Question: please help me with this excel assignment!! i need a full step by step. i need help with the what if scenario and recommendations Please

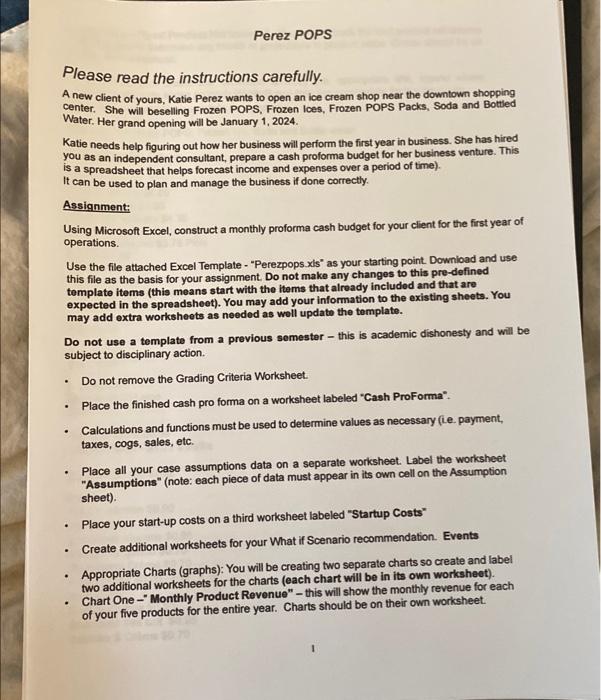

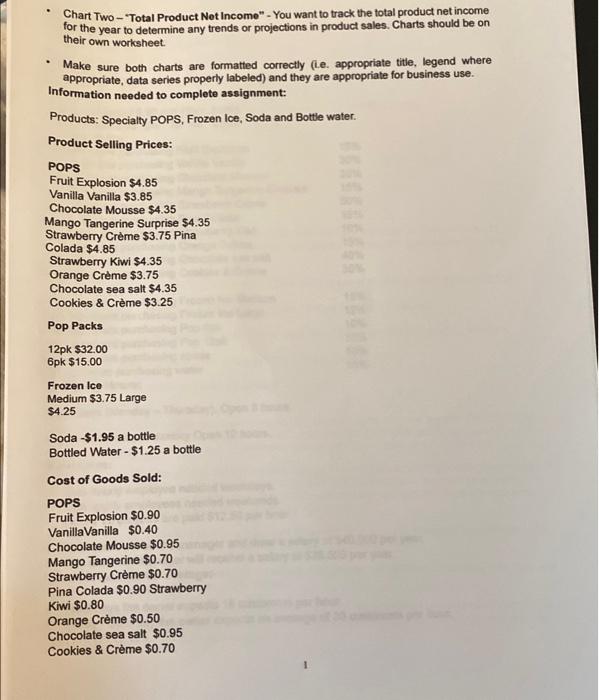

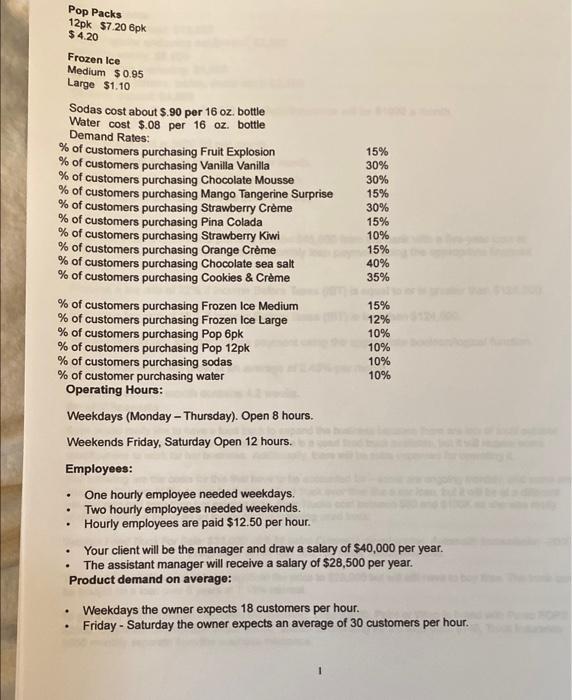

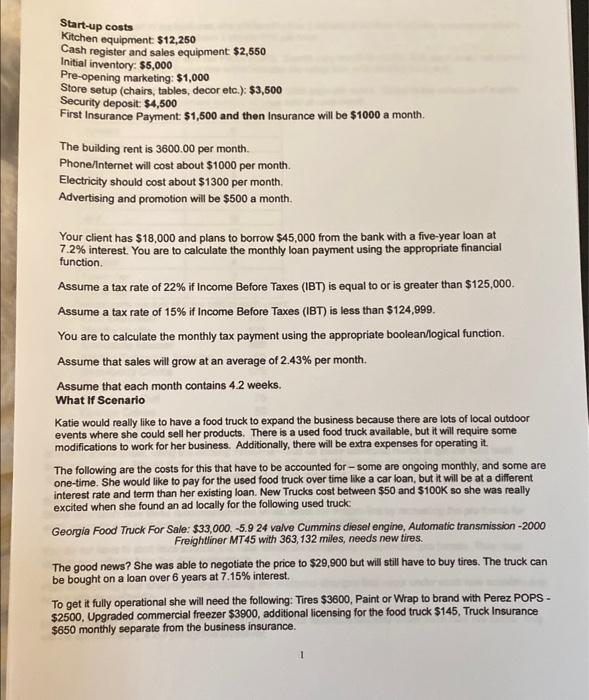

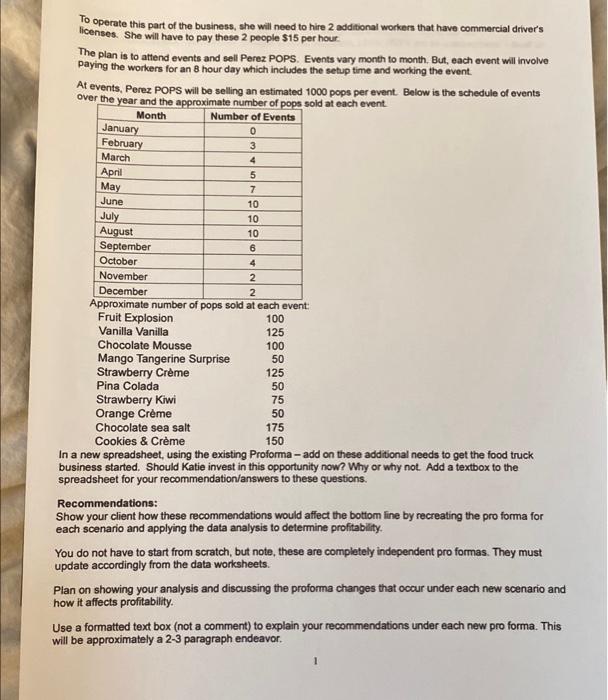

Please read the instructions carefully. A new client of yours, Katie Perez wants to open an ice crearn shop near the downtown shopping center. She will beselling Frozen POPS, Frozen loes, Frozen POPS Packs, Soda and Bottled Water. Her grand opening will be January 1, 2024 Katie needs help figuring out how her business will perform the first year in business. She has hired you as an independent consultant, prepare a cash proforma budget for her business venture. This is a spreadsheet that helps forecast income and expenses over a period of time). It can be used to plan and manage the business if done correctly. Assignment: Using Microsoft Excel, construct a monthly proforma cash budget for your client for the first year of operations. Use the file attached Excel Template - "Perezpops.xis" as your starting point. Download and use this file as the basis for your assignment. Do not make any changes to this pre-defined template items (this means start with the items that already included and that are expected in the spreadsheet). You may add your information to the existing sheets. You may add extra worksheets as needed as woll updato the template. Do not use a template from a previous semester - this is academic dishonesty and will be subject to disciplinary action. - Do not remove the Grading Criteria Worksheet. - Place the finished cash pro forma on a worksheet labeled "Cash ProForma". - Calculations and functions must be used to determine values as necessary (Le. payment, taxes, cogs, sales, etc. - Place all your case assumptions data on a separate worksheet. Label the worksheet "Assumptions" (note: each piece of data must appear in its own cell on the Assumption sheet). - Place your start-up costs on a third worksheet labeled "Startup Costs" - Create additional worksheets for your What if Scenario recommendation. Events - Appropriate Charts (graphs): You will be creating two separate charts so create and label two additional worksheets for the charts (each chart will be in its own worksheet). - Chart One - " Monthly Product Revenue" - this will show the monthly revenue for each of your five products for the entire year. Charts should be on their own worksheet. - Chart Two - 'Total Product Net Income" - You want to track the total product net income for the year to determine any trends or projections in product sales. Charts should be on their own worksheet. - Make sure both charts are formatted correctly (L.e. appropriate title, legend where appropriate, data series properly labeled) and they are appropriate for business use. Information needed to complete assignment: Products: Specialty POPS, Frozen Ice, Soda and Bottle water. Product Selling Prices: POPS Fruit Explosion \$4.85 Vanilla Vanilla $3.85 Chocolate Mousse $4.35 Mango Tangerine Surprise \$4.35 Strawberry Crme \$3.75 Pina Colada \$4.85 Strawberry Kiwi $4.35 Orange Crme $3.75 Chocolate sea salt $4.35 Cookies \& Crme $3.25 Pop Packs 12 pk $32.00 6pk$15.00 Frozen lce Medium \$3.75 Large $4.25 Soda $$1.95 a bottle Bottled Water - $1.25 a bottle Cost of Goods Sold: POPS Fruit Explosion $0.90 VanillaVanilla $0.40 Chocolate Mousse $0.95 Mango Tangerine $0.70 Strawberry Crme $0.70 Pina Colada $0.90 Strawberry Kiwi $0.80 Orange Crme $0.50 Chocolate sea salt $0.95 Cookies \& Crme $0.70 1 Weekdays (Monday - Thursday). Open 8 hours. Weekends Friday, Saturday Open 12 hours. Employees: - One hourly employee needed weekdays. - Two hourly employees needed weekends. - Hourly employees are paid $12.50 per hour. - Your client will be the manager and draw a salary of $40,000 per year. - The assistant manager will receive a salary of $28,500 per year. Product demand on average: -Weekdays the owner expects 18 customers per hour. - Friday - Saturday the owner expects an average of 30 customers per hour. Start-up costs Kitchen equipment: \$12,250 Cash register and sales equipment $2,550 Initial inventory: $5,000 Pre-opening marketing: $1,000 Store setup (chairs, tables, decor etc.): $3,500 Security deposit: $4,500 First Insurance Payment: $1,500 and then Insurance will be $1000 a month. The building rent is 3600.00 per month. Phone/Internet will cost about $1000 per month. Electricity should cost about $1300 per month. Advertising and promotion will be $500 a month. Your client has $18,000 and plans to borrow $45,000 from the bank with a five-year loan at 7.2% interest. You are to calculate the monthly loan payment using the appropriate financial function. Assume a tax rate of 22% if Income Before Taxes (IBT) is equal to or is greater than $125,000. Assume a tax rate of 15% if Income Before Taxes (IBT) is less than $124,999. You are to calculate the monthly tax payment using the appropriate boolean/logical function. Assume that sales will grow at an average of 2.43% per month. Assume that each month contains 4.2 weeks. What if Scenario Katie would really like to have a food truck to expand the business because there are lots of local outdoor events where she could sell her products. There is a used food truck available, but it will require some modifications to work for her business. Additionally, there will be extra expenses for operating it. The following are the costs for this that have to be accounted for - some are ongoing monthly, and some are one-time. She would like to pay for the used food truck over time like a car loan, but it will be at a different interest rate and term than her existing loan. New Trucks cost between $50 and $100K so she was really excited when she found an ad locally for the following used truck: Georgla Food Truck For Sale: $33,000,5.924 valve Cummins diesel engine, Automatic transmission -2000 Freightliner MT 45 with 363,132 miles, needs new tires. The good news? She was able to negotiate the price to $29,900 but will still have to buy tires. The truck car be bought on a loan over 6 years at 7.15% interest. To get it fully operational she will need the following: Tires $3600, Paint or Wrap to brand with Perez POPS $2500, Upgraded commercial freezer $3900, additional licensing for the food truck $145, Truck Insurance $650 monthly separate from the business insurance. 1 To operate this part of the business, she will need to hire 2 edditional workers that have commercial driver's licenses. She will have to pay these 2 people $15 per hour: The plan is to attend events and sell Perez POPS. Events vary month to month. But, each event will involve paying the workers for an 8 hour day which includes the setup time and working the event. At events, Perez POPS will be selling an estimated 1000 pops per event. Below is the schedule of events over the year and the aporoximate number of noos sold at each event. Approximate number of pops sold at each event: In a new spreadsheet, using the existing Proforma - add on these additional needs to get the food truck business started. Should Katie invest in this opportunity now? Why or why not. Add a textbox to the spreadsheet for your recommendation/answers to these questions. Recommendations: Show your client how these recommendations would affect the bottom line by recreating the pro forma for each scenario and applying the data analysis to determine profitability. You do not have to start from scratch, but note, these are completely independent pro formas. They must update accordingly from the data worksheets. Plan on showing your analysis and discussing the proforma changes that occur under each new scenario and how it affects profitability. Use a formatted text box (not a comment) to explain your recommendations under each new pro forma. This will be approximately a 2-3 paragraph endeavor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts