Question: Please write down the detailed steps, and it is better to explain why it is so in the calculation part. Thanks!! 3) Jakesman Inc financial

Please write down the detailed steps, and it is better to explain why it is so in the calculation part. Thanks!!

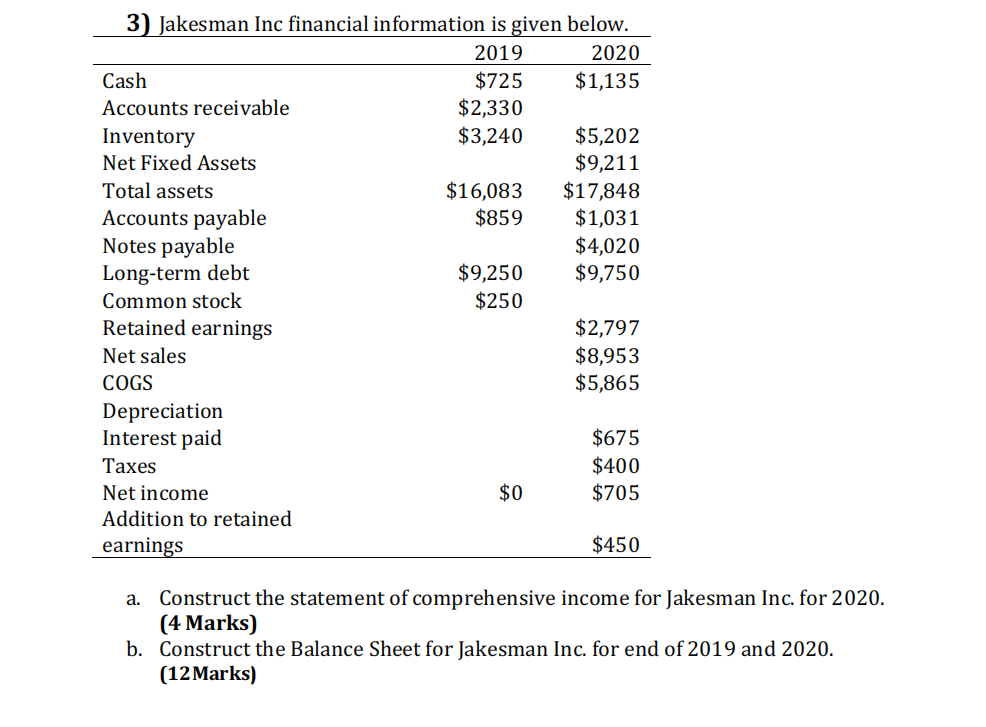

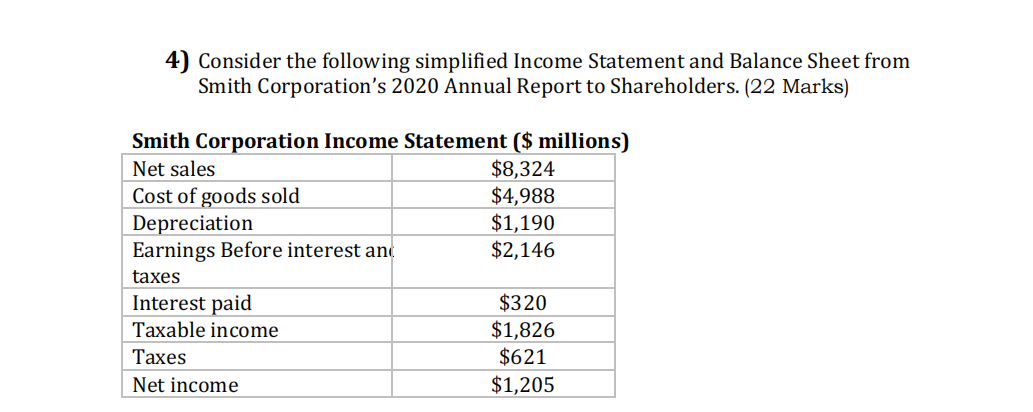

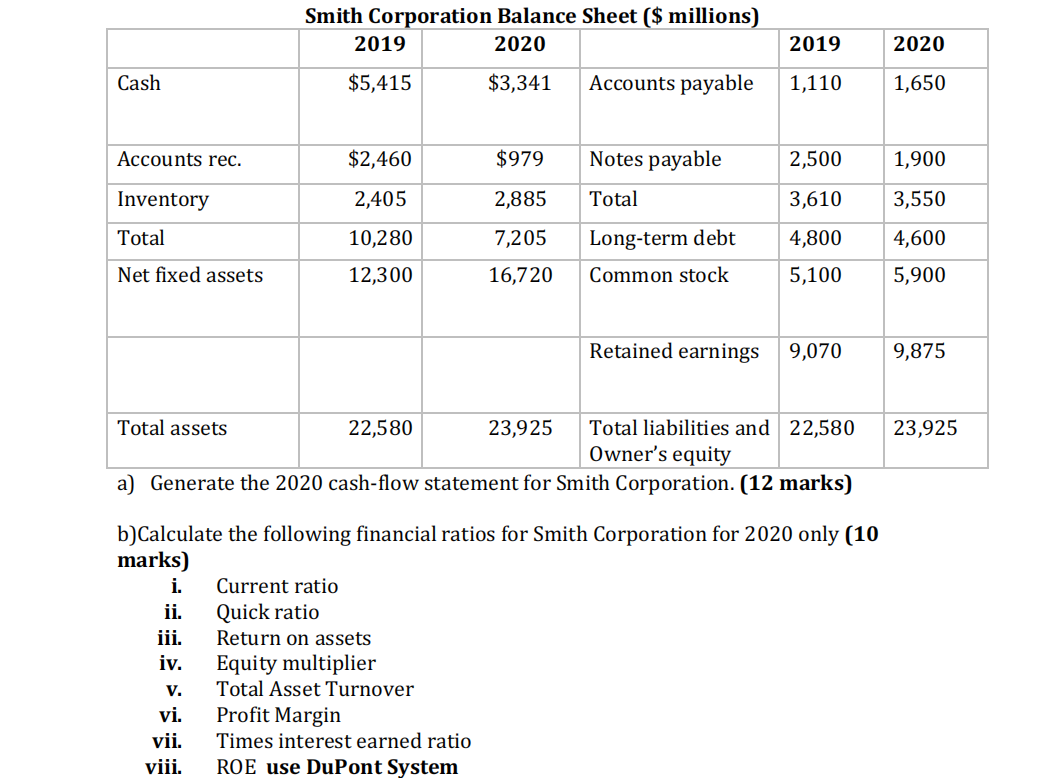

3) Jakesman Inc financial information is given below. 2019 2020 Cash $725 $1,135 Accounts receivable $2,330 Inventory $3,240 $5,202 Net Fixed Assets $9,211 Total assets $16,083 $17,848 Accounts payable $859 $1,031 Notes payable $4,020 Long-term debt $9,250 $9,750 Common stock $250 Retained earnings $2,797 Net sales $8,953 COGS $5,865 Depreciation Interest paid $675 Taxes $400 Net income $0 $705 Addition to retained earnings $450 a. Construct the statement of comprehensive income for Jakesman Inc. for 2020. (4 Marks) b. Construct the Balance Sheet for Jakesman Inc. for end of 2019 and 2020. (12 Marks) 4) Consider the following simplified Income Statement and Balance Sheet from Smith Corporation's 2020 Annual Report to Shareholders. (22 Marks) Smith Corporation Income Statement ($ millions) Net sales $8,324 Cost of goods sold $4,988 Depreciation $1,190 Earnings Before interest and $2,146 taxes Interest paid $320 Taxable income $1,826 Taxes $621 Net income $1,205 Smith Corporation Balance Sheet ($ millions) 2019 2020 $5,415 $3,341 Accounts payable 2019 2020 Cash 1,110 1,650 Accounts rec. $2,460 $979 Notes payable 2,500 1,900 Inventory 2,405 2,885 Total 3,610 3,550 Total 10,280 7,205 4,800 4,600 Long-term debt Common stock Net fixed assets 12,300 16,720 5,100 5,900 Retained earnings 9,070 9,875 23,925 Total assets 22,580 23,925 Total liabilities and 22,580 Owner's equity a) Generate the 2020 cash-flow statement for Smith Corporation. (12 marks) b)Calculate the following financial ratios for Smith Corporation for 2020 only (10 marks) i. Current ratio ii. Quick ratio iii. Return on assets iv. Equity multiplier V. Total Asset Turnover vi. Profit Margin vii. Times interest earned ratio viii. ROE use DuPont System

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts