Question: please write observation and evaluation for the provided info NOTE 13: Income Taxes The following is a reconcliation of the federal statulory tax rate to

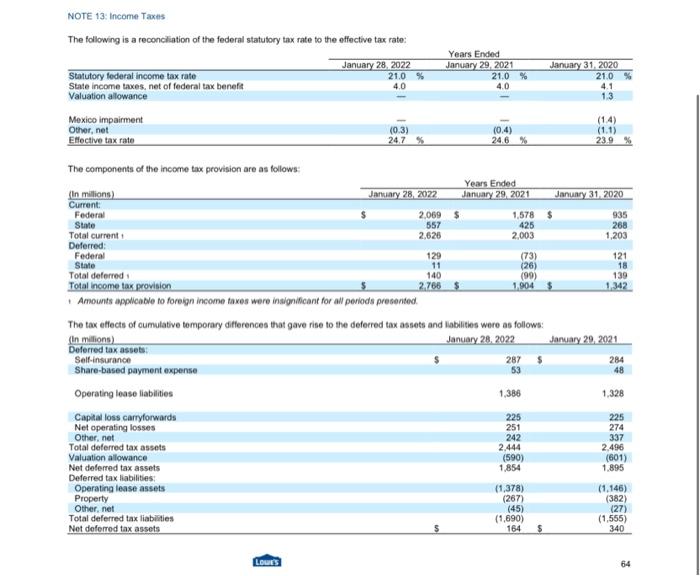

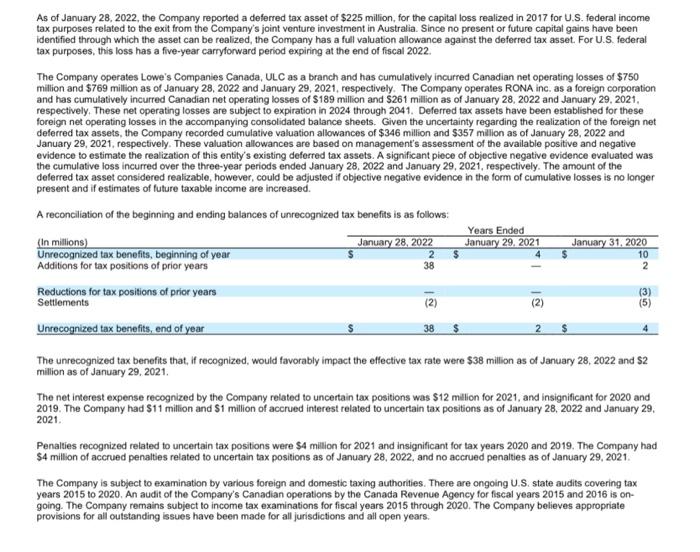

NOTE 13: Income Taxes The following is a reconcliation of the federal statulory tax rate to the effective tax rate: As of January 28, 2022, the Company reported a deferred tax asset of $225 million, for the capital loss realized in 2017 for U.S. federal income tax purposes related to the exit from the Company's joint venture investment in Australia. Since no present or future capital gains have been identified through which the asset can be realized, the Company has a full valuation allowance against the deferred tax asset. For U.S. federal tax purposes, this loss has a five-year carryforward period expiring at the end of fiscal 2022. The Company operates Lowe's Companies Canada, ULC as a branch and has cumulatively incurred Canadian net operating losses of $750 million and $769 million as of January 28, 2022 and January 29, 2021, respectively. The Company operates RONA inc. as a foreign corporation and has cumulatively incurred Canadian net operating losses of $189 million and \$261 million as of January 28, 2022 and January 29, 2021. respectively. These net operating losses are subject to expiration in 2024 through 2041. Deferred tax assets have been established for these foreign net operating losses in the accompanying consolidated balance sheets. Given the uncertainty regarding the realization of the foreign net deferred tax assets, the Company recorded cumulative valuation allowances of $346 million and $357 million as of January 28 , 2022 and January 29, 2021, respectively. These valuation allowances are based on management's assessment of the available positive and negative evidence to estimate the realization of this entity's existing deferred tax assets. A significant piece of objective negative evidence evaluated was the cumulative loss incurred over the three-year periods ended January 28, 2022 and January 29, 2021, respectively. The amount of the delerred tax asset considered realizable, however, could be adjusted if objective negative evidence in the form of cumulative losses is no longer present and if estimates of future taxable income are increased. A reconciliation of the beginning and ending balances of unrecognized tax benefits is as follows: The unrecognized tax benefits that, if recognized, would favorably impact the effective tax rate were $38 million as of January 28,2022 and $2 million as of January 29, 2021. The net interest expense recognized by the Company related to uncertain tax positions was $12 milion for 2021 , and insignificant for 2020 and 2019. The Company had $11 million and $1 million of accrued interest related to uncertain tax positions as of January 28, 2022 and January 29 , 2021. Penalties recognized related to uncertain tax positions were $4 million for 2021 and insignificant for tax years 2020 and 2019 . The Company had $4 million of accrued penalties related to uncertain tax positions as of January 28, 2022, and no accrued penalties as of January 29,2021. The Company is subject to examination by various foreign and domestic taxing authorities. There are ongoing U.S. state audits covering tax years 2015 to 2020. An audit of the Company's Canadian operations by the Canada Revenue Agency for fiscal years 2015 and 2016 is ongoing. The Company remains subject to income tax examinations for fiscal years 2015 through 2020. The Company believes appropriate provisions for all outstanding issues have been made for all jurisdictions and all open years. Use the following tax disclosure from Lowe's and answer the following questions: 1. Provide a definition of "effective tax rate." In Lowe's tax disclosure, the effective tax rate for fiscal 2021 is 24.7%. How did Lowe's obtain that tax rate? Using the information given in the tax disclosure and in Lowe's income statement, show how the effective tax rate for fiscal 2021 is 24.7%. (8\%) 2. Lowe's reported its net deferred tax assets at $164 million for fiscal 2021 which ended on January 28,2022 . What does the number mean? From the tax disclosure, what might contribute to the firm's net deferred tax assets? (6%) 3. Lowe's tax disclosure involves "valuation allowance." In the context of Lowe's tax disclosure, explain the nature of "valuation allowance." (6%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts