Question: Pls answer 3 and 4 only! eBook Show Me How Entries Related to Uncollectible Accounts Apr. 3 Nov. 23 The following transactions were completed by

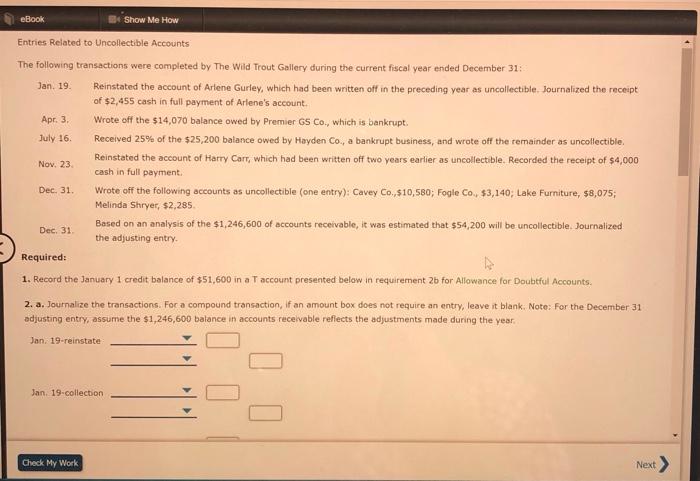

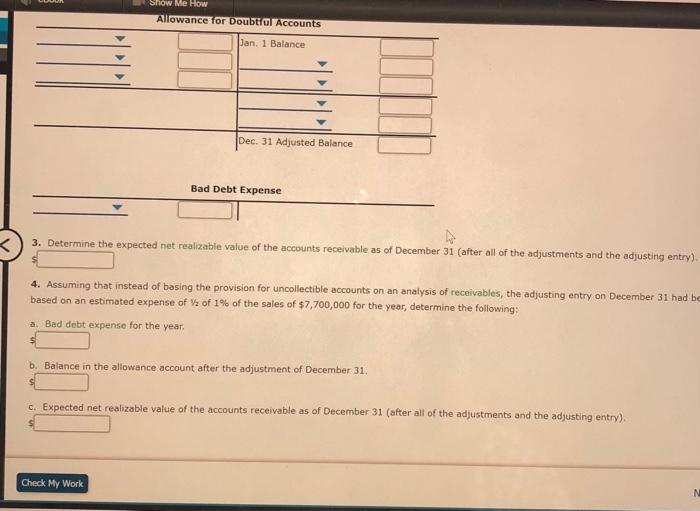

eBook Show Me How Entries Related to Uncollectible Accounts Apr. 3 Nov. 23 The following transactions were completed by The Wild Trout Gallery during the current fiscal year ended December 31: Jan. 19 Reinstated the account of Arlene Gurley, which had been written off in the preceding year as uncollectible, Journalized the receipt of $2,455 cash in full payment of Arlene's account Wrote off the $14,070 balance owed by Premier GS Co., which is bankrupt. July 16 Received 25% of the $25,200 balance owed by Hayden Co., a bankrupt business, and wrote of the remainder as uncollectible Reinstated the account of Harry Carr, which had been written off two years earlier as uncollectible. Recorded the receipt of $4,000 cash in full payment Wrote off the following accounts as uncollectible (one entry): Cavey Co.,$10,580; Fogle Co., $3,140, Lake Furniture, $8,075; Melinda Shryer, $2,285 Based on an analysis of the $1,246,600 of accounts receivable, it was estimated that $54,200 will be uncollectible. Journalized the adjusting entry Required: 1. Record the January 1 credit balance of $51,600 in a T account presented below in requirement 2b for Allowance for Doubtful Accounts. 2. a. Journalize the transactions. For a compound transaction, If an amount box does not require an entry, leave it blank. Note: For the December 31 adjusting entry, assume the $1,246,600 balance in accounts receivable reflects the adjustments made during the year. Dec. 31. Dec. 31 Jan. 19-reinstate Jan. 19-collection Check My Work Next > Show Me How Allowance for Doubtful Accounts Jan. 1 Balance Dec. 31 Adjusted Balance Bad Debt Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts