Question: Please write type the answer by computer, so that i can see this clearly, thank you An investment manager forecasts the 1 year Treasury bill

Please write type the answer by computer, so that i can see this clearly, thank you

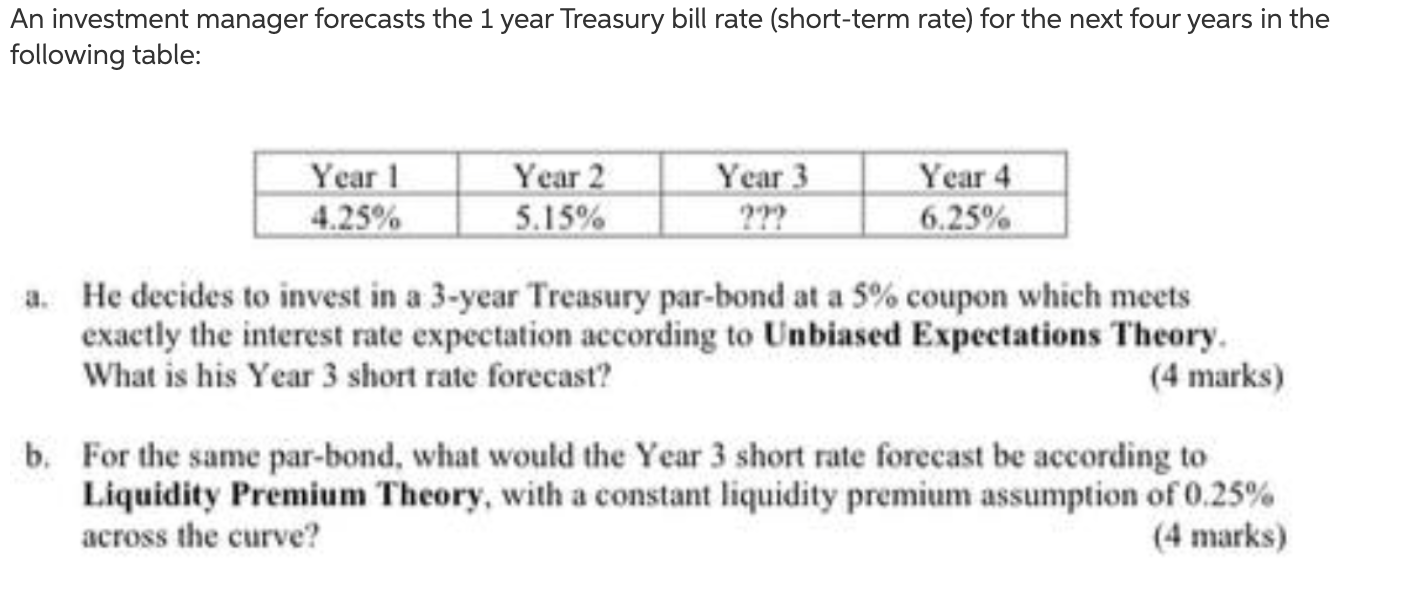

An investment manager forecasts the 1 year Treasury bill rate (short-term rate) for the next four years in the following table: Year 1 4.25% Year 2 5.15% Year 3 2?? Year 4 6.25% a. He decides to invest in a 3-year Treasury par-bond at a 5% coupon which meets exactly the interest rate expectation according to Unbiased Expectations Theory What is his Year 3 short rate forecast? (4 marks) b. For the same par-bond, what would the Year 3 short rate forecast be according to Liquidity Premium Theory, with a constant liquidity premium assumption of 0.25% across the curve? (4 marks) An investment manager forecasts the 1 year Treasury bill rate (short-term rate) for the next four years in the following table: Year 1 4.25% Year 2 5.15% Year 3 2?? Year 4 6.25% a. He decides to invest in a 3-year Treasury par-bond at a 5% coupon which meets exactly the interest rate expectation according to Unbiased Expectations Theory What is his Year 3 short rate forecast? (4 marks) b. For the same par-bond, what would the Year 3 short rate forecast be according to Liquidity Premium Theory, with a constant liquidity premium assumption of 0.25% across the curve? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts