Question: Please write down the detailed steps, and it is better to explain why it is so in the calculation part. Thanks!! 1) (24 Marks) MUSIX,

Please write down the detailed steps, and it is better to explain why it is so in the calculation part. Thanks!!

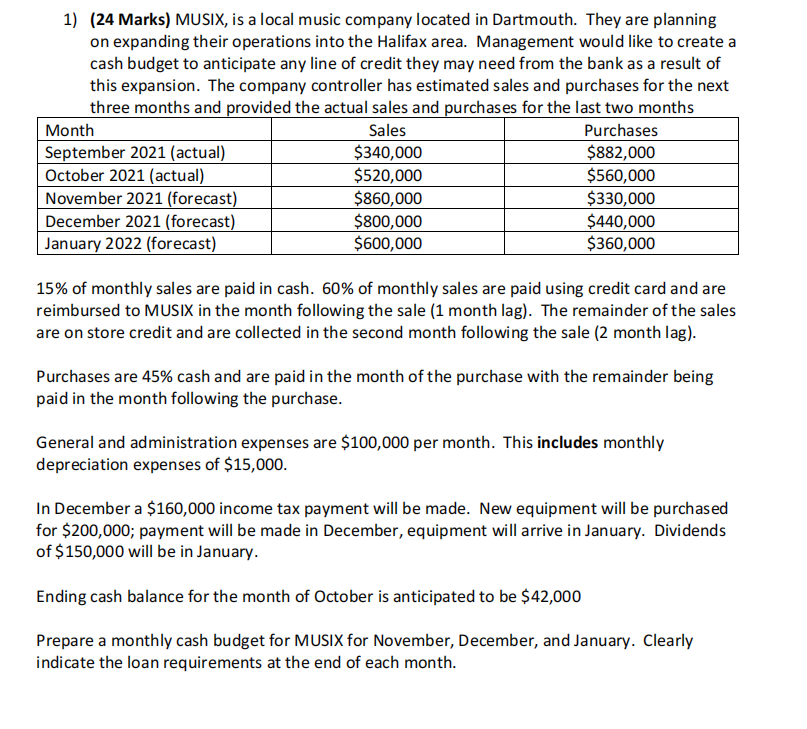

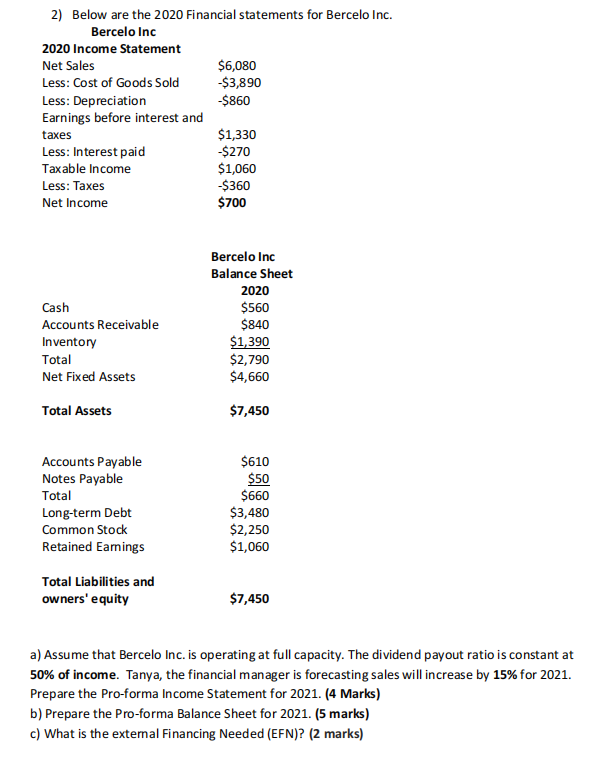

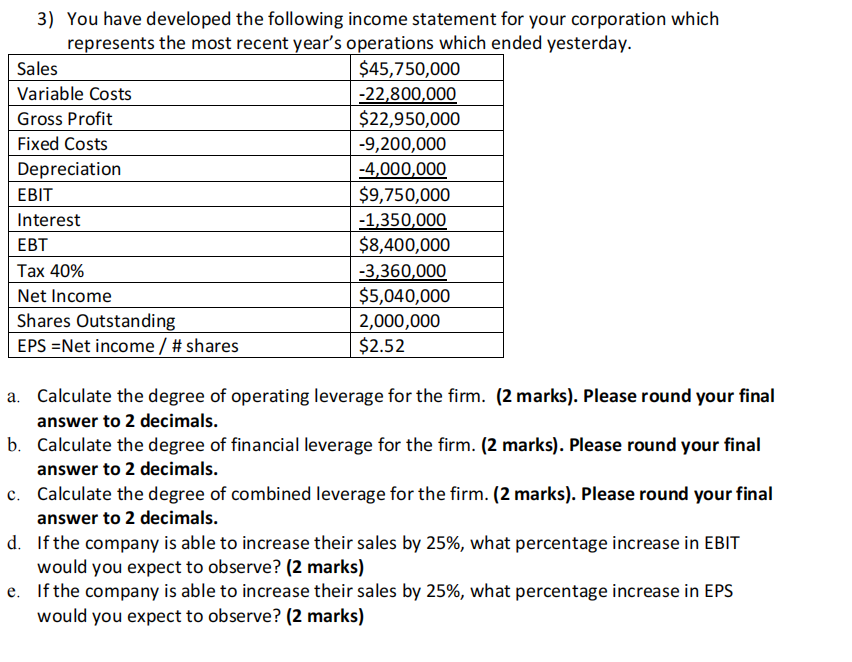

1) (24 Marks) MUSIX, is a local music company located in Dartmouth. They are planning on expanding their operations into the Halifax area. Management would like to create a cash budget to anticipate any line of credit they may need from the bank as a result of this expansion. The company controller has estimated sales and purchases for the next three months and provided the actual sales and purchases for the last two months Month Sales Purchases September 2021 (actual) $340,000 $882,000 October 2021 (actual) $520,000 $560,000 November 2021 (forecast) $860,000 $330,000 December 2021 (forecast) $800,000 $440,000 January 2022 (forecast) $600,000 $360,000 15% of monthly sales are paid in cash. 60% of monthly sales are paid using credit card and are reimbursed to MUSIX in the month following the sale (1 month lag). The remainder of the sales are on store credit and are collected in the second month following the sale (2 month lag). Purchases are 45% cash and are paid in the month of the purchase with the remainder being paid in the month following the purchase. General and administration expenses are $100,000 per month. This includes monthly depreciation expenses of $15,000. In December a $160,000 income tax payment will be made. New equipment will be purchased for $200,000; payment will be made in December, equipment will arrive in January. Dividends of $150,000 will be in January. Ending cash balance for the month of October is anticipated to be $42,000 Prepare a monthly cash budget for MUSIX for November, December, and January. Clearly indicate the loan requirements at the end of each month. 2) Below are the 2020 Financial statements for Bercelo Inc. Bercelo Inc 2020 Income Statement Net Sales $6,080 Less: Cost of Goods Sold $3,890 Less: Depreciation $860 Earnings before interest and taxes $1,330 Less: Interest paid $270 Taxable income $1,060 Less: Taxes $360 Net Income $700 Cash Accounts Receivable Inventory Total Net Fixed Assets Bercelo Inc Balance Sheet 2020 $560 $840 $1,390 $2,790 $4,660 Total Assets $7,450 Accounts Payable Notes Payable Total Long-term Debt Common Stock Retained Earings $610 $50 $660 $3,480 $2,250 $1,060 Total Liabilities and owners' equity $7,450 a) Assume that Bercelo Inc. is operating at full capacity. The dividend payout ratio is constant at 50% of income. Tanya, the financial manager is forecasting sales will increase by 15% for 2021. Prepare the Pro-forma Income Statement for 2021. (4 Marks) b) Prepare the Pro-forma Balance Sheet for 2021. (5 marks) c) What is the extemal Financing Needed (EFN)? (2 marks) 3) You have developed the following income statement for your corporation which represents the most recent year's operations which ended yesterday. Sales $45,750,000 Variable Costs -22,800,000 Gross Profit $22,950,000 Fixed Costs -9,200,000 Depreciation -4,000,000 EBIT $9,750,000 Interest -1,350,000 $8,400,000 Tax 40% -3,360,000 Net Income $5,040,000 Shares Outstanding 2,000,000 EPS =Net income / # shares $2.52 a. Calculate the degree of operating leverage for the firm. (2 marks). Please round your final answer to 2 decimals. b. Calculate the degree of financial leverage for the firm. (2 marks). Please round your final answer to 2 decimals. c. Calculate the degree of combined leverage for the firm. (2 marks). Please round your final answer to 2 decimals. d. If the company is able to increase their sales by 25%, what percentage increase in EBIT would you expect to observe? (2 marks) e. If the company is able to increase their sales by 25%, what percentage increase in EPS would you expect to observe? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts