Question: pls answer the two questions Question 10 5 points Save Answer The chief financial officer of Portland Oil has given you the assignment of determining

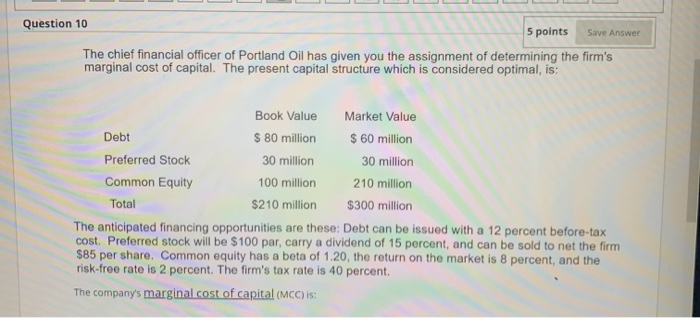

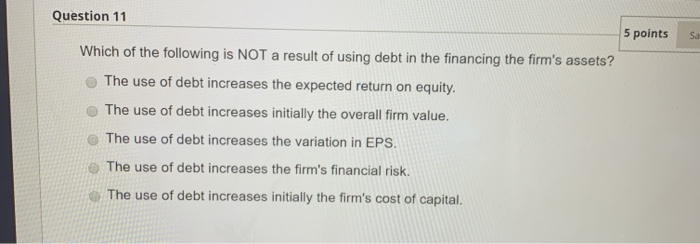

Question 10 5 points Save Answer The chief financial officer of Portland Oil has given you the assignment of determining the firm's marginal cost of capital. The present capital structure which is considered optimal, is: Book Value Market Value Debt $ 80 million $ 60 million Preferred Stock 30 million 30 million Common Equity 100 million 210 million Total $210 million $300 million The anticipated financing opportunities are these: Debt can be issued with a 12 percent before-tax vill be $100 par, carry a dividend of 15 percent, and can be sold to net the firm $85 per share. Common equity has a bota of 1.20, the return on the market is 8 percent, and the risk-free rate is 2 percent. The firm's tax rate is 40 percent The company's marginal cost of capital (MCC) is: The company's marginal cost of capital (MCC) is: 08.34 percent 10.60 percent 9.38 percent 9.64 percent 11.47 percent Question 11 5 points sa Which of the following is NOT a result of using debt in the financing the firm's assets? The use of debt increases the expected return on equity. The use of debt increases initially the overall firm value. The use of debt increases the variation in EPS. The use of debt increases the firm's financial risk. The use of debt increases initially the firm's cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts