Question: Please write out in table format, will upvote once completed! Journalize the adjusting entries required at the end of the fiscal year. a. The supplies

Please write out in table format, will upvote once completed!

Please write out in table format, will upvote once completed!

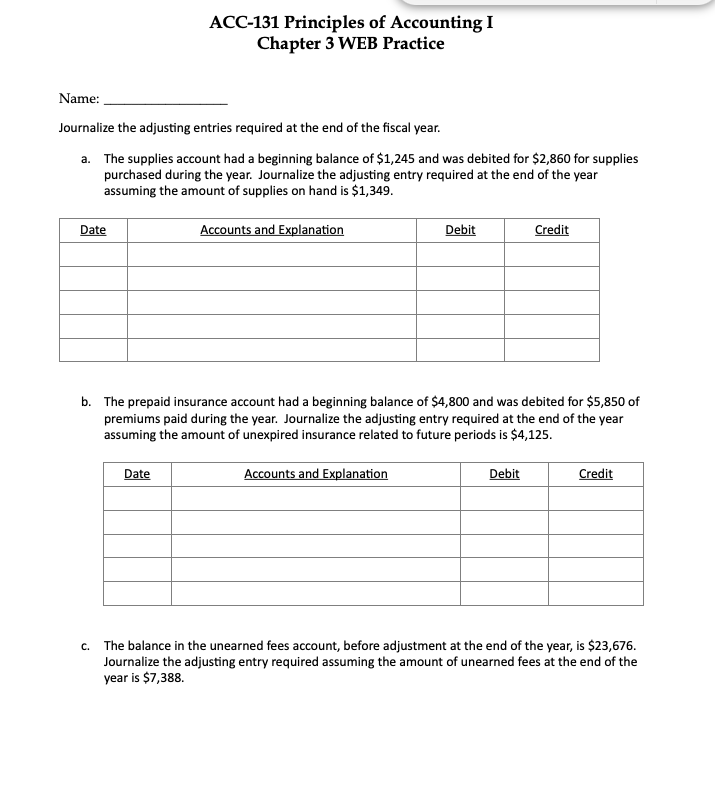

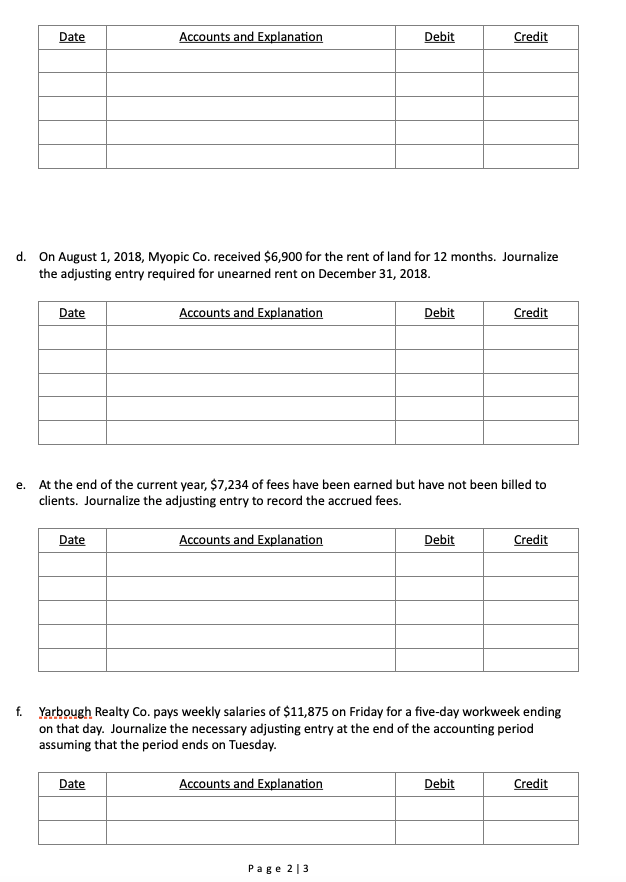

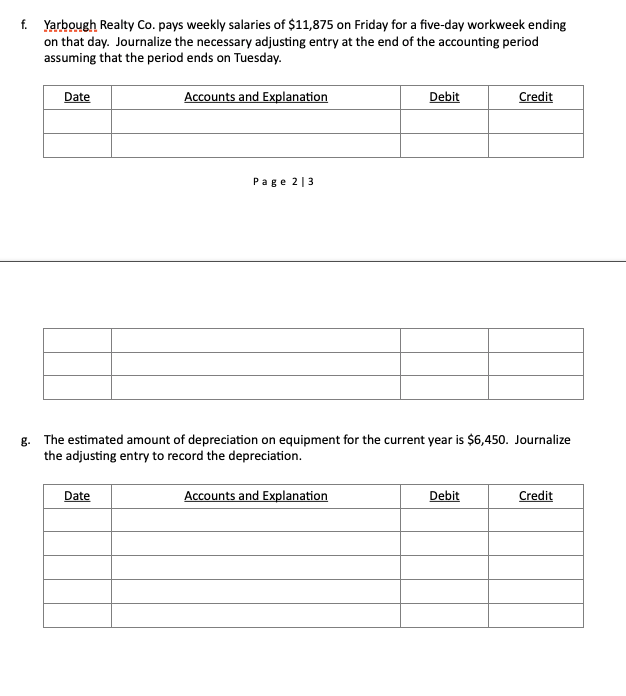

Journalize the adjusting entries required at the end of the fiscal year. a. The supplies account had a beginning balance of $1,245 and was debited for $2,860 for supplies purchased during the year. Journalize the adjusting entry required at the end of the year assuming the amount of supplies on hand is $1,349. b. The prepaid insurance account had a beginning balance of $4,800 and was debited for $5,850 of premiums paid during the year. Journalize the adjusting entry required at the end of the year assuming the amount of unexpired insurance related to future periods is $4,125. c. The balance in the unearned fees account, before adjustment at the end of the year, is $23,676. Journalize the adjusting entry required assuming the amount of unearned fees at the end of the year is $7,388. d. On August 1, 2018, Myopic Co. received $6,900 for the rent of land for 12 months. Journalize the adjusting entry required for unearned rent on December 31,2018. e. At the end of the current year, $7,234 of fees have been earned but have not been billed to clients. Journalize the adjusting entry to record the accrued fees. Yarbough Realty Co. pays weekly salaries of $11,875 on Friday for a five-day workweek ending on that day. Journalize the necessary adjusting entry at the end of the accounting period assuming that the period ends on Tuesday. P ag e 23 f. Yarbough Realty Co. pays weekly salaries of $11,875 on Friday for a five-day workweek ending on that day. Journalize the necessary adjusting entry at the end of the accounting period assuming that the period ends on Tuesday. Page 23 g. The estimated amount of depreciation on equipment for the current year is $6,450. Journalize the adjusting entry to record the depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts