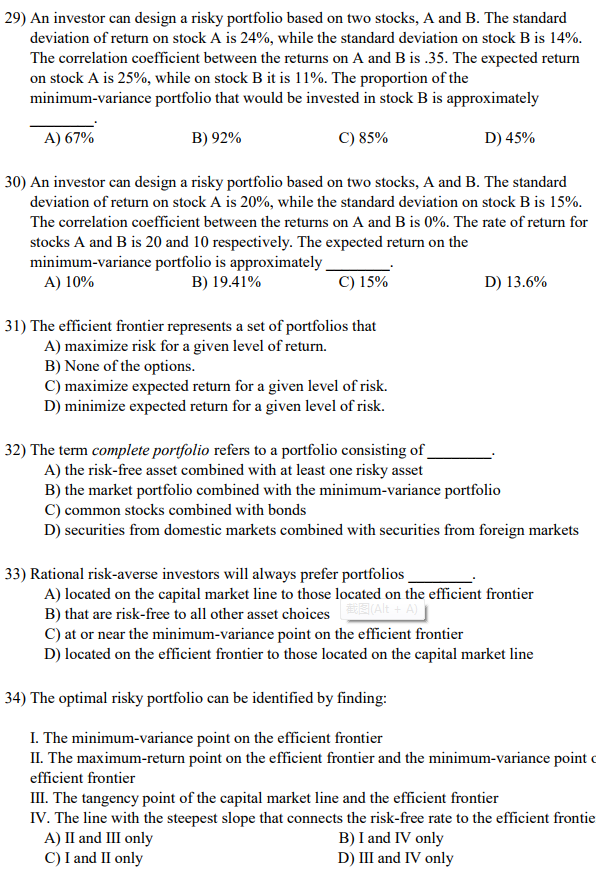

29) An investor can design a risky portfolio based on two stocks, A and B. The standard deviation of return on stock A is 24%, while the standard deviation on stock B is 14%. The correlation coefficient between the returns on A and B is .35. The expected return on stock A is 25%, while on stock B it is 1 1%. The proportion of the minimum-variance portfolio that would be invested in stock B is approximately A) 67% B) 92% C) 85% D) 45% 30) An investor can design a risky portfolio based on two stocks, A and B. The standard deviation of return on stock A is 20%, while the standard deviation on stock B is 15%. The correlation coefficient between the returns on A and B is 0%. The rate of return for stocks A and B is 20 and 10 respectively. The expected return on the minimum-variance portfolio is approximately A) 10% B) 19.41% C) 15% D) 13.6% 31) The efficient frontier represents a set of portfolios that A) maximize risk for a given level of return. B) None of the options C) maximize expected return for a given level of risk. D) minimize expected return for a given level of risk. 32) The term complete portfolio refers to a portfolio consisting of A) the risk-free asset combined with at least one risky asset B) the market portfolio combined with the minimum-variance portfolio C) common stocks combined with bonds D) securities from domestic markets combined with securities from foreign market:s 33) Rational risk-averse investors will always prefer portfolios A) located on the capital market line to those located on the efficient frontier B) that are risk-free to all other asset choices C) at or near the minimum-variance point on the efficient frontier D) located on the efficient frontier to those located on the capital market line 34) The optimal risky portfolio can be identified by finding: I. The minimum-variance point on the efficient frontier II. The maximum-return point on the efficient frontier and the minimum-variance point efficient frontier III. The tangency point of the capital market line and the efficient frontier IV. The line with the steepest slope that connects the risk-free rate to the efficient frontie A) II and III only C) I and II only B) I and IV only D) III and IV only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts