Question: Which option would you recommend? Why? 2) X has an opportunity to borrow $100,000 on his credit card at 3% annual percentage rate (APR). Should

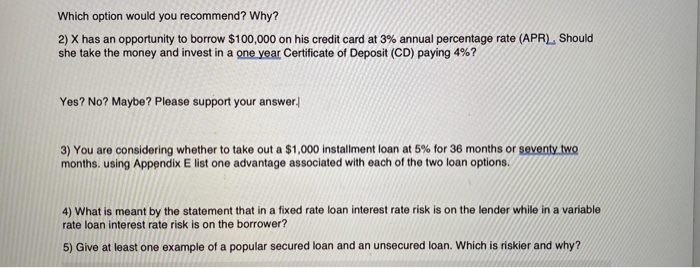

Which option would you recommend? Why? 2) X has an opportunity to borrow $100,000 on his credit card at 3% annual percentage rate (APR). Should she take the money and invest in a one year Certificate of Deposit (CD) paying 4%? Yes? No? Maybe? Please support your answer. 3) You are considering whether to take out a $1,000 installment loan at 5% for 36 months or seventy two months, using Appendix E list one advantage associated with each of the two loan options. 4) What is meant by the statement that in a fixed rate loan interest rate risk is on the lender while in a variable rate loan interest rate risk is on the borrower? 5) Give at least one example of a popular secured loan and an unsecured loan. Which is riskier and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts