Question: pleasw solve all VUCURTIU Question 19 1 points Sov Your computer system crashed and damaged the accounting records of your company, Oasis Corp. The remains

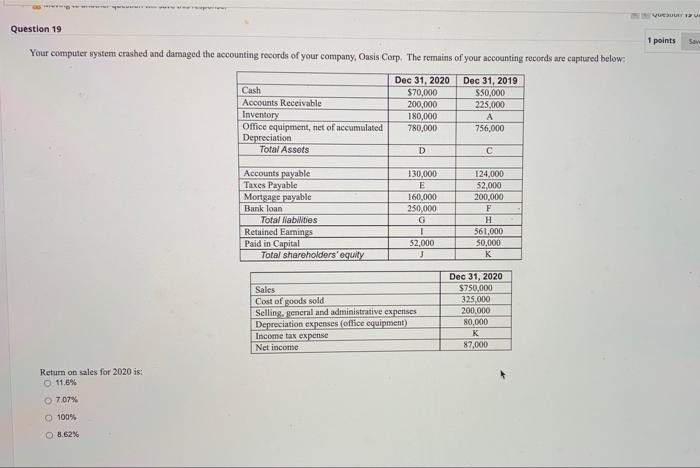

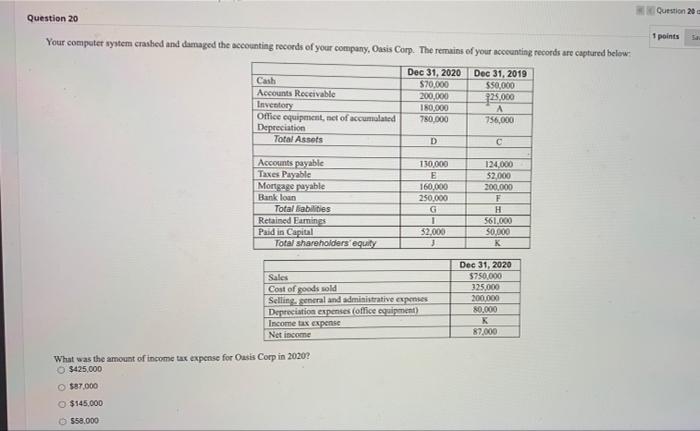

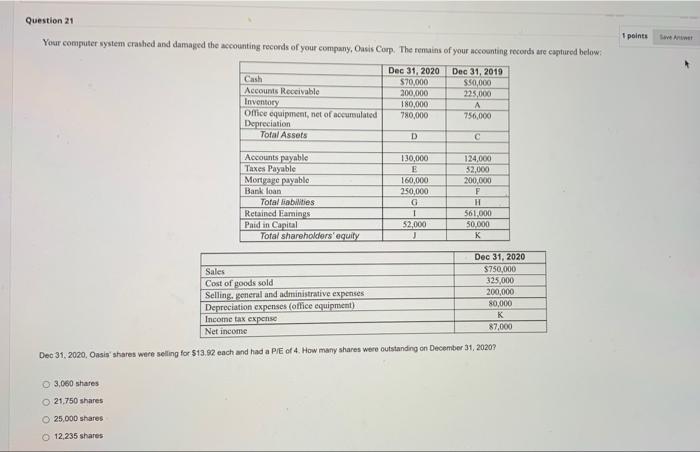

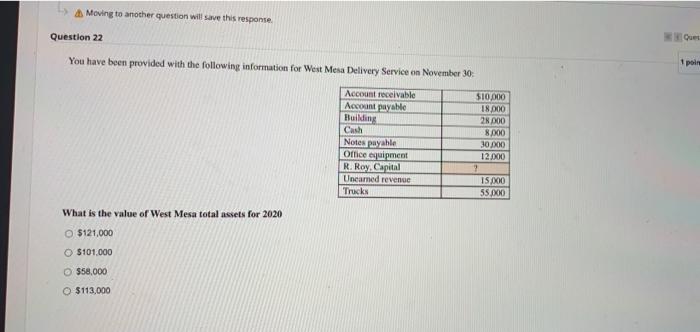

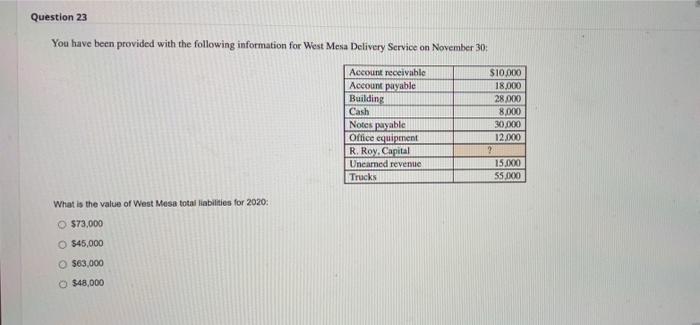

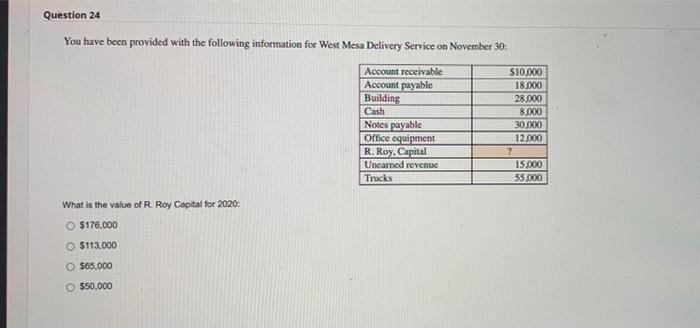

VUCURTIU Question 19 1 points Sov Your computer system crashed and damaged the accounting records of your company, Oasis Corp. The remains of your accounting records are captured below: Cash Accounts Receivable Inventory Office equipment, net of accumulated Depreciation Total Assets Dec 31, 2020 $70,000 200,000 180,000 780,000 Dec 31, 2019 $50,000 225.000 A 756,000 D Accounts payable Taxes Payable Mortgage payable Bank loan Total Nabities Retained Earnings Paid in Capital Total shareholders'oquity 130,000 E 160,000 250,000 G 124,000 52,000 200,000 F H 561,000 50,000 K 52.000 J Sales Cost of goods sold Selling general and administrative expenses Depreciation expenses (office equipment) Income tax expense Net income Dec 31, 2020 $750,000 325,000 200.000 80,000 K 87,000 Return on sales for 2020 is: 11.6% 7.07% 100% O 8.62% Question 20 Question 20 1 points Your computer system crashed and damaged the accounting records of your company. Oasis Corp. The remains of your accounting records are captured below: Dec 31, 2019 $50,000 Dec 31, 2020 $70,000 200,000 180,000 780.000 Cash Accounts Receivable Inventory Office equipment, net of accumulated Depreciation Total Assets 125.000 A 756,000 D 124.000 52.000 200.000 Accounts payable Taxes Payable Mortgage payable Bank loan Total liabilities Retained Parnings Paid in Capital Total shareholders equity 130,000 E 160.000 250.000 G 1 $2.000 3 561.000 30.000 Sales Cost of goods sold Selling central and administrative expenses Depreciation expenses (office equipment) Income tax expense Net income What was the amount of income tax expense for Oasis Corp in 2020? $425,000 $87.000 Dec 31, 2020 $750,000 125.000 200.000 80.000 K 87.000 $145,000 $58.000 Question 21 1 points Laverne Your computer system crashed and damaged the accounting records of your company, Oasis Corp. The remains of your accounting records are captured below: Dec 31, 2020 Dec 31, 2019 Cash $70,000 $50,000 Accounts Receivable 200,000 225,000 Inventory 180,000 Office equipment, net of accumulated 780,000 756,000 Depreciation Total Assets D Accounts payable Taxes Payable Mortgage payable Bank loan Total Babies Retained Famings Paid in Capital Total shareholders' equity 130,000 E 160,000 250,000 G 1 52,000 J 124.000 32.000 200,000 F H 561,000 50.000 Sales Cost of goods sold Selling. oneral and administrative expenses Depreciation expenses (office equipment) Income tax expense Net income Dec 31, 2020 $750,000 325,000 200,000 80,000 K 87,000 Dec 31, 2020. Oasis' shares were selling for $13.99 each and had a PE of 4. How many shares were outstanding on December 31, 20207 3,060 shares 21,750 shares 25,000 shares 12,235 shares Moving to another question will save this response Question 22 Ques You have been provided with the following information for West Mesa Delivery Service on November 30 1 poin Account receivable Account payable Building Cash Notes payahle Office equipment R. Roy, Capital Uncamned revenue Trucks 510,000 18.000 28000 8000 30 200 12.000 ? IS200 55X What is the value of West Mesa total assets for 2020 $121,000 $101.000 $58,000 O $113,000 Question 23 You have been provided with the following information for West Mesa Delivery Service on November 30: Account receivable Account payable Building Cash Notes payable Office equipment R. Roy.Canital Unearned revenue Trucks $10.000 18.000 28 000 8.000 30,000 12.000 ? 15.30 55.000 What is the value of West Mesa total liabilities for 2020: O $73,000 0 $45,000 $63.000 $48,000 Question 24 You have been provided with the following information for West Mesa Delivery Service on November 30: Account receivable Account payable Building Cash Notes payable Office equipment R. Roy, Capital Uncarned revenue Trucks $10,000 18,000 28.000 8.000 30.000 12.000 2 15.000 55.000 What is the value of R. Roy Capital for 2020: $175,000 $113,000 $65.000 $50,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts