Question: plesse help with 5-11 only need help with 9-11! will leave a like Given the following information for Walk or Run (WoR) Incorporated, construct a

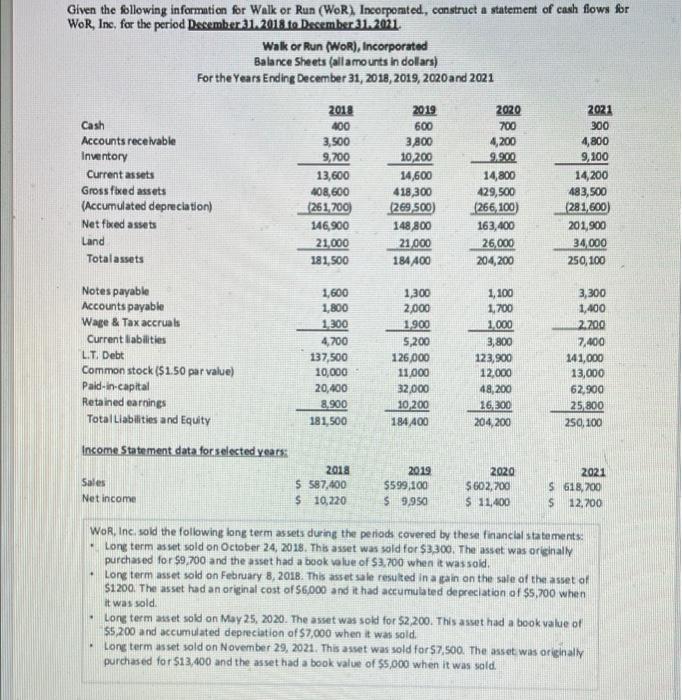

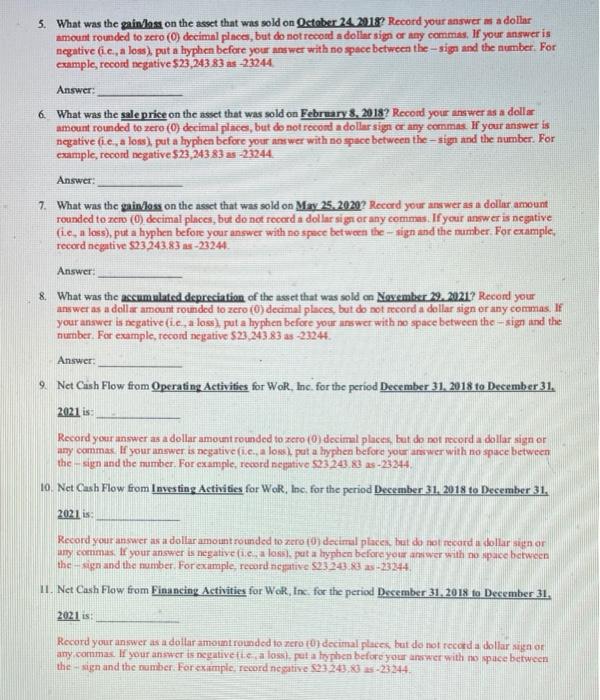

Given the following information for Walk or Run (WoR) Incorporated, construct a statement of cash flows for Wor, Inc, for the period December 31, 2018 to December 31, 2011 Walk or Run (WoR), Incorporated Balance Sheets (allamounts in dolars) For the Years Ending December 31, 2018, 2019, 2020 and 2021 Cash Accounts receivable Inventory Current assets Gross fixed assets (Accumulated depreciation) Net fixed assets Land Totalassets 2018 400 3,500 9,700 13,600 408,600 (261,700 146,900 21,000 181,500 2019 600 3,800 10,200 14,600 418,300 (269,500) 148,800 21000 184 400 2020 700 4,200 9.900 14,800 429,500 (266,100) 163,400 26,000 204,200 2021 300 4,800 9,100 14,200 483,500 (281,600) 201,900 34,000 250, 100 Notes payable Accounts payable Wage & Tax accruals Current abilities L.T. Debt Common stock (51.50 par value) Paid-in-capital Retained earnings Total Liabilities and Equity 1,600 1,800 1.300 4,700 137,500 10,000 20,400 8.900 181,500 1,300 2,000 1900 5,200 126,000 11.000 32.000 10,200 184 400 1,100 1,700 1.000 3,800 123,900 12,000 48,200 26.300 204,200 3,300 1,400 2.700 7,400 141,000 13,000 62,900 25 800 250, 100 Income Statement data for selected years: Sales Net income 2018 5 587,400 $ 10,220 2019 $599,100 $ 9,950 2020 $ 602,700 $ 11,400 2021 S 618,700 s 12.700 . Wor, Inc. sold the following long term assets during the periods covered by these financial statements: Long term as set sold on October 24, 2018. This asset was sold for $3,300. The asset was originally purchased for $9.700 and the asset had a book value of $3,700 when it was sold Long term asset sold on February 8, 2018. This asset sale resulted in a pain on the sale of the asset of 51200. The asset had an original cost of $6,000 and it had actumulated depreciation of 55,700 when it was sold. long term asset sold on May 25, 2020. The asset was sold for 52,200. This awet had a book value of $5,200 and accumulated depreciation of $7,000 when it was sold. Long term asset sold on November 29, 2021. This asset was sold forS7.500. The asset was originally purchased for $13,000 and the asset had a book value of $5,000 when it was sold. 5. What was the gaindlass on the assct that was sold on October 24, 2018 Record your answer m a dollar amount rounded to zero () decimal place, but do not record a dollar sign or any commas. If your answer is negative (ie, a loss) put a hyphen before your answer with no space between the sign and the number. For example, record negative $23,243 83 as-23244 Answer: 6. What was the sale price on the asset that was sold on February 8, 2018? Record your answer as a dollar amount rounded to zero () decimal places, but do not recond a dollar sign or any commes. If your answer is negative fi.c., a loss), put a hyphen before your answer with no space between the---sign and the number. For example, record negative $23,24383 as -23244 Answer: 7. What was the main loss on the asset that was sold on May 25.2020? Record your answer as a dollar amount rounded to zero (O) decimal places, but do not record a dollar sign or any commes. If your answer is negative (1.c, a loss), put a hyphen before your answer with no space between the - sign and the number. For example, record negative 523 243,83 as-23244 Answer: 8. What was the accumulated depreciation of the asset that was sold on November 19, 2021? Record your answer as a dollar amount rounded to zero (0) decimal places, but do not record a dollar sign or any comunas IF your answer is negative fi.c., a loss) put a hyphen before your answer with no space between the sign and the number. For example, record negative $23,243 83 as-23244 Answer: 9. Net Cash Flow from Operating Activities for WoR, Inc for the period December 31, 2018 to December 31, 2021 is Record your answer as a dollar amount rounded to zero (0) decimal places, but do not recorda dollar sign or any commax If your answer is negativeti.c., a lossl put a hyphen before your answer with no space between the - sign and the number. For example, record negative 23.243.83 as-23244 10. Net Cash Flow from Investing Activities for WoR, Inc. for the period December 31, 2018 to December 31. 2021 is: Record your answer as a dollar amount rounded to zero (decimal place, but do not recorda dollar signer any commas if your answer is negative. a los put a hyphen before your answer with no space between the sign and the number. For example record negative S23243.83 as-23244 11. Net Cash Flow from Financing Activities for Wor, Inc. for the period December 31, 2018 to December 31, 2021 is: Record your answer a dollar amount rounded to meto ) decimal places but do not recorda dollar signer any.commas. If your answer is negative tea loss). puta lyphen before your answer with no space between the-sign and the number. For example, record nesative $23.243.83 25-23244

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts