Question: Please write working out step by step. Exercise 10.5 (a) A new employee aged 25 joins a DC pension plan. Her starting salary is $40000

Please write working out step by step.

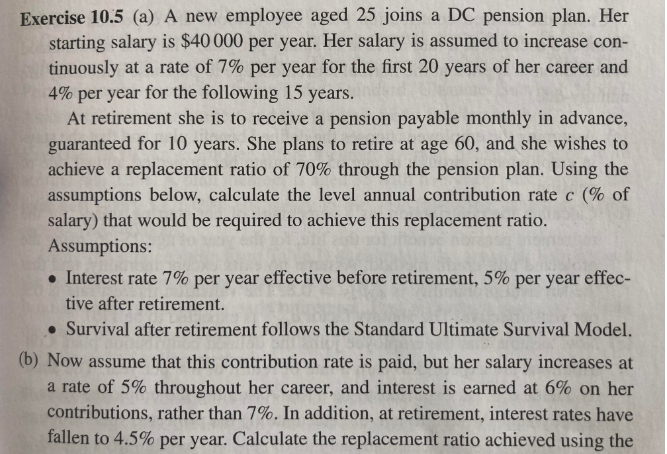

Exercise 10.5 (a) A new employee aged 25 joins a DC pension plan. Her starting salary is $40000 per year. Her salary is assumed to increase continuously at a rate of 7% per year for the first 20 years of her career and 4% per year for the following 15 years. At retirement she is to receive a pension payable monthly in advance, guaranteed for 10 years. She plans to retire at age 60 , and she wishes to achieve a replacement ratio of 70% through the pension plan. Using the assumptions below, calculate the level annual contribution rate c (\% of salary) that would be required to achieve this replacement ratio. Assumptions: - Interest rate 7% per year effective before retirement, 5% per year effective after retirement. - Survival after retirement follows the Standard Ultimate Survival Model. (b) Now assume that this contribution rate is paid, but her salary increases at a rate of 5% throughout her career, and interest is earned at 6% on her contributions, rather than 7%. In addition, at retirement, interest rates have fallen to 4.5% per year. Calculate the replacement ratio achieved using the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts