Question: Plot the three stocks, the minimum variance portfolio and the market value-weighted portfolio in a coordinate system with the standard deviation from the first axis

Plot the three stocks, the minimum variance portfolio and the market value-weighted portfolio in a coordinate system with the standard deviation from the first axis and the expected return up the second axis.

Given the following info

Stock A: Expected return 12%. std=0.15

Stock B: Expected return 8% std=0.2

Stock C: Expected return 4% std=.3

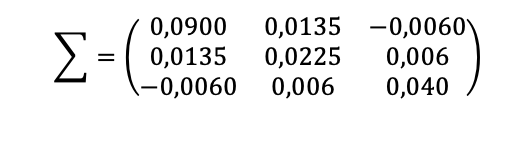

The covariance variance matrix is given by:

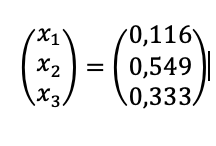

the portfolio weights in the minimum variance portfolio is given by:

and its std is given by 0,12

-( 0,0900 0,0135 -0,0060 0,0135 -0,0060 0,0225 0,006 0,006 0,040 "1 2 , 10,116) 0,549 10,333 ) -( 0,0900 0,0135 -0,0060 0,0135 -0,0060 0,0225 0,006 0,006 0,040 "1 2 , 10,116) 0,549 10,333 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts