Question: pleese solve now i need help Question 5. Omega plc is considering a new three-year expansion project that requires an initial no. current asset investment

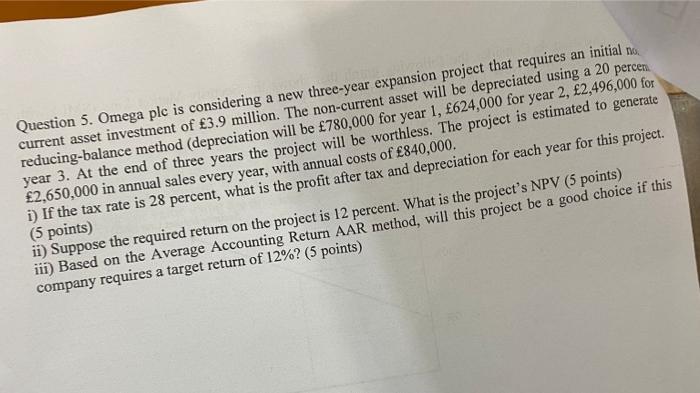

Question 5. Omega plc is considering a new three-year expansion project that requires an initial no. current asset investment of 3.9 million. The non-current asset will be depreciated using a 20 percen reducing-balance method (depreciation will be 780,000 for year 1,624,000 for year 2,2,496,000 for year 3 . At the end of three years the project will be worthless. The project is estimated to generate 2,650,000 in annual sales every year, with annual costs of 840,000. i) If the tax rate is 28 percent, what is the profit after tax and depreciation (5 points) iii) Based on the Average Accounting Return AAR company requires a target return of 12% ? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts