Question: please write down the working required: preparr a statement of cash flows using the indirect method. Disose any non cash investing and financing activities and

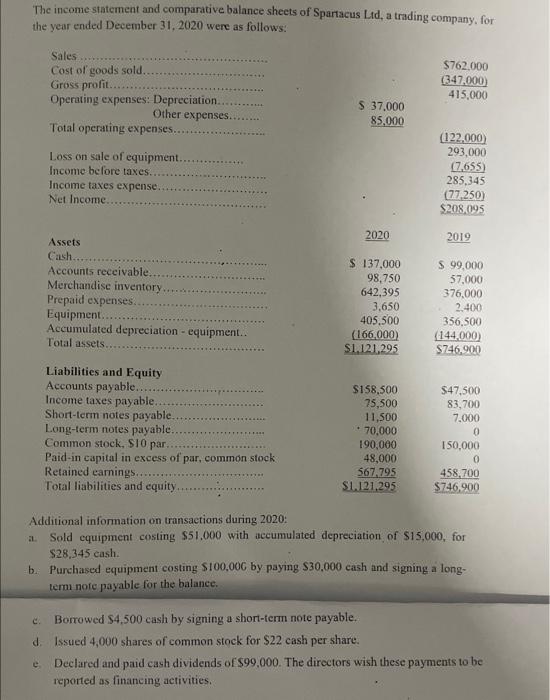

The income statement and comparative balance sheets of Spartacus Ltd, a trading company, for the year ended December 31, 2020 were as follows: a. Sales Cost of goods sold. Gross profit... Operating expenses: Depreciation.. Other expenses.. Total operating expenses. Loss on sale of equipment. Income before taxes.. Income taxes expense. Net Income... e Assets Cash. Accounts receivable. Merchandise inventory Prepaid expenses. Equipment.... Accumulated depreciation - equipment.. Total assets.. Liabilities and Equity Accounts payable. Income taxes payable. Short-term notes payable. Long-term notes payable. Common stock, $10 par. Paid-in capital in excess of par, common stock Retained earnings... Total liabilities and equity.. $ 37,000 85,000 2020 $ 137,000 98,750 642,395 3,650 405,500 (166,000) $1.121.295 $158,500 75,500 11,500 70,000 190,000 48,000 567,795 $1.121.295 C. Borrowed $4,500 cash by signing a short-term note payable. d. Issued 4,000 shares of common stock for $22 cash per share. $762.000 (347,000) 415,000 (122,000) 293,000 (7,655) 285,345 (77,250) $208,095 2019 $ 99,000 57,000 376,000 2,400 356,500 (144,000) $746,900 Additional information on transactions during 2020: Sold equipment costing $51.000 with accumulated depreciation of $15,000, for $28,345 cash. b. Purchased equipment costing $100,000 by paying $30,000 cash and signing a long- termi note payable for the balance. $47,500 83,700 7,000 0 150,000 0 458,700 $746,900 Declared and paid cash dividends of $99,000. The directors wish these payments to be reported as financing activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts