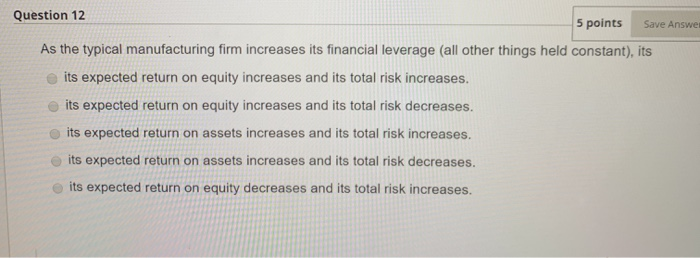

Question: pls all four questions Question 12 5 points Save Answe As the typical manufacturing firm increases its financial leverage (all other things held constant), its

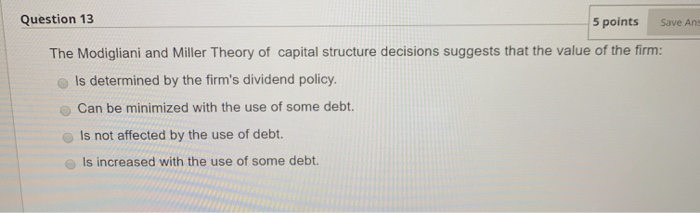

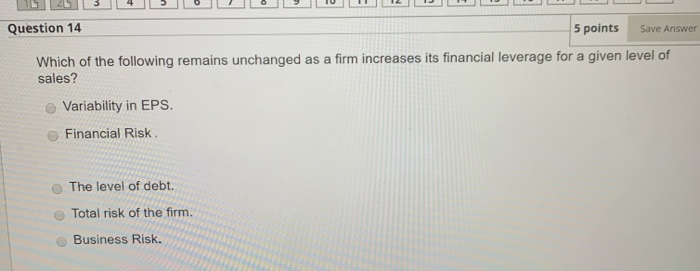

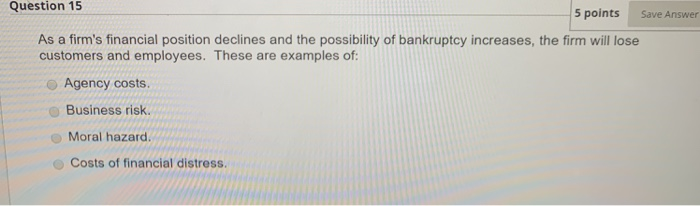

Question 12 5 points Save Answe As the typical manufacturing firm increases its financial leverage (all other things held constant), its its expected return on equity increases and its total risk increases. its expected return on equity increases and its total risk decreases. its expected return on assets increases and its total risk increases. its expected return on assets increases and its total risk decreases. its expected return on equity decreases and its total risk increases. Question 13 5 points The Modigliani and Miller Theory of capital structure decisions suggests that the value of the firm: Is determined by the firm's dividend policy. Can be minimized with the use of some debt. Is not affected by the use of debt. Is increased with the use of some debt. Question 14 5 points Save Answer Which of the following remains unchanged as a firm increases its financial leverage for a given level of sales? Variability in EPS. Financial Risk The level of debt. Total risk of the firm. Business Risk. Question 15 5 points Save Answer As a firm's financial position declines and the possibility of bankruptcy increases, the firm will lose customers and employees. These are examples of: Agency costs Business risk. Moral hazard Costs of financial distress

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts