Question: PLEASEEE answer the rest - thank you Webflix has $35 million of sales and $3.5 of net income this year. Sales are expected to grow

PLEASEEE answer the rest - thank you

PLEASEEE answer the rest - thank you

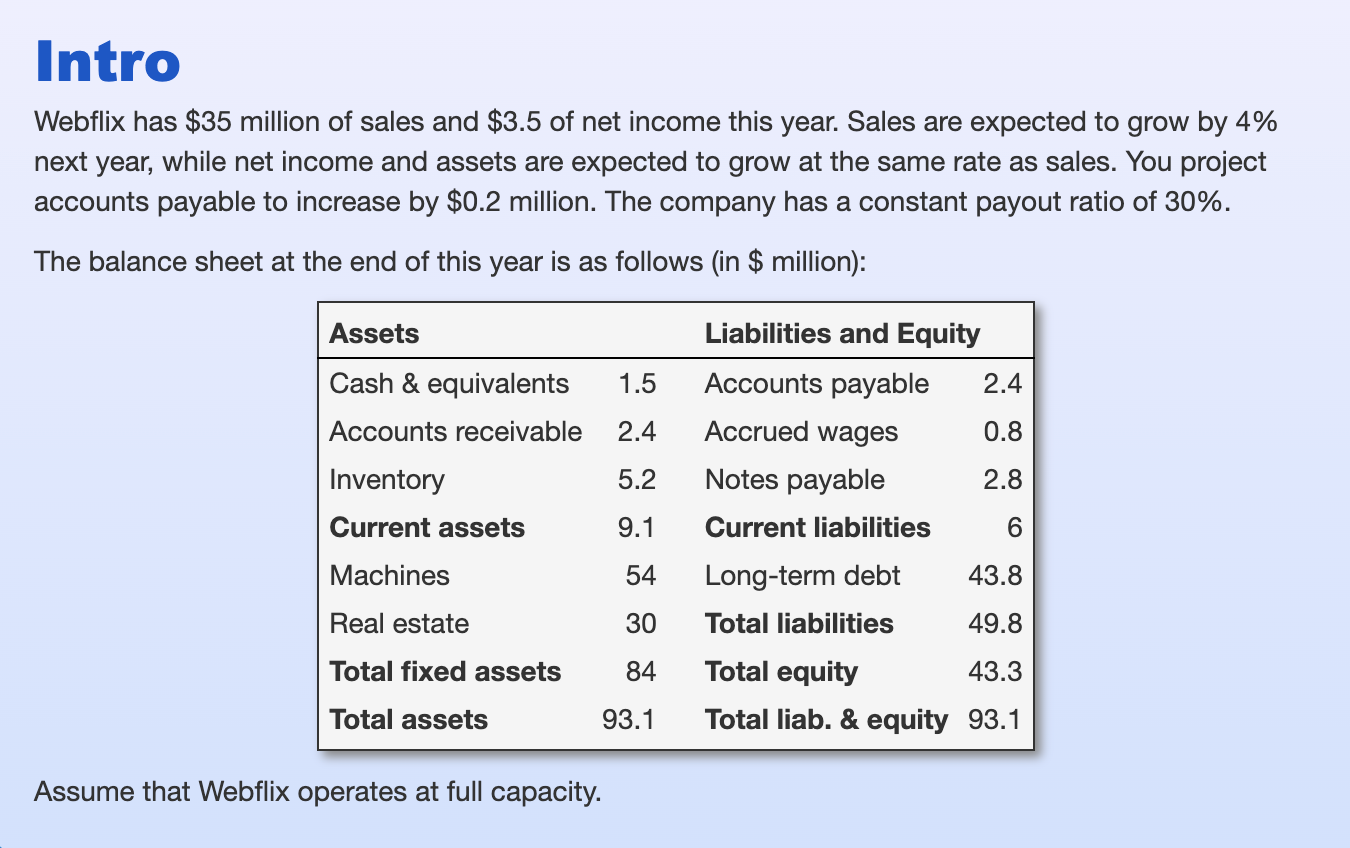

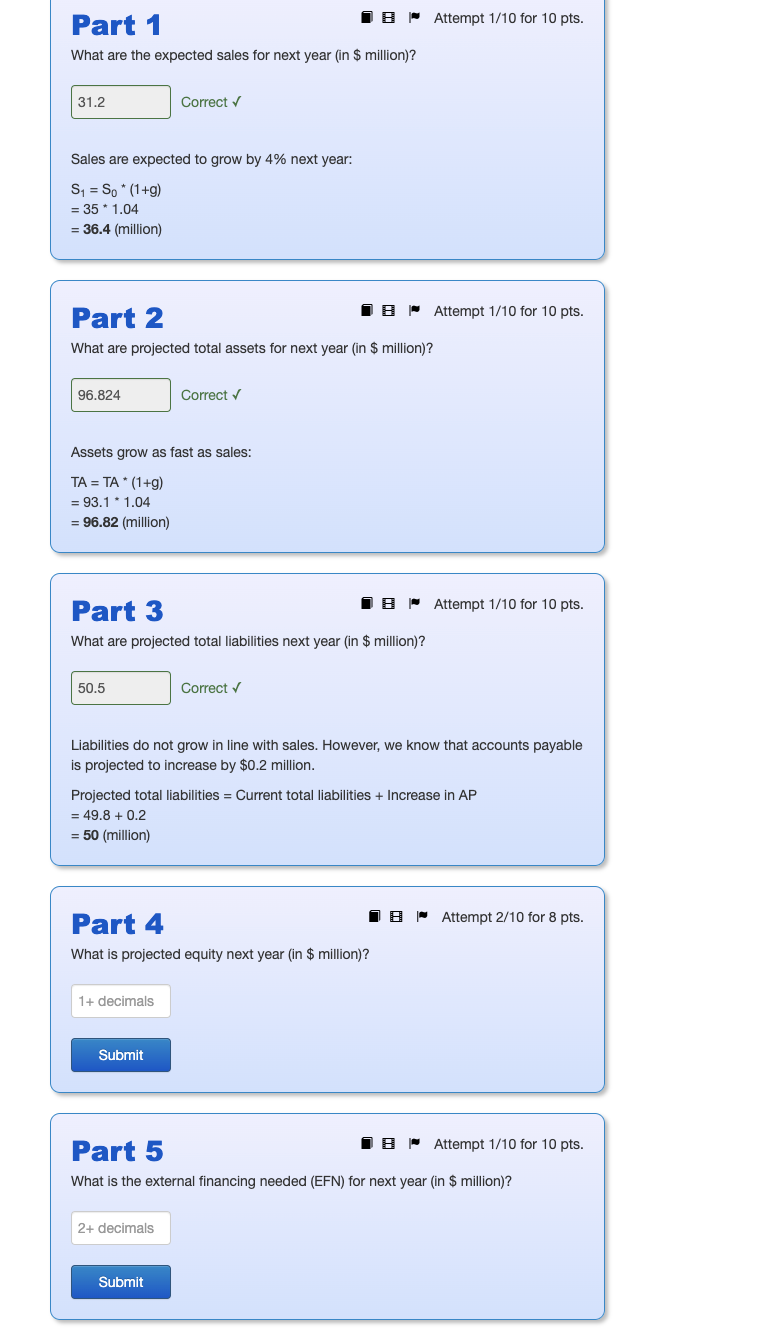

Webflix has $35 million of sales and $3.5 of net income this year. Sales are expected to grow by 4% next year, while net income and assets are expected to grow at the same rate as sales. You project accounts payable to increase by $0.2 million. The company has a constant payout ratio of 30%. The balance sheet at the end of this year is as follows (in $ million): Assume that Webflix operates at full capacity. Part 1 Attempt 1/10 for 10 pts. What are the expected sales for next year (in \$ million)? Correct Sales are expected to grow by 4% next year: S1=S0(1+g)=351.04=36.4(million) Part 2 Attempt 1/10 for 10 pts. What are projected total assets for next year (in \$ million)? Correct Assets grow as fast as sales: TA=TA(1+g)=93.11.04=96.82(million) Part 3 Attempt 1/10 for 10 pts. What are projected total liabilities next year (in \$ million)? Correct Liabilities do not grow in line with sales. However, we know that accounts payable is projected to increase by $0.2 million. Projected total liabilities = Current total liabilities + Increase in AP =49.8+0.2=50(million) Part 4 Attempt 2/10 for 8 pts. What is projected equity next year (in \$ million)? Part 5 Attempt 1/10 for 10 pts. What is the external financing needed (EFN) for next year (in \$ million)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts