Question: Please write every single step, and make sure hand writting is clear New York Co. is evaluating the proposed acquisition of a new machine, which

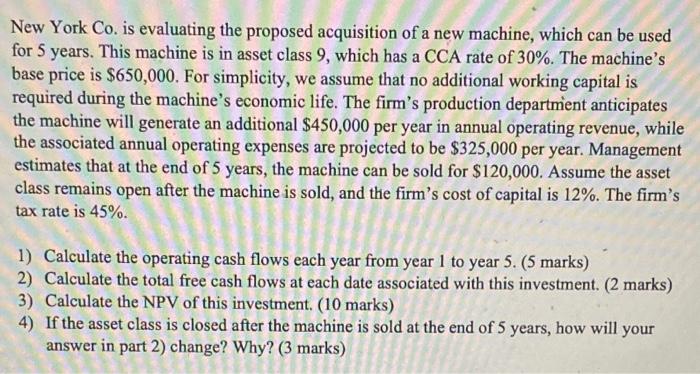

New York Co. is evaluating the proposed acquisition of a new machine, which can be used for 5 years. This machine is in asset class 9, which has a CCA rate of 30%. The machine's base price is $650,000. For simplicity, we assume that no additional working capital is required during the machine's economic life. The firm's production department anticipates the machine will generate an additional $450,000 per year in annual operating revenue, while the associated annual operating expenses are projected to be $325,000 per year. Management estimates that at the end of 5 years, the machine can be sold for $120,000. Assume the asset class remains open after the machine is sold, and the firm's cost of capital is 12%. The firm's tax rate is 45%. 1) Calculate the operating cash flows each year from year 1 to year 5. (5 marks) 2) Calculate the total free cash flows at each date associated with this investment. (2 marks) 3) Calculate the NPV of this investment. (10 marks) 4) If the asset class is closed after the machine is sold at the end of 5 years, how will your answer in part 2) change? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts