Question: pleaseee help asapp!! important Dana and Dalal have a partnership agreement which includes the following provisions regarding sharing net income and net loss: 1. Since

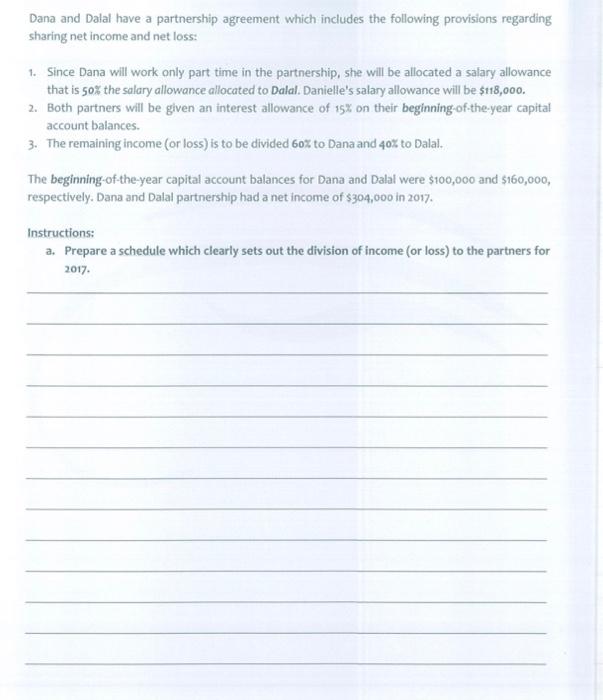

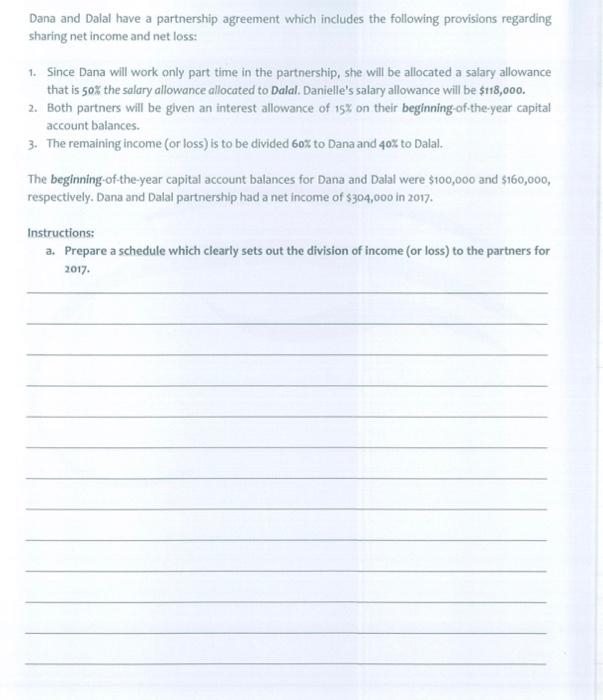

Dana and Dalal have a partnership agreement which includes the following provisions regarding sharing net income and net loss: 1. Since Dana will work only part time in the partnership, she will be allocated a salary allowance that is 50% the salary allowance allocated to Dalal. Danielle's salary allowance will be $118,000. 2. Both partners will be given an interest allowance of 15% on their beginning-of-the-year capital account balances. 3. The remaining income (or loss) is to be divided 60% to Dana and 40% to Dalal. The beginning-of-the-year capital account balances for Dana and Dalal were $100,000 and $160,000, respectively. Dana and Dalal partnership had a net income of $304,000 in 2017. Instructions: a. Prepare a schedule which clearly sets out the division of income (or loss) to the partners for 2017. b. Journalize the division of 2017 net income (loss) to the partners. Debit Credit Account Titles

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts